Article 4 in a series on the Arlington, MA Master Planning process. Prepared by Barbara Thornton .

Most of Arlington’s budget depends on the Town’s tax base. As the cost of services increases, the Town budget must increase. Massachusetts communities are limited in their ability to increase taxes on existing property. Many municipalities have developable land that can add new value to the existing tax base. But Arlington has little developable land left. Retaining and expanding both the employment base and the tax base will require redevelopment on existing sites. Business districts along Massachusetts Avenue and other commercial areas are most likely to see this redevelopment. It will not only expand the tax base, it may give residents an opportunity to work closer to where they live.

The Master Planning process, coordinated through the Arlington Dept. of Planning and Development and assisted by RKG Associates, architects and planners, reported the following in their examination of the Town’s Economic Development issues:

Economic Development Goals:

- Identify areas of “economic underutilization”

- Maximize the buildout potential of commercial and industrial properties

- Support conditions that benefit small, independent businesses

- Improve access to public transit and parking

- Preserve and maintain Arlington’s historic structures and cultural properties to leverage economic development

Key Findings on Economic Development

- Arlington’s convenient access to employment centers in Boston and Cambridge attracts highly educated and skilled homebuyers and renters. 39% of its labor force comutes to these two cities.

- Based on recent MCAS and SAT scores, Arlington has a highly ranked school district. This enhances the town’s residential appeal.

- The Town’s tax rate is lower than most surrounding cities and towns and does not have a separate, higher rate for commercial properties.

- Between 2008 and 2012 the number of businesses in Town increased by 70. And employment rates recovered, surpassing the pre-recession rates.

- A diverse base of local businesses covers nearly all industry sectors. Jobs in construction, personal and other services, education, health care, real estate and government make up larger percentages of employment here than in the Boston metropolitan area.

- Two theaters, Capitol and Regent, draw about 200,000 patrons a year who spend $2.4 million per year at shops and restaurants in these districts.

- A vibrant local arts community includes both organizations and many self employed residents who work in fine and performing arts. This creative infrastructure helps make Arlington’s commercial districts interesting places to shop, visit and work. And this boosts the use and value of the commercial properties.

- Wages paid by local employers in Arlington are much lower (-39%) than in Middlesex County for all industries except retail. This contributes to the fairly small percentage of Arlington residents who work in the town.

Town Profile: Redevelopment or Residential Property Tax Pain

Arlington is part of the Boston-Cambridge-Quincy, MA New England City

and Town Area (NECTA) Division (Boston Metro), an area that includes

Boston and ninety-two communities with employment ties to Greater Boston

and the Route 128/I-95 suburbs. It has clear strengths in the Arts,

Culture and Tourism sectors of economic development and in redevelopment

opportunities to expand commercial and industrial development.

Currently there are 415 commercial and industrial properties in town, a combined total of 193 acres and about 2.5 million sq. ft. of floor space, generating over $6 million in real estate taxes.

Of the 4,400 respondents to the 2012 Arlington Vision 2020 annual survey (included in the Town Census), 67% rated “distinctive commercial centers” as important of very important to the town. Many believe that new economic development, opportunities for start-up businesses and the future of Arlington’s business districts are important for the Town. Analysis shows that by 2020 the current zoning by-law’s height and parking limits will significantly limit reinvestment in many of Arlington’s commercial parcels. This, in turn, will limit the growth in tax base revenue and in employment opportunities.

Most of the recent growth in tax base has been due to the redevelopment of residential property. The rate has fallen but the single family tax bill still remains among the top 50 highest in the state. This could be alleviated with an expansion of the commercial and industrial tax base which has declined from 9% in the 1980’s to just 6% of the Town’s tax base today. In order to restore taxes from commercial and industrial properties to the pre-recession level, the Town would need a plan that required major land use and density changes in the Town’s commercial and industrial districts. Just to regain the same balance of taxes from residential (back to 92% ) and commercial/ industrial (return to 8%), the Town would need to almost double the current amount of commercial floor space, the equivalent of adding another story to each existing commercial structure in town.

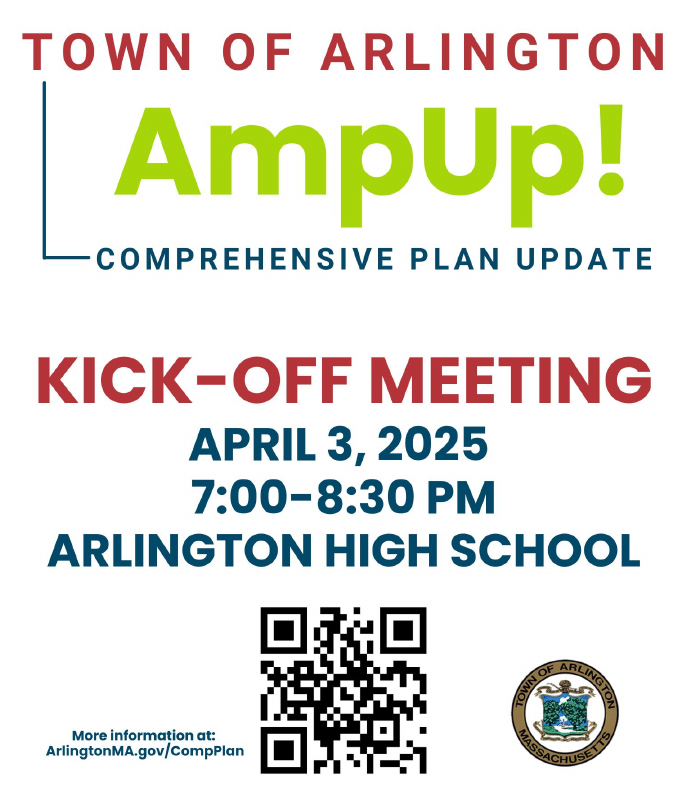

Public Discussion on Opportunities Will Shape Future

The meeting convened last April 3, 2014 to discuss the economic

development plan included a wide ranging discussion on the need for

change in the old density requirements defined primarily by zone and by

height limitations. The Town has at least five sites where new

commercial or mixed-use redevelopment could occur. The possibilities

could enrich the town both financially and in building on its native

strengths in arts, tourism and entrepreneurship. More discussions can be

expected as the Master Plan is drafted and the Town moves toward a

closer examination of its Zoning By-Laws.