Prof. Christophe Reinhardt runs the MIT Sustainable Design Lab. On Nov. 25, 2019 he gave a very interesting presentation, including talk and slides, that shows a pathway to make more housing, all kinds of housing, and greater housing density both more palatable in Arlington, and actually desirable. He also stressed the importance of paying attention to housing now in order to meet the climate change challenge. Charts (starting about 10 min in) show how drastically we need to reduce our carbon footprint to reach net zero by 2050. Buildings today account for about 40% of our carbon emissions world wide. What we build today will likely be around through 2050.

Paying attention to housing design is important to create a sustainable environment.

Here is the link for the Reinhardts talk and slide show:

http://scienceforthepublic.org/energy-and-resources/designing-sustainable-urban-development

or see it on youtube: https://youtu.be/YAeCvUZmUrI

He uses research, drawn from around the world and locally, to show what measurable attributes make local communities desirable to live in and what attributes of housing make residents happy.

Key attributes for success (slide is at about 18:15 min. in presentation):

1. Economic opportunities (proximity to work opportunities)

2. High quality living (daylight access for buildings, streets, walkable, mixed use, micro-units, vibrant public spaces, organic food, fitness opportunities)

3. Sustainability (comfortable work and play and living spaces, resource efficiency)

The presentation was arranged by the Robbins Library. It was developed and recorded by Science for the Public as part of it’s lecture series.

For more information on sustainability and cities, cities and local municipalities are beginning to recognize the important linkages between urban resiliency, human well-being, and climate change mitigation and adaptation activities. https://news.mongabay.com/2019/11/how-cities-can-lead-the-fight-against-climate-change-using-urban-forestry-and-trees-commentary/ Courtesy of Science for the Public Interest Weekly News Roundup.

(For more opportunities to learn about sustainability, buildings and cities, sign up for the FREE MITx “Sustainable Building Design” online course which starts January.)

(Elliot L. is an 8th grader at the Ottoson Middle School)

In the middle of COVID-19, I started to notice a large construction project happening right down the street in our little neck of the woods by Thompson school. I simply assumed it was another apartment building, but after asking the adults of my community, I found it was much more impactful than that. Arlington was supporting a large affordable housing project to be established, along with plans of putting Arlington EATS, a food pantry, below it. This got the gears in my tiny sixth grade mind churning. I began asking questions like: how do you apply to live there? How much does it cost? Do the owners provide you with furniture? Of course, most of those questions were answered by my parents, and then quickly put in the back of my mind. However, the idea of affordable housing stuck with me, especially when you can see it from your front porch. Upon reaching the 8th grade, where I am now, I found myself and every student in my class presented with a year long project trying to make change in Arlington. This assignment, called the Civics Action Project, or CAP, guides students to choosing a local issue they wish to address.

The premise got me thinking. How can I help my community with our rising cost of living and need for affordable housing? Initially, the other students and I were overwhelmed by the magnitude of the issue, and had trouble thinking of a reachable solution.

Despite this, a small group of classmates and I were intrigued by a bill mentioned by Claire Ricker, Arlington’s director of Planning and Community Development, during an informational panel. Ms. Ricker talked about the MBTA Communities Act, a law requiring Arlington to create higher-density housing near the T. We knew we had found our goal, to raise awareness and support zoning for affordable housing as part of the act.

However, as our research continued, we learned of the real function of this legislation. The goal of the MBTA communities act is to build more compact middle income housing. This will make it so people like young adults and downsizers can come to live in this town, building their future and contributing to a diverse community. This is an essential step in the right direction for the town, but our strides need to be longer.

In order to support our goal, we still wanted to learn more about Arlington’s affordable housing needs. We wanted to promote those issues, as well as the missing middle housing we desperately need. Our group started by conducting a survey that we posted on Arlington forums, along with directly sending it to as many people as we could. 60 residents responded, and we then shared these results with Select Board member Len Diggins. Here are some of the most interesting results of this survey!

After the results of our survey, along with other actions taken to learn more about the MBTA communities act, my group and I came to a conclusion of our plan: In order to try and make a change in Arlington, we were going to spread the word to as many adults as we could in order to support both the higher-density housing the MBTA communities act is focused on, and lower cost housing. While these are separate things, our thinking is that the more people who can vote and hear about this, the more willing they will be to connect and support the different pieces of the puzzle to solve our housing issue. This is not just a one-time thing. The MBTA communities act is a planned, strategic opportunity to make Arlington a better place for the future. We hope with the information provided, you will also keep the cause of affordable housing progressing as well. Thank you for reading!

from Banker & Tradesman, March 10, 2020: https://www.bankerandtradesman.com/63-percent-in-greater-boston-back-adus/ B&T produced a terrific report on the strong interest across the nation in allowing more ADUs (Accessory Dwelling Units) . This follows after California recently passed strong “YIMBY” legislation encouraging the developement of ADU’s.

“A new, nationwide survey from real estate website Zillow has found that nearly two-thirds of Boston-area residents want the ability to convert their single-family homes into multifamily units.

While the survey conducted across 20 of the nation’s largest metro areas found three in four respondents agree local governments should do more to keep housing affordable, and most agree that allowing more building would help, they remain skeptical of large, multifamily buildings.

The latest Zillow Housing Aspirations Report asked homeowners for their feelings about how best to help quell affordability issues by allowing more homes into their neighborhoods, and comes as in-law suites and backyard cottages gain attention as possible solutions to sharply rising housing costs.

Housing experts say even modest rezoning to allow for more accessory dwelling and small multifamily units could spur the creation of millions of new homes nationwide. Even rezoning limited to areas near MBTA stations would enable the construction of enough units to meet most of the units the state needs to build by 2025 to satisfy demand, according to the Massachusetts Housing Partnership.

Small multifamily buildings – those between two and four units – are increasingly being promoted in some corners as so-called “missing middle” housing that can increase both supply and affordability because the structures often cost less to build than larger multifamily ones.

“In an era of historically low supply and escalating housing prices, the need for more solutions to create housing opportunities is greater than ever. Our latest research shows that homeowners in major markets are generally supportive of providing a range of housing options that allow for not only more housing units, but also a diversity of housing types in existing communities,” Zillow senior economist Cheryl Young said in a statement. “Homeowners may continue to shy away from adding large multifamily buildings nearby, but are open to adding units in their own backyards. This ‘missing middle’ housing, they believe, could help alleviate the housing crunch without sacrificing neighborhood look and feel while improving local amenities and transit. These findings show that broad-based support, especially from homeowners, provides the middle ground necessary to move the needle needed to bring relief to the housing crunch.”

In Greater Boston, 63 percent of survey respondents said homeowners should be able to add additional housing units to their property, compared to 57 percent in Minneapolis, where city officials last year eliminated single-family zoning city-wide in an effort to boost housing production and affordability.

Nationwide, 57 percent of those surveyed backed the ideas of increasing density on single-family lots, and 30 percent said they would be willing to invest money to create housing on their own property if allowed.

The strongest support comes from younger and lower-income homeowners and those in the West, where housing tends to be the most expensive. The highest support was in the San Diego (70 percent), Seattle (67 percent) and San Francisco (64 percent) metros, and the lowest was in the Detroit (47 percent), Phoenix (50 percent) and Dallas (51 percent) areas.

Support also was strongest among homeowners of color – two-thirds (67 percent) of Black homeowners supported this type of density, compared with just over half (54 percent) of white homeowners. Zillow researchers speculated in an announcement that this may be related to persistent homeownership gaps driven in large part by historical discriminatory and exclusionary housing policies.

Advocacy was more muted for larger multifamily buildings. Only 37 percent of homeowners surveyed nationwide said they would support a large apartment building or complex in their neighborhood – and that support was more starkly divided among generations. Nearly 60 percent of homeowners aged 18 to 34 were open to large buildings, compared with only a quarter of those 55 and older.

However new housing construction comes about, more than three-quarters of homeowners surveyed said single-family neighborhoods should remain that way, with more older homeowners (81 percent) agreeing than younger homeowners (69 percent). And a little more than half said adding homes was acceptable if they fit in with the general look and feel of the neighborhood. Homeowners expressed concern about the impact of more homes on traffic and parking, with 76 percent saying that it would have a negative impact. About half said it would have a positive impact on amenities and transit.

Still, about two-thirds of homeowners (64 percent) said that more homes in single-family neighborhoods would have a positive effect on the overall availability of more-affordable housing options. Support for this sentiment was highest in Greater Boston, at 68 percent.”

A study by Elise Rapoza and Michael Goodman shows that new housing construction in MA does not have an adverse affect on municipal or school budgets. And when it might, state funding covers the difference. This study contradicts the often heard argument against new housing development, especially multi-family housing, because it, the argument claims, it will have a negative fiscal impact on communities.

In the aggregate, development of new housing offers net fiscal benefit to both municipalities and the state. Additional analysis validates a second study which found that increased housing production does not predict enrollment changes in Massachusetts school districts. In the new study, a distinct minority of municipalities did incur net fiscal burdens—burdens that the net new state tax proceeds associated with the development of new housing are more than sufficient to offset.

by JP Lewicke

When you love the place you live and you want to help it become even better, how can you make a difference? Arlington is an extremely civically active community, with hundreds of residents involved in Town Meeting, several dozen boards and committees, and numerous other groups that play an important role in improving our town. The vast array of options can be a bit dizzying for a newcomer to sort through.

Fortunately, Arlington has recently launched Arlington Civic Academy to provide interested residents with a pathway to becoming more civically literate and involved. Ably organized by Joan Roman, Arlington’s Public Information Officer, Civic Academy takes place over the course of six weeks and aims to provide participants with the information they need for constructive civic engagement. Applications are open from now until August 4th for the fall session, which will take place between September 12th and October 17th.

It’s clear that town government takes the Academy seriously. The Town Manager, Select Board Chair, Town Moderator, and the heads of several town departments have stayed late into the evening to attend Civic Academy sessions. Their formal presentations do a great job of explaining how different areas of town government work and how best to get involved, but the chance to meet them and ask them questions is equally valuable. The participants usually have a lot of very insightful questions, and it’s a great opportunity to learn more and become a more effective advocate in the future.

The other participants are another great part of the program. It’s also a great chance to make connections with other people who are equally enthusiastic about learning and getting involved in making their town a better place. There have been two sessions of the program so far, and several participants have gone on to run for Town Meeting, join the Master Plan Update Advisory Committee, volunteer for last fall’s tax override campaign, and propose warrant articles. We just had a get-together for members of both Civic Academy sessions to meet each other and network, and are hopeful that Civic Academy alumni can help connect future participants in the program to opportunities to get involved in helping Arlington become even better.

I ran for Town Meeting this spring after attending Civic Academy last fall, and I found that it served me well after I was elected. It taught me how the budgeting process worked, including all the steps from the Town Manager’s office working with individual departments, the Finance Committee compiling a cohesive budget, and Town Meeting approving that budget. When constituents from my precinct have questions about how to get help with something from the town, I know which boards or committees or town departments they should reach out to. I also have a better understanding of the current constraints and opportunities faced by our town across multiple areas.

When I started working with Paul Schlictman on advocating for extending the Red Line further into Arlington, I reached out to the members of my Civic Academy class to see if they were also interested, and several of them were incredibly generous with their time and helped us set up our website and mailing list. I would highly recommend applying to Civic Academy, and I’m very thankful that the town puts so much effort into making it a great experience.

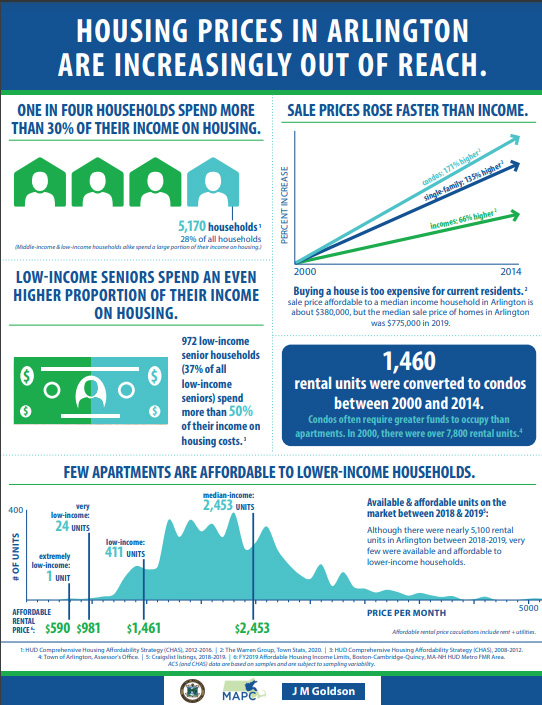

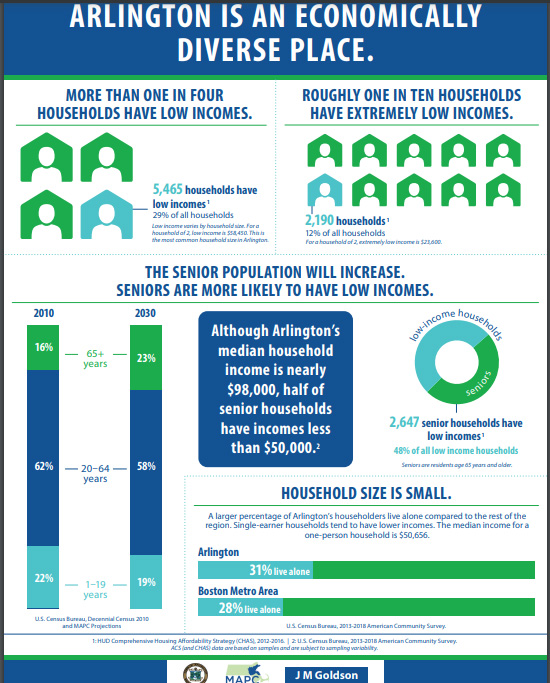

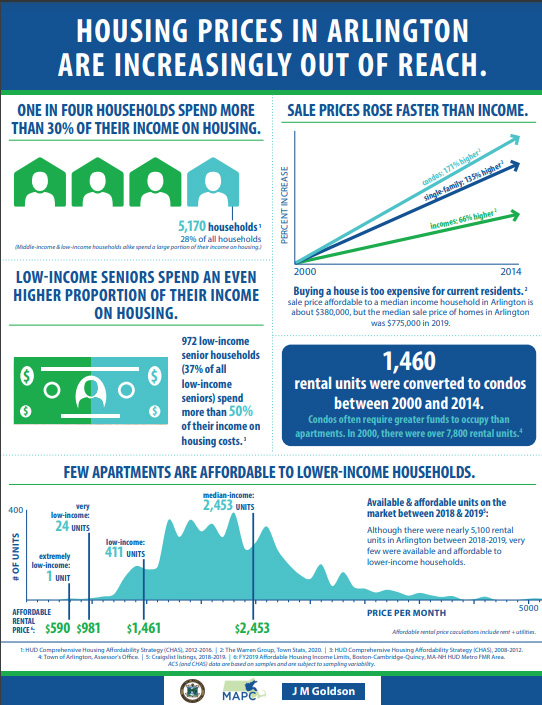

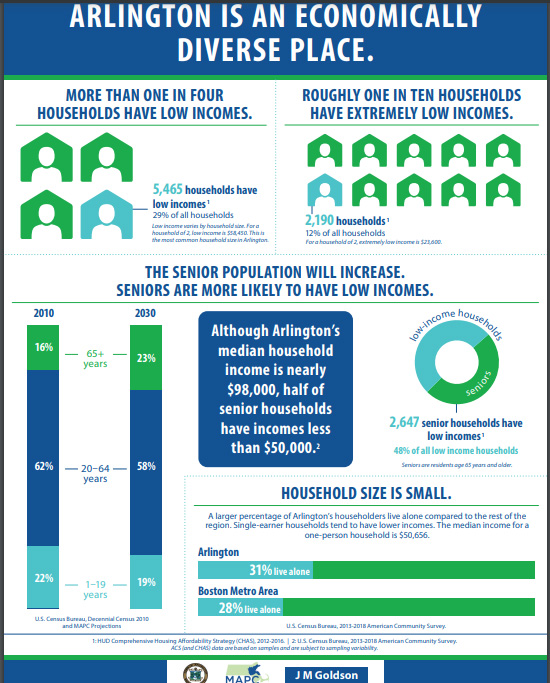

In a 2019 study, MAPC found that:

This study raises important questions about the wisdom of continuing to commit large sections of the land area of our municipalities to be on reserve for parking cars. Such extra space could be used to benefit the open space, environmental sustainability and the need for more housing.

It’s January 2023, and as we do every year, folks in Arlington are taking out nomination papers, gathering signatures, and strategizing on how to campaign for the town election on Saturday April 1st. The town election is where we choose members of Arlington’s governing institutions, including the Select Board (Arlington’s executive branch), the School Committee, and — most relevantly for this post — Town Meeting.

If you’re new to New England, Town Meeting is an institution you may not have heard of, but it’s basically the town’s Legislative Branch. Town Meeting consists of 12 members from each of 21 Precincts, for 252 members total. Members serve three-year terms, with one-third of the seats up for election in any year, so that each precinct elects four representatives per year (perhaps with an extra seat or two, as needed to fill vacancies). For a deeper dive, Envision Arlington’s ABC’s of Arlington Government gives a great overview of Arlington’s government structure.

As our legislative branch, town meeting’s powers and responsibilities include:

Town Meeting is an excellent opportunity to serve your community, and to learn about how Arlington and its municipal government works. Any registered voter is eligible to run. If this sounds like an interesting prospect, I’d encourage you to run as a candidate. Here’s what you’ll need to do:

Town Meeting traditionally meets every Monday and Wednesday, from 8:00 — 11:00 pm, starting on the 4th Monday in April (which is April 24th this year), and lasting until the year’s business is concluded (typically a few weeks).

If you’d like to connect with an experienced Town Meeting Member about the logistics of campaigning, or the reality of serving at Town Meeting, please email info(AT)equitable-arlington.org and I’d be happy to make an introduction.

During the past few years, Town Meeting was our pathway to legalizing accessory dwelling units, reducing minimum parking requirements, and loosening restrictions on mixed-use development in Arlington’s business districts. Aside from being a rewarding experience, it’s a way to make a difference!

(Contributed by Ben Rudick and Steve Revilak)

We should end exclusionary Single Family Zoning in Arlington. This is inspired by Minneapolis which ended Single Family Zoning city-wide last year, as Oregon did. To be clear, we’re not suggesting an end to single family homes, only to exclusionary Single Family Zoning; you can still have a single-family house, but now you’d have the option to build a two-family or duplex instead.

79% of all residential land in Arlington is zoned exclusively for single family homes (in the R0 and R1 districts), meaning the only legal use of that land is for a single home built upon a large lot (source: Arlington GIS via the Department of Planning and Community Development). This is a problem for three key reasons:

If you’d like to support us, please share this post and join our Facebook group, Arlington Neighbors for More Neighbors, where we’ll post updates and hearing times for the warrant article we’ve submitted to effect this change.