by Andy Greenspon

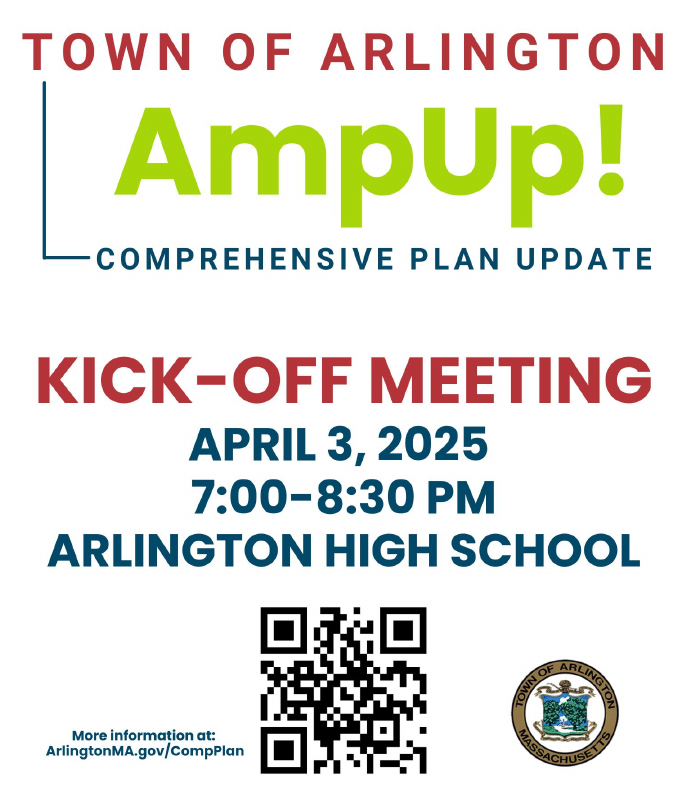

The kick-off event for updating Arlington’s Comprehensive Plan (formerly called the Master Plan) is just around the corner on April 3rd from 7-8:30 PM in the Arlington High School Cafeteria!

It’s the time of year when folks in Arlington are taking out nomination papers, gathering signatures, and strategizing on how to campaign for the town election on Saturday April 1st. The town election is where we choose members of Arlington’s governing institutions, including the Select Board (Arlington’s executive branch), the School Committee, and — most relevantly for this post — Town Meeting.

by Laura Wiener

by Steve Revilak

Could Arlington be better using its curb space? Here are some ways the curb can be used to create green infrastructure, promote public safety and accessibility, support sustainable transportation, strengthen business districts, and enable new ‘car-light’ development.

On Tuesday August 6, 2024, Governor Healey signed the Affordable Homes Act (H.4977) into law. At 181 pages, the Affordable Homes Act is a lengthy bill, but the things it does generally fall into three categories: funding, changes to state law, and changes to state agencies.

Arlington has recently launched Arlington Civic Academy to provide interested residents with a pathway to becoming more civically literate and involved.

The Town of Arlington and the Arlington Affordable Housing Trust Fund have created the Acquisition, Creation and Conversion (ACC) Program to provide a flexible source of funding for creating deed-restricted affordable housing in Arlington. Up to $250,000 is available per restricted unit, and the Town has dedicated federal ARPA funds to support the ACC Program.

State Representatives Dave Rogers (Arlington, Belmont and Cambridge) and Sean Garballey (Arlington, Medford) have sent a letter to Town Meeting Members backing the MBTA Communities Plan. They write: