This 102 page document is the most recently revised set of recommendations by the Town of Arlington’s Redevelopment Board. The report takes into consideration the comments and information provided over the last few months’ public hearing process. It also incorporates a citizen petition which strengthens the case for increasing permanent affordable housing with the passage of these zoning related Articles. Town Meeting convenes on April 22, 2019.

Related articles

by JP Lewicke

When you love the place you live and you want to help it become even better, how can you make a difference? Arlington is an extremely civically active community, with hundreds of residents involved in Town Meeting, several dozen boards and committees, and numerous other groups that play an important role in improving our town. The vast array of options can be a bit dizzying for a newcomer to sort through.

Fortunately, Arlington has recently launched Arlington Civic Academy to provide interested residents with a pathway to becoming more civically literate and involved. Ably organized by Joan Roman, Arlington’s Public Information Officer, Civic Academy takes place over the course of six weeks and aims to provide participants with the information they need for constructive civic engagement. Applications are open from now until August 4th for the fall session, which will take place between September 12th and October 17th.

Find Out How the Town Works

It’s clear that town government takes the Academy seriously. The Town Manager, Select Board Chair, Town Moderator, and the heads of several town departments have stayed late into the evening to attend Civic Academy sessions. Their formal presentations do a great job of explaining how different areas of town government work and how best to get involved, but the chance to meet them and ask them questions is equally valuable. The participants usually have a lot of very insightful questions, and it’s a great opportunity to learn more and become a more effective advocate in the future.

Participants Make Arlington Civic Academy Great

The other participants are another great part of the program. It’s also a great chance to make connections with other people who are equally enthusiastic about learning and getting involved in making their town a better place. There have been two sessions of the program so far, and several participants have gone on to run for Town Meeting, join the Master Plan Update Advisory Committee, volunteer for last fall’s tax override campaign, and propose warrant articles. We just had a get-together for members of both Civic Academy sessions to meet each other and network, and are hopeful that Civic Academy alumni can help connect future participants in the program to opportunities to get involved in helping Arlington become even better.

Helping Others Learn to Navigate Town Processes

I ran for Town Meeting this spring after attending Civic Academy last fall, and I found that it served me well after I was elected. It taught me how the budgeting process worked, including all the steps from the Town Manager’s office working with individual departments, the Finance Committee compiling a cohesive budget, and Town Meeting approving that budget. When constituents from my precinct have questions about how to get help with something from the town, I know which boards or committees or town departments they should reach out to. I also have a better understanding of the current constraints and opportunities faced by our town across multiple areas.

When I started working with Paul Schlictman on advocating for extending the Red Line further into Arlington, I reached out to the members of my Civic Academy class to see if they were also interested, and several of them were incredibly generous with their time and helped us set up our website and mailing list. I would highly recommend applying to Civic Academy, and I’m very thankful that the town puts so much effort into making it a great experience.

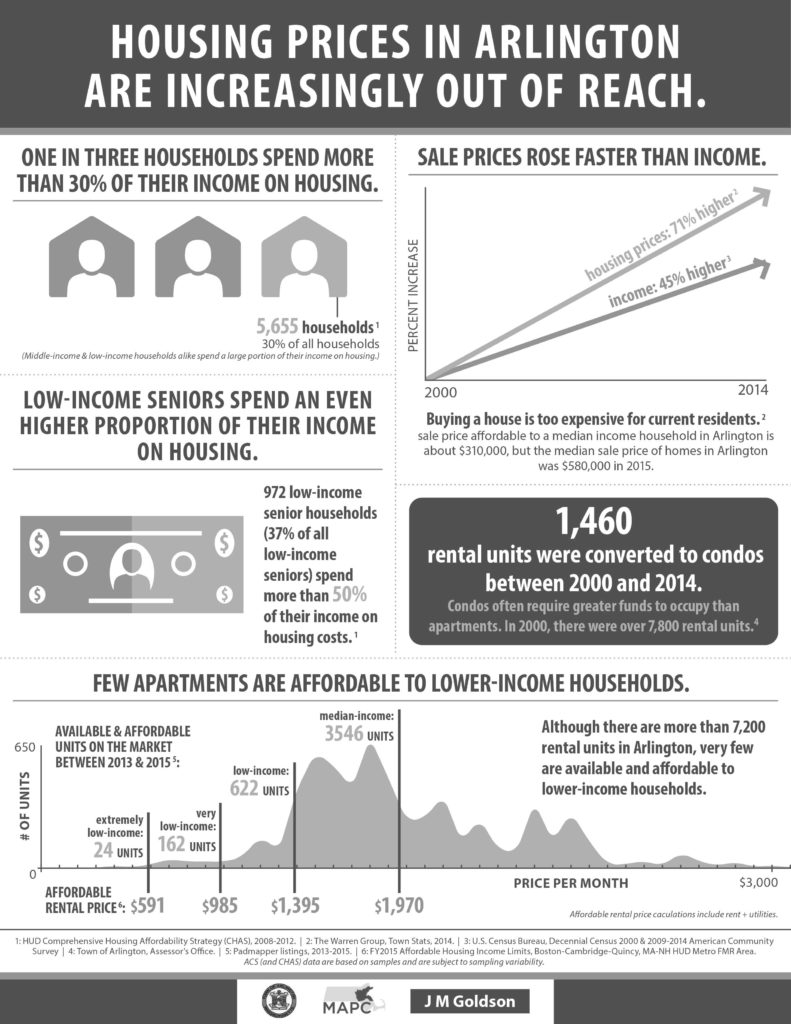

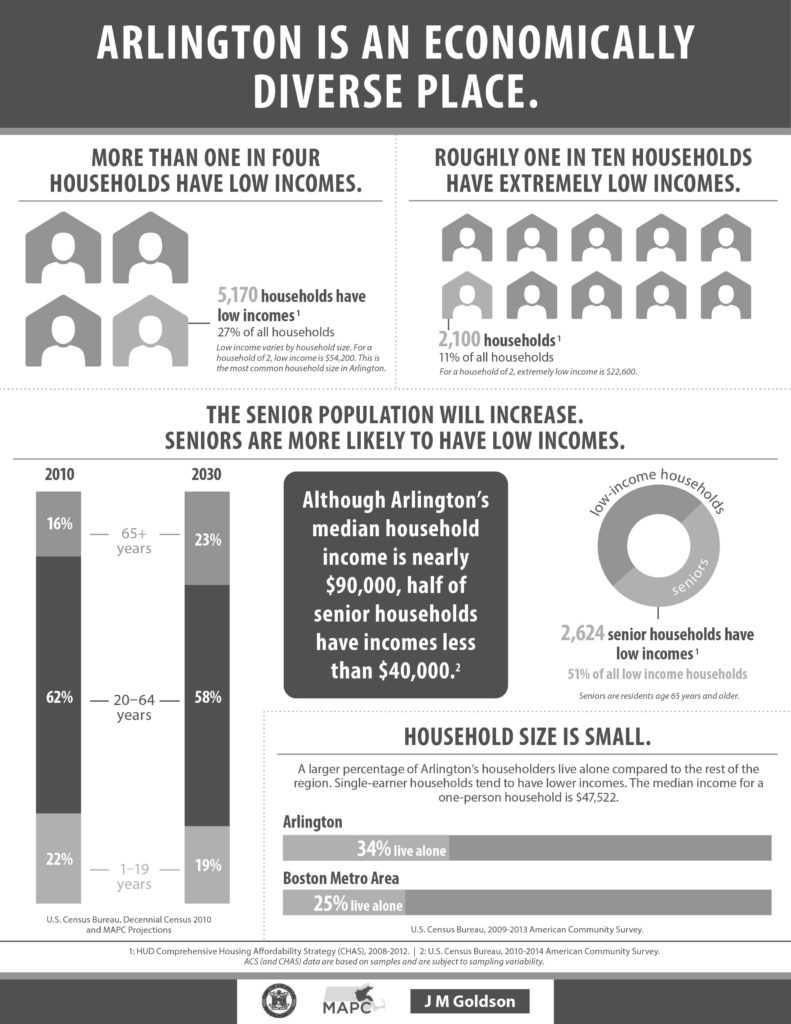

Many issues are under discussion as a result of these proposed zoning Articles. Issues include: housing affordability, the diversity of housing and incomes in Arlington, environmental concerns and sustainability, tax burdens or tax savings potentially resulting from growth, the risk of postponing the decisions, and the image of Arlington as a community that values diversity and equitability. This one page “fact sheet” attempts to address many of these issues and concerns.

by Annie LaCourt

One of the concerns people have about the current MBTA Communities zoning proposal is the effect that the increase in housing will have on the town’s budget. Will the need for new services make demands on our budget we cannot meet without more frequent overrides? Or will the new tax revenues from the new buildings cover the cost of that increase in services?

The simple answers to these questions are

- No: It will not make unmanageable demands on the budget; and

- Yes: the new tax revenue from the multi-family housing anticipated will cover the costs of any new services required.

Adopting the current MBTA Communities zoning proposal may even slow the growth of our structural deficit, as I will show in more detail using as examples some of the more recent multi-family projects that have been built in Arlington.

How Does Our Budget Work and What is the Structural Deficit?

First, some basic facts about finance in Arlington: Like every other community in Massachusetts, Arlington’s property tax increases are limited by Proposition 2.5 to 2.5% of the levy limit each year. What is the levy limit? It’s all of the taxes we are allowed to collect across the whole town, without getting specific approval from the Town’s voters. For FY 23 the levy limit is $135,136,908. $3,271,996 of that is the 2.5% increase we are allowed under the law. But also added to that is $1,202,059 of new growth, which comes from properties whose assessment changed because they were substantially improved–either renovated or by increasing capacity. When we reassess a property that has a new house or building on it, we are allowed to add the new taxes generated by the change in value of the property to the levy limit.

Property taxes make up approximately 75% of the town’s revenue. So – except for new growth – that means that the bulk of our budget can only grow 2.5% a year. Other categories of income like State Aid have a much less reliable growth pattern. If the state has a bad fiscal year, our state aid is likely to remain flat or decrease.

Expenses

On the expense side, our default is a budget to maintain the same level of services year to year. We cap increases in the budgets of town departments by 3.25% and the school budget by 3.5%, save for special education costs which are capped slightly higher.

We also have several major categories of expense that are beyond our control that increase at a greater rate than 2.5%. These include, among other things, funding our pension obligations, health insurance costs and our trash collection contract.

Structural Deficit

This difference between the increase in revenues and the increase in costs is the structural deficit. It’s structural because we can’t cut our way out of it without curtailing services severely and we can’t stop paying for things like pensions and insurance that are contractual obligations.

The question of how MBTA communities zoning will affect this is crucial. So let’s take a deeper dive, first on revenue and then on expenses.

How Will MBTA Communities Affect New Growth?

How MBTA-C zoning will affect new growth depends on what gets built and at what rate. Let’s consider some real world examples:

882 Mass Ave. used to be a single story commercial building. It was assessed at $938,000 and the owner paid approximately $9,887 in taxes annually. It has been rebuilt as a mixed use building with commercial space on the ground level and 22 apartments on 4 floors above. The new assessment is approximately $4,800,000 and the new tax bill is about $54,000.00. That means $45,000 in new growth – new property taxes that will grow at the rate of 2.5% in subsequent years.

Another example is 117 Broadway. The building that used to be at that address was entirely commercial, assessed at $1,050,000 and paid around $11,770 in taxes annually. After being rebuilt as mixed use by the Housing Corporation of Arlington, it is assessed at $3,900,000 and taxed at $43,719. 117 Broadway has commercial on the ground floor and 4 stories of affordable housing above. The new growth for this example is approximately $30,000.

What these examples show, and our assessor believes is a pattern, is that a new mixed use or multi-family building increases the taxes we can collect by as much as 400%, depending on the kinds of housing units.

So we can expect new development under MBTA Communities to increase the levy limit substantially over time, reducing the size and frequency of future tax increases.

How Will This New Housing Affect the Cost of Services?

Of course, with new residents comes a need for additional services. However, town-provided services will be impacted differently. Snow and Ice removal, for example, will not be affected at all – we aren’t adding new roads. Many other services provided by public works are like snow and ice: They would only increase at a faster rate if we added more land area or more town facilities to the base.

Services like public safety and health and human services may see gradual increases in service requests, as more people place more demand on these departments. Right now we have a patrol officer for every 850 or so residents. This means we might need to add a new patrol officer if the population increases by 850 residents. But it’s not clear that a new officer would be needed; it depends on the trends the police department sees in their data. I think of these services as increasing by stair steps: Adding a few, or even a few hundred, residents doesn’t require us to add staff to provide more services. Adding a few thousand might mean we need to add a position but we will have added a great deal to the levy limit before we need to add those positions.

Trash Collection Impact

There is one town service that sees an impact every time we add a new unit of housing – trash collection. The town spends approximately $200 per household on solid waste collection and disposal. As mentioned above, 882 Broadway has 22 new 1 bedroom and studio apartments. When that building was all commercial the businesses paid privately for trash removal. The new trash collection costs will be at least $4,400 annually. It’s possible, however, that the building will need a dumpster and that could cost up to $20,000 annually. Either way the new revenue ($45,000) outstrips the increased costs. The town is working on creative solutions for new buildings to keep this cost as affordable as possible.

What About Schools?

Regardless of new housing construction, our student population ebbs and flows. Families move in with small children who go through the school system. The kids graduate high school but their parents, now in their 50’s or 60’s, don’t move until they are much older and need a different living situation. When they sell their homes, the new owners are likely to be families with children again. We can see a pattern of boom and bust in our school population if we look back. Right now, we are seeing a drop in elementary population as this cycle plays out again. We now have 221 fewer students enrolled in the elementary schools than we did in 2019.

We account for this ebb and flow in the budget. A number of years ago, we set a policy to add a growth factor to the school budget. We increase the budget by 50% of per pupil costs for each new student. Currently that is $8800.00 per student. But the policy works in reverse as well. We reduce the budget by the same amount per child as the student population wanes. We also see increased state aid under chapter 70 when our student population grows and may see reductions if it shrinks.

Will Multifamily Homes Add Students?

The new multi-family housing generated by MBTA communities zoning may add students to our schools – but not as many as you might think. Other large multi-family developments like the Legacy apartments and the new development at the old Brigham site have not added a lot of children to the schools directly. Going back to our two example buildings, 882 Mass Ave is all studio and 1 bedroom units, so we are unlikely to see children living there. Our MBTA communities zoning, however, must by law allow new housing that is appropriate for families. So for planning purposes, it’s best to assume we will see growth in the school population.

So what will the effect of this new housing be on the school population and our budget? Given that the new housing will be built gradually, it’s more likely to stabilize our student population than precipitously increase it. The same will be true for our budget: We will see some increases in the school budget growth factor but also increases in state aid and increases in tax revenue from the new construction.

Conclusions

If we create an MBTA communities zone per the working groups recommendation or something close to that, we will see the effect on our budget over time, not immediately. Even if the zone has a theoretical capacity of 1300 additional units (total capacity minus what is already there) the development of new housing won’t be abrupt. For budget purposes, we project our long range plan five years into the future.

When we get to a year, say FY 2023, the actual state of our budget never looks exactly like the projection created five years earlier. We cannot predict the future very far out. What we can do is look back and see what the effects of previous development have been on our budget, and we can assess the risks of our decisions. Experience tells us that multi-family development doesn’t break the budget or swamp the schools, even when the developments are large. It also tells us that turnover in the population causes ebbs and flows in the school population, regardless of new development. We can say with certainty that multi-family development increases our revenues through new growth, and that past experience has been that that new growth mitigates the need for overrides.

My conclusion is that the new development that will occur if we create a robust zone that allows multi-family development by right, will at worst give us growth in our revenues that keeps pace with any increase in services we need. At best, those new revenues will outstrip the growth in expenses and help mitigate our structural deficit. The risk of allowing this new growth is low, and the rewards are worth it, in the form of new missing middle housing, climate change mitigation, and vibrant business districts fueled by new customers nearby.

A few days ago, the Boston Globe ran an article titled “2021 set records in Boston Housing Market. What now?“. It’s not unusual to see stories about housing in the news — the market is highly competitive and the sale prices can be jaw dropping. Jaw dropping can take several forms: from the new (and used) homes that sell for over two million dollars, to the amount of money that someone will pay to purchase a small post-war cape (around $900,000, give or take).

According to the globe article, the Greater Boston Association of Realtors estimates that the median price of a single family homes in the Boston area rose 10.5% in 2021, to $750,000. Arlington is comfortably in the upper half of this median: according to our draft housing production plan the median sale price of our single family homes was $862,500 in 2020, and rose to $960,000 in the first half of 2021 (see page 39).

In June 2021, I got myself into a habit of sampling real estate sales listed in the Arlington Advocate, and compiling them into a spreadsheet. My observations are generally consistent with the sources cited above; Arlington’s housing is expensive and it’s appreciated rapidly, particularly in the last 6–10 years. It’s a great time for existing owners, but less so if you’re in the market for your first home.

We’re actually facing two problems, which are related but not identical. The first is high cost, which creates financial stress and a barrier to entry (though it is a boon for those who sell). The second problem is quantity; there are regional and national housing shortages, and that contributes to high prices and bidding wars.

Addressing these challenges will require collective effort on behalf of all communities in the metro area; this is a regional problem and we’ll all have to pitch in. There isn’t a single recipe for what “pitching in” means, but here are some for what communities can do.

First, produce more affordable housing. Affordable housing is a complex regulatory subject, but it basically boils down to two things: (1) the housing is reserved for households with lower incomes than the area as a whole, and (2) there’s a deed restriction (or similar) that prevents it from being sold or rented at market rates. Affordable housing usually costs more to produce than it generates in income, and the difference has to be made up with subsidies. It takes money.

Second, simply produce more housing. This is the obvious way to address an absolute shortage in the number of dwellings available. Some communities have set goals for housing production. Under the Walsh administration, Boston set a goal of producing 69,000 new housing units by 2030. Somerville’s goal is 6000 new housing units, and Cambridge’s is 12,500 (page 152 of pdf). To the best of my knowledge, Arlington has not set a numeric housing production goal, but it’s something I’d like to see us do.

Finally, communities could be more flexible with the types of housing they allow. Arlington is predominantly zoned for single- and two-family homes. The median sale price of our single family homes was $960,000 during the first half of 2021, and a large portion of that comes from the cost of land. That’s the reality we have, and the existing housing costs what it costs. So, we might consider allowing more types of “missing middle” housing, where the per dwelling costs tend to be lower: apartments, town houses, triple-deckers, and the like.

Of course, this assumes that our high cost of housing is a problem that needs to be solved; we could always decide that it isn’t. In the United States, home ownership is seen as a way to build equity and wealth. It’s certainly been fulfilling that objective, especially in recent years.

Prepared by: Barbara Thornton with the capable assistance of Alex Bagnall, Pamela Hallett, Patrick Hanlon, Karen Kelleher, Steve Revilak and Jennifer Susse.

As Arlington considers new zoning and other policy decisions to increase the amount of affordable housing in the town, a concern has been raised about the threat of greater costs to the Town’s budget from new people with school age children moving into the town. The concern: additional children in the public schools costs the town more than the additional new property tax revenue the Town collects from the new housing.

This post examines this concern, drawing on data from two recent housing developments, representing 283 units of housing in Arlington, to determine that actually the Town budget gains over 4.5 times the actual cost of paying for the students. According to the most recent 2020 tax bills, the Town expects to collect $1,250,370 in revenue and to spend an additional $269,589 for the new Arlington Public School students living in these developments.

The data suggests that the fear of increased school costs, overwhelming the potential new revenue from new housing construction is not warranted.

For more information, see the full post here.

As the public hearings on the zoning articles proceeded in late winter and early spring, 2019, it became clear that there was a very strong sentiment that the proposed increase in density in these designated zoning districts should result in an increase in affordable housing in Arlington. This coincided with the approved 2015 Master Plan’s stated goals:

- Encourage mixed-use development that includes affordable housing, primarily in well-established commercial areas.

- Provide a variety of housing options for a range of incomes, ages, family sizes, and needs.

- Preserve the “streetcar suburb” character of Arlington’s residential neighborhoods.

- Encourage sustainable construction and renovation of new and existing structures (see ch. 5, pg 77++ for housing section)

- The Yes on 16 report supports the citizen initiated petition resulting in Article 16 and demonstrates the tremendous impact of rapidly increasing land values on the overall affordability of property in Arlington. Building a stack of homes on one footprint is far more financially affordable than creating a single home on the same footprint of land.

The City of Somerville estimates that a 2% real estate transfer fee — with 1% paid by sellers and 1% paid by buyers, and that exempts owner-occupants (defined as persons residing in the property for at least two years) — could generate up to $6 million per year for affordable housing. The hotter the market, and the greater the number of property transactions, the more such a fee would generate.

Other municipalities are also looking at this legislation but need “home rule” permission, one municipality at a time, from the state to enact it locally. Or, alternatively, legislation could be passed at the state level to allow all municipalities to opt into such a program and design their own terms. This would be much like the well regarded Community Preservation Act (CPA) program that provides funds for local governments to do historic preservation, conservation, etc.

This memorandum from the City of Somerville to the legislature provides a great deal of information on the history, background and justification for such legislation.

House bill 1769, filed January, 2019, is an “Act supporting affordable housing with a local option for a fee to be applied to certain real estate transactions“.

COMMENT:

KK: This article suggests Arlington may be likely to pass a real estate transfer tax: https://www.counterpunch.org/2019/12/19/boston-one-step-closer-to-a-luxury-real-estate-transfer-tax/