Beginning last July, 2020, the Town of Arlington and community groups in the town are sponsoring a number of webinars and zoom conversations addressing the need for affordable housing programs in Arlington. Several factors contribute to the Arlington housing situation: diversity of housing types, prices, diversity of incomes, availability of housing subsidies, rapid growth in property values that greatly exceed the rate of growth of income.

This is our national challenge for the next 25 years, according to Jeffrey C. Fuhrer, Executive Vice President/Chief Strategy Officer for MassDevelopment, the Commonwealth’s economic development and finance authority.

Accessory Dwelling Units (aka “granny flats”)

Arlington has an opportunity to set up an Affordable Housing Trust Fund to provide more housing stability for its low and moderate income residents. The vote will occur in the Town Meeting starting Nov. 16, 2020.

A Guide for Arlington

The Massachusetts Housing Partnership put together this 2018 guidebook, v.3, to help municipalities adopt Municipal Affordable Housing Trust Fund (MAHT) legislation to suit the specific needs of each municipality.

For Arlington’s Nov 2020 Special Town Meeting, my colleague Ben Rudick filed the following warrant article:

This is the second in a series of “Arlington 2020” articles. The first article looked at the number of one-, two-, and three-family homes and condominiums in Arlington, and how that housing stock has changed over time. This article will examine changes in the value of those properties. We’re going to look at “value” through the lens of property assessments, so we should start with an explanation of what property assessments are and how they’re used.

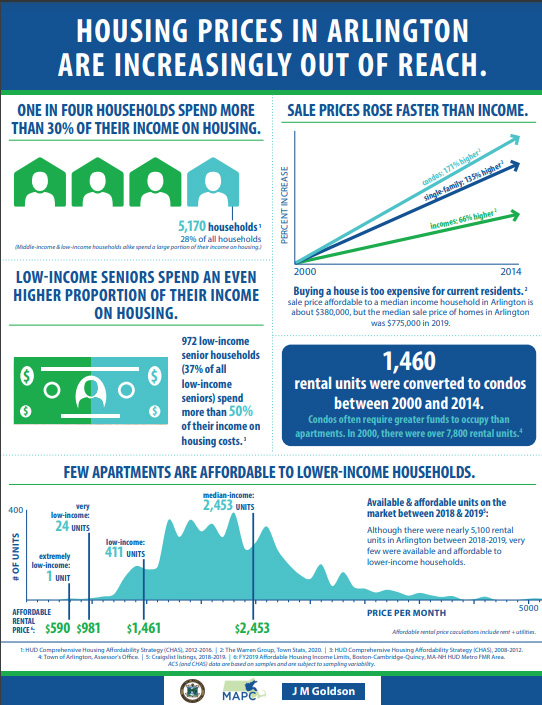

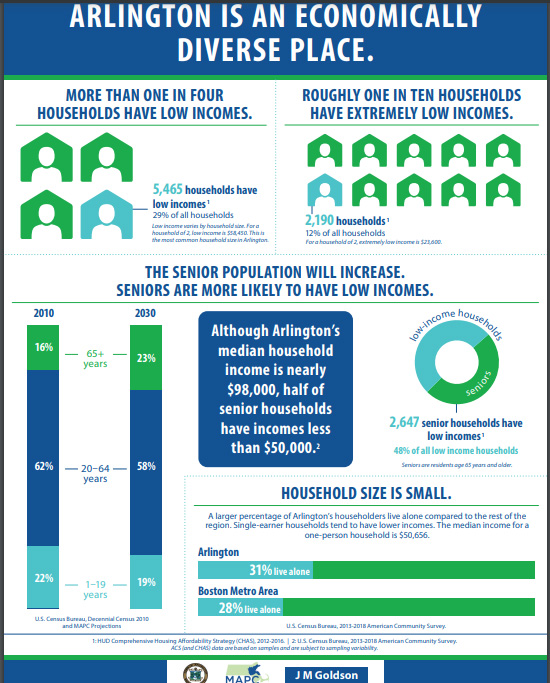

I recently came across a report from Arlington’s Department of Planning and Community Development, titled “Overview of Affordable Housing Challenges and Opportunities”. The report begins:

During the last few months, Arlington’s Department of Planning and Community Development and Zoning Bylaw Working Group have been conducting a study of the town’s industrial districts. The general idea has been to begin with an assessment of current conditions, and consider whether there are zoning changes that might make these districts more beneficial to the community as a whole.