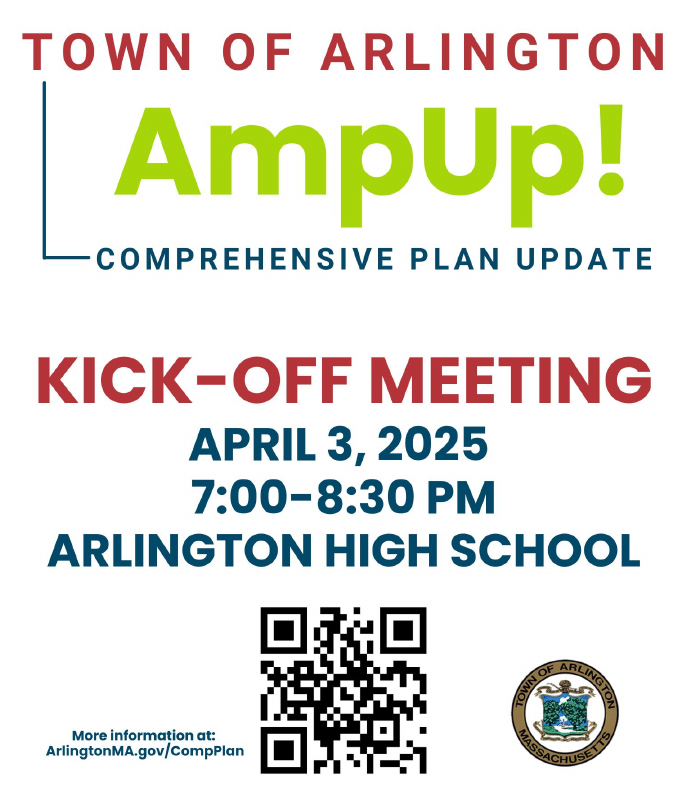

The kick-off event for updating Arlington’s Comprehensive Plan (formerly called the Master Plan) is just around the corner on April 3rd from 7-8:30 PM in the Arlington High School Cafeteria!

It’s the time of year when folks in Arlington are taking out nomination papers, gathering signatures, and strategizing on how to campaign for the town election on Saturday April 1st. The town election is where we choose members of Arlington’s governing institutions, including the Select Board (Arlington’s executive branch), the School Committee, and — most relevantly for this post — Town Meeting.

Arlington has a Representative Town Meeting form of government; each spring, our 252 elected town meeting members gather to consider a range of issues, including changes to town bylaws and zoning. While there were not any “big ticket” items this year, Town Meeting adopted a number of smaller, incremental changes that could make it easier to do mixed-use development (e.g., housing over retail), along with improving the sustainability of certain types of projects. These include:

It's January 2023, and as we do every year, folks in Arlington are taking out nomination papers, gathering signatures, and strategizing on how to campaign for the town election on Saturday April 1st. The town election is where we choose members of Arlington's governing institutions, including Town Meeting. We encourage you to run!

Massachusetts' 2020 Economic Development Bill included a set of housing choice provisions: these require communities served by the MBTA to provide a district of reasonable size where multi-family housing is allowed by right. The law gives us significant flexibility to design a district that best suits our needs, but the district must allow housing suitable for families with children, without age restrictions, and at a rate of at least 15 dwellings per acre. Arlington is one of 175 MBTA communities in Massachusetts that share in the responsibility for meeting these requirements.

2021 set records in Boston housing market.

Arlington is in the process of update the town’s 2016 Housing Production Plan, and the Housing Plan Implementation Committee and Planning Department have put together a “meeting in a box” as part of their outreach efforts. The idea is to package a set of discussion questions and supplementary materials, so that groups can talk through the questions on their own and provide written feedback. Meeting in a box materials are available from the town website.

It’s New Year’s eve and I’m determined to get my third and final “Arlington 2020” article written and posted before 2021 rolls in. I’ve written these articles to paint a picture of Arlington’s housing stock, and how our housing costs have changed over time. The first article looked at the number of one-, two-, and three-family homes and condominiums in Arlington. The second article looked at how the costs of these homes has varied over time.

For Arlington’s Nov 2020 Special Town Meeting, my colleague Ben Rudick filed the following warrant article:

This is the second in a series of “Arlington 2020” articles. The first article looked at the number of one-, two-, and three-family homes and condominiums in Arlington, and how that housing stock has changed over time. This article will examine changes in the value of those properties. We’re going to look at “value” through the lens of property assessments, so we should start with an explanation of what property assessments are and how they’re used.