I recently came across a report from Arlington’s Department of Planning and Community Development, titled “Overview of Affordable Housing Challenges and Opportunities”. The report begins:

Greater Boston’s revitalization is provoking an unexpectedly severe housing challenge in Arlington. Throughout eastern Massachusetts, growth in regional demand has caused housing prices to soar. Additionally, Arlington’s neighborhood stability and recently improved accessibility makes the town particularly attractive. While this is an initial boon for property owners, it harms others.

The surge in demand and resulting tight housing market have restricted residential choice, currently locking many households into existing living situations, even as they enter new lifestages and their needs change. Although all income levels and types of households are affected, these changes tend to hit tenants harder than homeowners especially the elderly, the poor, young singles, along with growing families, minority groups, and those with special housing needs.

This report was commissioned for Arlington’s Fair Housing Committee, and presented to them in February 1988. Despite being written 32 years ago, it’s quite descriptive of the housing challenges facing Metro-Boston — and Arlington — today. These challenges include rising home prices, conversion of rental properties into condominiums, the phenomenon of being “house rich and cash poor”, pressures of speculation, and insufficient new housing production.

Figure F from the report provides a summary of what was required to purchase a median-value home in Arlington. I’ve reproduced the table here, with a few small adaptations.

| 1970 | 1980 | 1986 | |

| median value | $30,000 | $62,700 | $169,000 |

| 20% downpayment | $6,000 | $12,540 | $33,800 |

| Mortgage | $24,000 | $50,160 | $135,200 |

| Interest | 8.25% | 13% | 12% |

| Monthly Principal & Interest | $180.29 | $559.95 | $1391.21 |

| Monthly Real estate taxes | $75.00 | $110.00 | $140.00 |

| Total monthly cost | $255.59 | $669.95 | $1531.21 |

| Annual income required | $10,491 | $28,780 | $65,623 |

Here’s the same table, where all values are converted to 2020 dollars [1], and where I’ve added a column for 2020 [2].

| 1970 | 1980 | 1986 | 2020 | |

| median value | $204,739 | $207,902 | $397,784 | $771,900 |

| 20% downpayment | $40,948 | $41,580 | $79,557 | $154,380 |

| Mortgage | $163,791 | $166,322 | $318,227 | $617,520 |

| Interest | 8.25% | 13% | 12% | 3.25% |

| Monthly Principal & Interest | $1,230 | $1,857 | $3,275 | $2,687 |

| Monthly Real estate taxes | $511 | $365 | $330 | $711 |

| Total monthly cost | $1,741 | $2,222 | $3,605 | $3,398 |

| Annual income required | $71,597 | $95,429 | $154,460 | $135,920 |

This is an interesting comparison. Buying a house in Arlington today is actually less expensive than it was in 1986 (i.e., the annual income requirement is 12% less), but this is predominantly due to today’s lower interest rates. That said, the income threshold is significantly higher than it was in 1980 or 1970. (The report’s introduction refers to 1970’s home prices as belonging to a “bygone era”.)

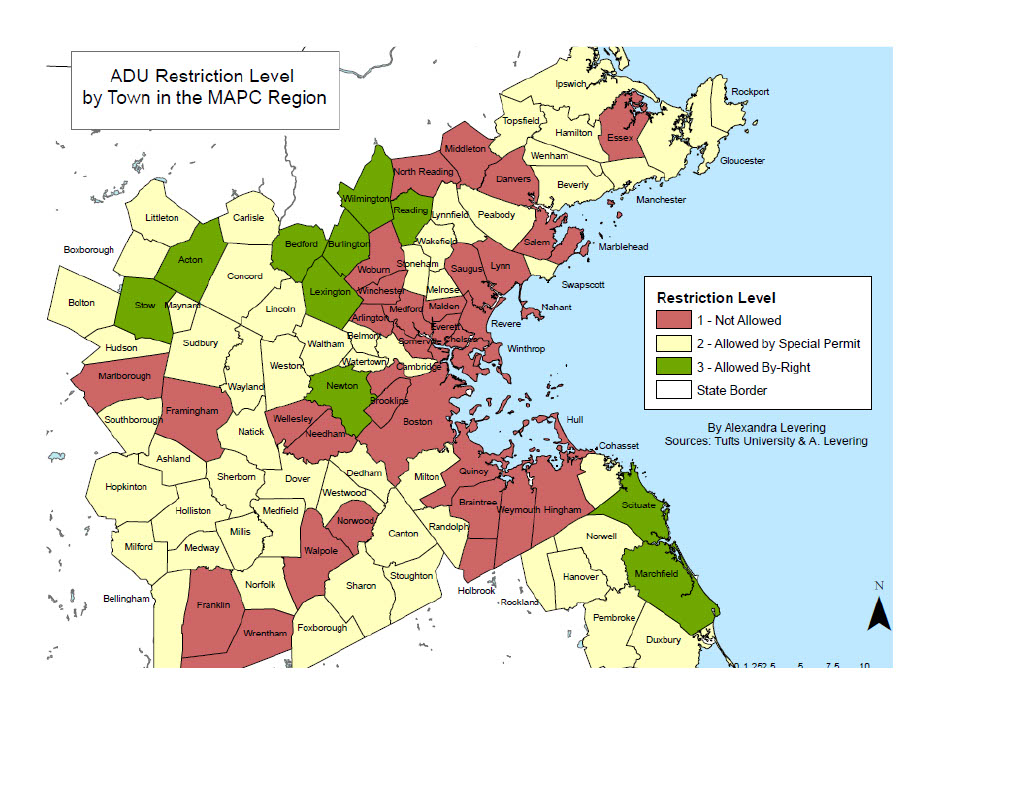

What solutions were proposed in 1988? The ideas put forward included transfer taxes, accessory apartments (aka accessory dwelling units or ADUs), and encouraging models for cooperative ownership. While I’m unsure of what may have been done to encourage cooperative ownership, I’m pretty certain that the transfer tax and ADU options were never implemented. At the very least, they’re not a part of today’s bylaws.

Between 1975 and 1991, Arlington’s Town Meeting voted in favor of a series of downzonings, and I believe the general sentiment during this period was one of anti-growth/anti-development. Apparently we studied the town’s changing demographics and increasing cost of housing, recognized there was was a problem, but never acted on the recommendations.

Two of the ideas for mitigating housing cost have come back in recent years. Accessory dwelling units were proposed in the 2019 town meeting (Article 15), but defeated by a vote of 137–82 (zoning articles require a 2/3’s supermajority to pass; although the majority voted in favor, that wasn’t enough). The 2020 town meeting may have the opportunity to consider a new ADU article (Article 37), along with the establishment of a real estate transfer fee (Article 20).

Here is a copy of the 1988 report to the Fair Housing Commission.

Footnotes

[1] Inflation adjustments derived from https://www.bls.gov/data/inflation_calculator.htm

[2] The 2020 median value is the median value of Arlington single-family homes, based on 2020 property assessments. The 2020 tax rate is $11.06/mil.