After a week of good coverage on the need for more housing units in the greater Boston region, on August 2, 2019 the GLOBE carried the following editorial, mentioning the situation in Arlington.

Good news? On housing? In Massachusetts?

Yes, that’s right. Even here in the land of the $600,000 starter home, a few forward-thinking cities and towns are starting to make progress on what sometimes seems like an intractable problem: the inadequate production of new housing that has sent the cost of renting or buying in Greater Boston into the stratosphere.

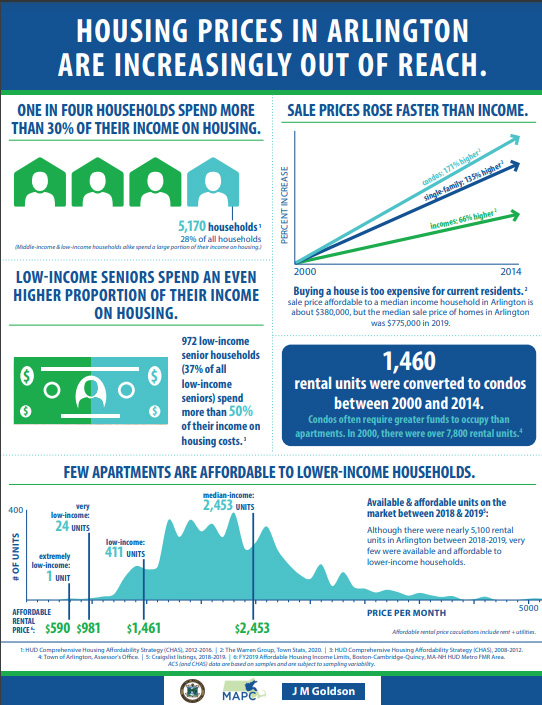

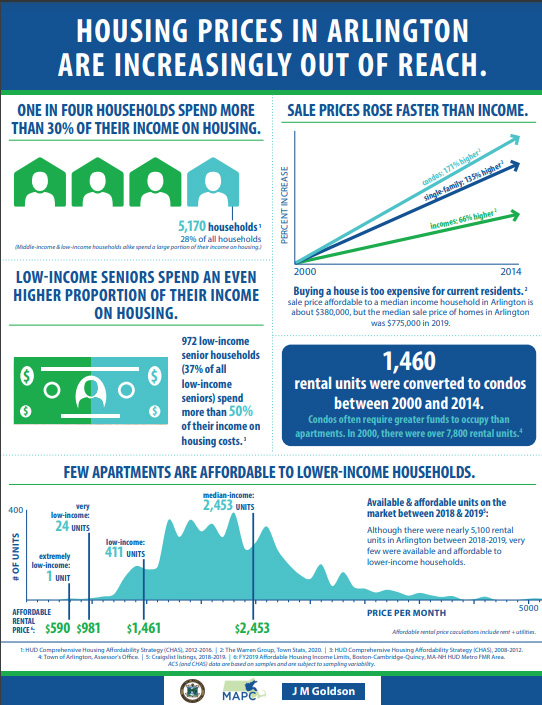

It’s way too soon to declare victory — not when the median sale price for a house in Massachusetts is $429,000 and $420,000 for a condo, according to the Warren Group. High prices happen when demand gallops past supply, causing buyers to bid up prices of existing homes to insane levels. In addition to squeezing renters and contributing to gentrification, the skyrocketing price of housing has evolved into a real threat to the region’s economic competitiveness.

“Greater Boston is losing current and potential domestic residents,” warned the Boston Foundation in its annual housing scorecard, “who are voting with their feet to live elsewhere for a variety of reasons.” Just on Tuesday, another report — this one from the real estate website Apartment List — found that only San Francisco has done a worse job than Greater Boston building new housing to respond to demand.

Thankfully, last year 15 cities and towns in Greater Boston made a joint pledge to pick up the pace of new housing construction by permitting 185,000 new housing units by 2030. Collectively, meeting that goal would mean tripling the pace of housing production. Some of the members of the group, called the Metropolitan Mayors Coalition, are doing their part to reach that goal faster than others — but almost all 15 report progress.

Even outside those three, there’s some impressive municipal-level progress. The Revere City Council approved development on the portion of the former Suffolk Downs racetrack that sits in that city, which will eventually bring in a whopping 2,700 housing units

Leading the way have been Boston, Cambridge, and Somerville, each of which has set numerical goals for housing production. Boston has been on a building spree and is on track to meet its goal of 69,000 new units by 2030. Cambridge volunteered 12,500 new housing units; and Somerville has said it will build 6,000. Committing to a specific goal is crucial: A hard number creates accountability for officials.

In Quincy, 1,500 housing units are under construction, and another 1,030 are either permitted or in the process of receiving permits. Medford has 497 housing units in construction. More than a thousand units are expected in Brookline over the next few years, in part thanks to the state’s 40B housing statute that lets developers bypass local zoning when towns have insufficient levels of affordable housing. Newton has 471 units under construction and another 273 permitted.

Other municipalities are working on plans or reforming zoning bylaws to set the stage for future growth. Austin Faison, Winthrop’s town manager, says that will involve setting a housing production goal. Everett rezoned land near the newly extended Silver Line, setting the stage for development. Braintree is in the process of updating its zoning bylaws that would include provisions for denser multi-family housing.

Arlington experienced a setback when its town meeting rejected an innovative plan to spur denser housing and allow so-called accessory dwelling units. Town manager Adam Chapdelaine said the town was now launching a “more cooperative effort” and would try again, and that the discussion would include coming up with a numerical goal.

The experience in Arlington points to one way the state can help municipalities. Town meetings and city councils require a two-thirds vote to change zoning, which can empower a small minority to thwart reforms needed to encourage housing. Governor Charlie Baker’s housing bill would change that by reducing to one-half the vote needed to change zoning — and deserves legislative approval pronto.

There’s one other way that the state can help, and this one won’t come as a surprise: better transportation. Access to transit can be a key to successful development. For instance, Revere wants a commuter rail stop at Wonderland. Without direct access to any rail service, Everett is banking on buses as part of its development plans.

Cities and towns that are moving forward on housing production inevitably encounter resistance, and they deserve great credit — not just for taking badly needed steps to build housing, but for doing so in a coordinated way. Keeping municipalities on the same page is part of what’s necessary to break down the longstanding barriers to housing in Massachusetts. As Chelsea city manager Thomas G. Ambrosino put it: “Having it be a region-wide effort and everyone rowing toward the same goal makes it easier for us to defend our efforts, because we can tell those who are critical about building that this is a regional need and everyone is in it together.”

from Banker & Tradesman, March 10, 2020: https://www.bankerandtradesman.com/63-percent-in-greater-boston-back-adus/ B&T produced a terrific report on the strong interest across the nation in allowing more ADUs (Accessory Dwelling Units) . This follows after California recently passed strong “YIMBY” legislation encouraging the developement of ADU’s.

“A new, nationwide survey from real estate website Zillow has found that nearly two-thirds of Boston-area residents want the ability to convert their single-family homes into multifamily units.

While the survey conducted across 20 of the nation’s largest metro areas found three in four respondents agree local governments should do more to keep housing affordable, and most agree that allowing more building would help, they remain skeptical of large, multifamily buildings.

The latest Zillow Housing Aspirations Report asked homeowners for their feelings about how best to help quell affordability issues by allowing more homes into their neighborhoods, and comes as in-law suites and backyard cottages gain attention as possible solutions to sharply rising housing costs.

Housing experts say even modest rezoning to allow for more accessory dwelling and small multifamily units could spur the creation of millions of new homes nationwide. Even rezoning limited to areas near MBTA stations would enable the construction of enough units to meet most of the units the state needs to build by 2025 to satisfy demand, according to the Massachusetts Housing Partnership.

Small multifamily buildings – those between two and four units – are increasingly being promoted in some corners as so-called “missing middle” housing that can increase both supply and affordability because the structures often cost less to build than larger multifamily ones.

“In an era of historically low supply and escalating housing prices, the need for more solutions to create housing opportunities is greater than ever. Our latest research shows that homeowners in major markets are generally supportive of providing a range of housing options that allow for not only more housing units, but also a diversity of housing types in existing communities,” Zillow senior economist Cheryl Young said in a statement. “Homeowners may continue to shy away from adding large multifamily buildings nearby, but are open to adding units in their own backyards. This ‘missing middle’ housing, they believe, could help alleviate the housing crunch without sacrificing neighborhood look and feel while improving local amenities and transit. These findings show that broad-based support, especially from homeowners, provides the middle ground necessary to move the needle needed to bring relief to the housing crunch.”

In Greater Boston, 63 percent of survey respondents said homeowners should be able to add additional housing units to their property, compared to 57 percent in Minneapolis, where city officials last year eliminated single-family zoning city-wide in an effort to boost housing production and affordability.

Nationwide, 57 percent of those surveyed backed the ideas of increasing density on single-family lots, and 30 percent said they would be willing to invest money to create housing on their own property if allowed.

The strongest support comes from younger and lower-income homeowners and those in the West, where housing tends to be the most expensive. The highest support was in the San Diego (70 percent), Seattle (67 percent) and San Francisco (64 percent) metros, and the lowest was in the Detroit (47 percent), Phoenix (50 percent) and Dallas (51 percent) areas.

Support also was strongest among homeowners of color – two-thirds (67 percent) of Black homeowners supported this type of density, compared with just over half (54 percent) of white homeowners. Zillow researchers speculated in an announcement that this may be related to persistent homeownership gaps driven in large part by historical discriminatory and exclusionary housing policies.

Advocacy was more muted for larger multifamily buildings. Only 37 percent of homeowners surveyed nationwide said they would support a large apartment building or complex in their neighborhood – and that support was more starkly divided among generations. Nearly 60 percent of homeowners aged 18 to 34 were open to large buildings, compared with only a quarter of those 55 and older.

However new housing construction comes about, more than three-quarters of homeowners surveyed said single-family neighborhoods should remain that way, with more older homeowners (81 percent) agreeing than younger homeowners (69 percent). And a little more than half said adding homes was acceptable if they fit in with the general look and feel of the neighborhood. Homeowners expressed concern about the impact of more homes on traffic and parking, with 76 percent saying that it would have a negative impact. About half said it would have a positive impact on amenities and transit.

Still, about two-thirds of homeowners (64 percent) said that more homes in single-family neighborhoods would have a positive effect on the overall availability of more-affordable housing options. Support for this sentiment was highest in Greater Boston, at 68 percent.”

According to Richard Rothstein in his 2017 book, Color of Law: A Forgotten History of How Our Government Segregated America, “we have created a caste system in this country, with African-Americans kept exploited and geographically separate by racially explicit government policies,” he writes. “Although most of these policies are now off the books, they have never been remedied and their effects endure.” Zoning was one of the policies that contributed significantly to this outcome.

Here are some highlights, selected for Arlington readers, from this book:

P. VII

“… until the last quarter of the twentieth century, racially explicit policies of federal, state and local governments defined where white and African Americans should live. Today’s racial segregation in the North, South, Midwest, and West is not the the unintended consequence of individual choices and of otherwise well-meaning law and regulation but of unhidden public policy that explicitly segregated every metropolitan area in the United States. The policy was so systematic and forceful that is effects endure to the present time. Without our government’s purposeful imposition of racial segregation, the other causes – private prejudice, white flight, real estate starring, bank redlining, income differences, and self-segregation – still would have existed but with far less opportunity for expression. Segregation by intentional government action is not de facto. Rather, it is what courts call de jure: segregation by law and public policy. “

1917 – Buchanan v. Warley – Supreme Court case that overturned racial zoning ordinance in Louisville, Kentucky. Municipalities ignore and fought against this. Kansas City and Norfolk through 1987.

1948 – Shelley v. Kraemer – Although racially restrictive real estate covenants are not per se illegal, since they do not involve state action, a court cannot enforce them under the Fourteenth Amendment. FHA continues to not insure mortgages for African Americans.

1968 – Fair Housing Act endorsed the rights of African Americans to to reside wherever they chose and could afford. Finally ending the Federal Housing Administration’s’ role in mortgage insurance discrimination.

1969 – Mass 40B law passed

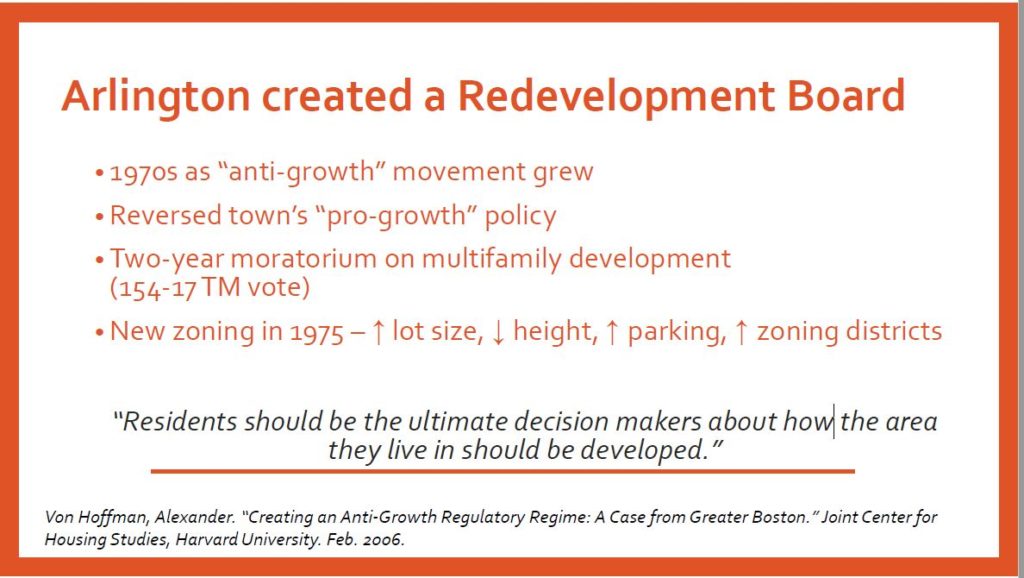

1972 – Head of Arlington ARB editorial talking about preserving the suburban way of life

1973 – Town Meeting passes moratorium on apartment construction

1975 – Arlington zoning re-do that all but stops development

1977 – Supreme Court upholds Arlington Heights, IL zoning that prohibited multi-unit development anywhere by adjacent to an outlying commercial area. In meetings leading to the adoption of these rules, the public urged support for racially discriminatory reasons.

p. 179″Residential segregation is hard to undo for several reasons:

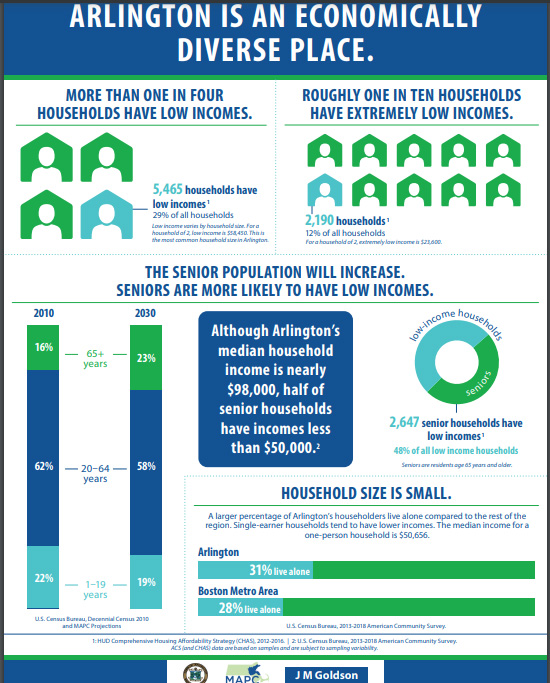

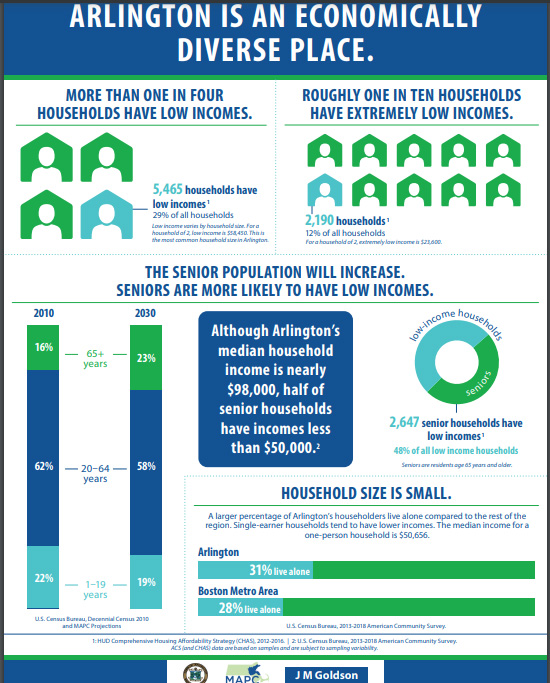

Does Arlington need more housing? If yes, will more housing result in higher school costs? There is a perception that more housing means more school age children and more school age children will strain the capacity and expand the budget of the Arlington Public Schools.

Prelimary reviews suggest that more housing would not strain the APS capacity for a variety of complex reasons. These reasons include: school age children do not always go to APS; by the time new housing came on line, the school enrollment, now growing, will have begun to decline; Arlington needs more diverse kinds of housing, not just family housing; the 283 units of housing that came on line through Brigham Square and 360 contributed more in property tax revenue than they cost in school enrollment costs…. by over $980K in 2019. Read this for more information.

More analysis is needed. More discussion is needed. These are complicated and nuanced issues. Readers with additional comments should send them to info@equitable-arlington.org.

by Arthur Prokosch

New research from the Urban Institute shows that rent control and rent stabilization policies in 27 metro areas increased the supply of rental units with prices affordable to extremely low-income residents. However, this came at the cost of less overall housing supply, and especially fewer rentals with prices affordable to higher-income residents. If subsidization proposals return to Boston and Massachusetts again next year, they will not be a silver bullet for affordability, but could be one ingredient in a successful strategy alongside more housing construction.

As detailed in an in-depth Boston Globe article, rent control in Massachusetts was last repealed statewide, 51-49%, by an initiative petition in 1994. A year ago, as the Globe also reported, Boston and Massachusetts saw a number of “rent stabilization” proposals to reinstitute some components of rent-control policies. None of these proposals included income-specific provisions like limits on higher-income tenants occupying rent-stabilized apartments. Discussions are likely to restart next year.

The new research gives stronger evidence that achieving the goal of affordable housing at all income levels requires multiple complementary strategies, because each affordable housing strategy has its own tradeoffs. Rent control may increase the number of very-low-priced rentals across an entire region, at least in the short run, with the tradeoff of reducing housing supply and affordability at higher income levels. Thus, at best, rent control would need to be paired with greater amounts of new housing production–even more than is already needed today–to be able to give a net benefit for low-income, moderate-income, and every other income band above very-low-income residents.

Other affordable-housing strategies have their own tradeoffs. Arlington’s inclusionary zoning requirements set aside some units for lower- and moderate-income residents, with a tradeoff of increasing the prices of the remaining units, or reducing their number. Meanwhile, nonprofit organizations like the Housing Corporation of Arlington and government agencies like the Arlington Housing Authority ensure that some lower-income residents can afford housing, with the tradeoff that their limited funding only allows them to serve a small fraction of the demand.

In contrast, reducing barriers to the construction of new housing decreases housing costs across a metro area. See another recent article for a description of how housing construction has a “filter effect”, slowing rent growth at all income levels. Even so, a range of strategies would help ensure that affordable housing arrives as quickly as it is needed, at every income level, and in every neighborhood where it is needed.

In summary, rent control can be a useful tool, one that’s most effective when combined with other strategies. Our housing problems are multi-faceted, and the responses have to be multi-faceted too.

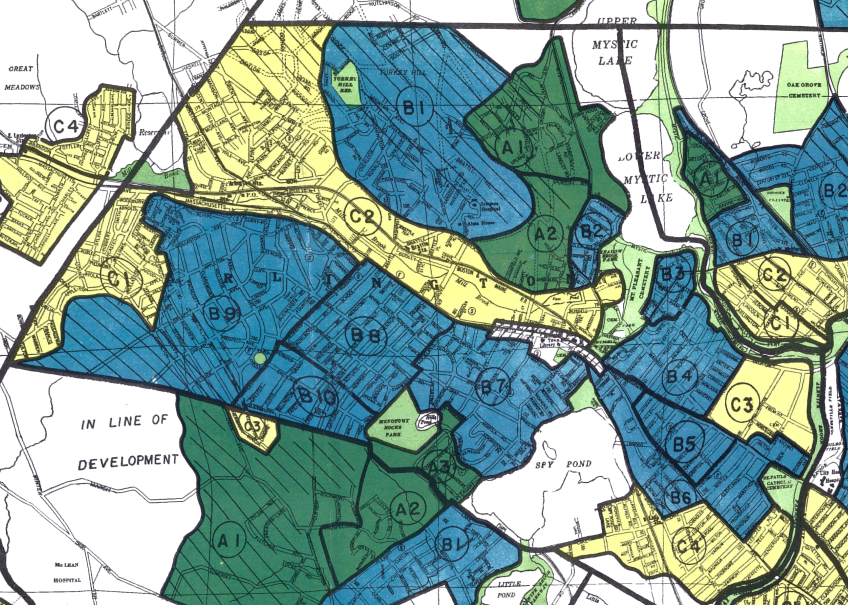

In the 1930’s the Home Owner’s Loan Corporation of America (HOLC) created actuarial maps of the United states. These maps were color coded — Green, Blue, Yellow, and Red — to reflect the amount of “risk” associated with home loans in those areas. The colors corresponded to “Best” (green), “Still Desirable” (blue), “Definitely Declining” (yellow), and “Hazardous” (red). Being in a green area made you likely to secure a federally-insured home mortgage, something that was effectively unavailable to red areas. Red areas were often associated with black populations, and these maps are where the term “redlining” comes from.

Here’s an HOLC map of Arlington, courtesy of the University of Richmond’s mapping inequality project.

Note that Arlington does not have any “Hazardous” (red) areas; 68% of the town fell into the top two grades, meaning that we were generally a safe bet as far as federal mortgage insurers were concerned. To the extent that the HOLC preferred white communities, Arlington seems to have fit the bill. According to US census data.

Today, Arlington is about 84% white. But during the time that mortgage approvals were based on the HOLC maps — the mid 1930’s through the mid 1960’s — we certainly qualified as an overwhelmingly (> 99%) white community.

Arlington had four yellow-lined (“definitely declining”) areas; about 32% of the town. C1 (on the western edge of town) was noted for an “infiltration of Jews”, a “heavy concentration of relief families”, and hilly terrain which was “not conducive to good development”. But it had good schools and a nice area along Appleton St. C2 (along Mass Ave and Mill Brook) was noted for “obsolescence” with “business and housing mixed together” and “railroad tracks through [the] neighborhood”. There was an infiltration of lower-class people, a moderate number of relief families, and “little possibility of conversion of properties to business use”.

C3 (East Arlington, around the present location Thompson School and Menotomy Manor) was noted for “Obsolescence, poor reputations” and “foreign concentration”. There was an “infiltration of foreign [residents]” and a “heavy concentration of relief families”. On the positive side, there were “a few small farms in this section of high grade development of the ground [which] may be anticipated in the early future with modest houses”.

Finally, C4 (around Spy Pond, and near the Alewife T station) was “obsolescent”, with an infiltration of foreign families, and a moderately heavy concentration of relief families. The HOLC noted that “Houses East of Varnum Street [and] south of Herbert Road are built on low ground and many have damp basements which makes them difficult to keep occupied”.

That’s what the HOLC saw as the declining side of Arlington: Jews, foreigners (mostly Italian), relief families, obsolescence, damp basements, and proximity to the Boston-Maine railroad.

Exercise for the reader. Arlington has five public housing projects: Drake Village, Winslow Towers, Chestnut Manor, Cusack Terrace, and Menotomy Manor. What HOLC colors are associated with our public housing?

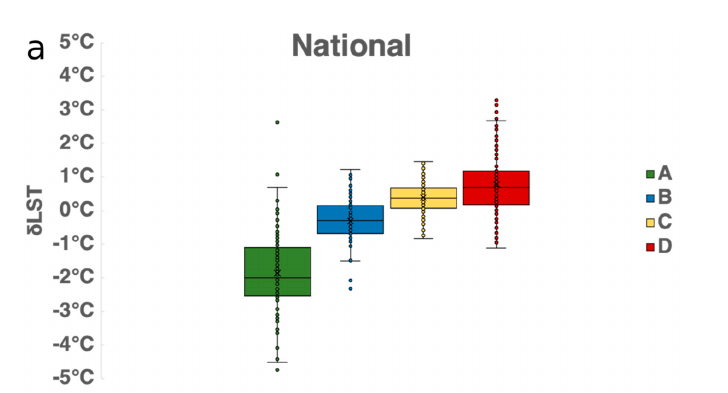

Buildings last for decades, and effects of the HOLC’s underwriting policies are still with us today — sometimes in unexpected ways. A 2020 paper called “The Effects of Historical Housing Policies on Resident Exposure to Intra-Urban Heat: A Study of 108 US Urban Areas” examined 108 communities, and tried to determine if there was a relationship between redlined areas and urban heat islands. Nationwide, this is what they found:

LST stands for “land surface temperature” and shows how different HOLC risk categories compare to the overall temperature of a region. Green areas tend to be cooler, with less paved surface, more extensive tree canopies, and buildings with reflective exteriors. Red areas are warmer with more paved surfaces, less tree canopy, and building exteriors that absorb and release heat (e.g., brick and cinderblocks). While the degree varies across different parts of the country, the general trend is the same: as one goes from green to red, the surface temperature goes up. Formerly-redlined areas are far more likely to contain heat islands.

Exercise for the reader. Are there heat islands in Arlington? What (HOLC) color are they?

As the global temperature warms, Arlington (like many other communities) will have to contend with heat islands. The treatment is likely to be area-specific, following patterns laid out in the HOLC’s maps from the early-20th century.

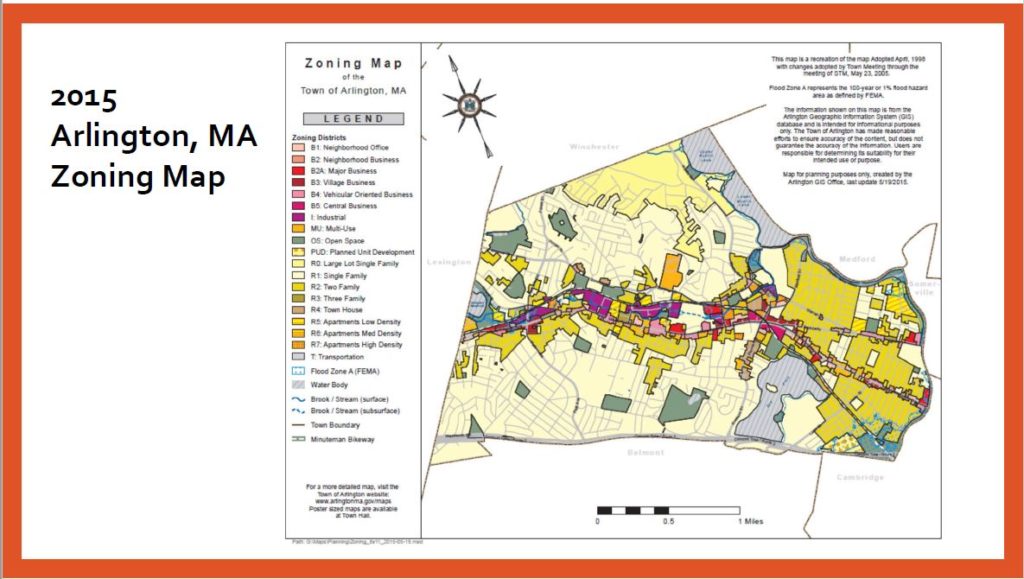

A report by Mass Housing Partnership’s Shelly Goehring looks at Arlington’s housing development history and policies to understand how municipal action and inaction can contribute to housing inaffordability and can limit the population diversity within a community. The report implies that it has been difficult historically for reputable housing developers to work with the regulatory structure within Arlington to get housing built.

Massachusetts has the nation’s 2nd largest gap in homeownership between households of color (31% own homes) and white households (69% own homes).

See the complete report for more information.

State Senator Cindy F. Friedman has written a letter to Town Meeting Members supporting Warrant Article 12 and a meaningful MBTA Communities Plan. She writes:

We all want Arlington and Massachusetts to remain welcoming, accessible places to live. In addition to our deficit of housing, I recognize the importance of encouraging smaller, more sustainable housing in walkable areas. Arlington’s Warrant Article 12 will provide a meaningful framework for making progress in these areas. The problems we are experiencing now —out of reach housing prices for new construction and existing homes — exacerbate the crisis and are seriously threatening the economic vibrancy of our communities.

To read Friedman’s full letter, click here for the PDF.