Many issues are under discussion as a result of these proposed zoning Articles. Issues include: housing affordability, the diversity of housing and incomes in Arlington, environmental concerns and sustainability, tax burdens or tax savings potentially resulting from growth, the risk of postponing the decisions, and the image of Arlington as a community that values diversity and equitability. This one page “fact sheet” attempts to address many of these issues and concerns.

Related articles

A few days ago, the Boston Globe ran an article titled “2021 set records in Boston Housing Market. What now?“. It’s not unusual to see stories about housing in the news — the market is highly competitive and the sale prices can be jaw dropping. Jaw dropping can take several forms: from the new (and used) homes that sell for over two million dollars, to the amount of money that someone will pay to purchase a small post-war cape (around $900,000, give or take).

According to the globe article, the Greater Boston Association of Realtors estimates that the median price of a single family homes in the Boston area rose 10.5% in 2021, to $750,000. Arlington is comfortably in the upper half of this median: according to our draft housing production plan the median sale price of our single family homes was $862,500 in 2020, and rose to $960,000 in the first half of 2021 (see page 39).

In June 2021, I got myself into a habit of sampling real estate sales listed in the Arlington Advocate, and compiling them into a spreadsheet. My observations are generally consistent with the sources cited above; Arlington’s housing is expensive and it’s appreciated rapidly, particularly in the last 6–10 years. It’s a great time for existing owners, but less so if you’re in the market for your first home.

We’re actually facing two problems, which are related but not identical. The first is high cost, which creates financial stress and a barrier to entry (though it is a boon for those who sell). The second problem is quantity; there are regional and national housing shortages, and that contributes to high prices and bidding wars.

Addressing these challenges will require collective effort on behalf of all communities in the metro area; this is a regional problem and we’ll all have to pitch in. There isn’t a single recipe for what “pitching in” means, but here are some for what communities can do.

First, produce more affordable housing. Affordable housing is a complex regulatory subject, but it basically boils down to two things: (1) the housing is reserved for households with lower incomes than the area as a whole, and (2) there’s a deed restriction (or similar) that prevents it from being sold or rented at market rates. Affordable housing usually costs more to produce than it generates in income, and the difference has to be made up with subsidies. It takes money.

Second, simply produce more housing. This is the obvious way to address an absolute shortage in the number of dwellings available. Some communities have set goals for housing production. Under the Walsh administration, Boston set a goal of producing 69,000 new housing units by 2030. Somerville’s goal is 6000 new housing units, and Cambridge’s is 12,500 (page 152 of pdf). To the best of my knowledge, Arlington has not set a numeric housing production goal, but it’s something I’d like to see us do.

Finally, communities could be more flexible with the types of housing they allow. Arlington is predominantly zoned for single- and two-family homes. The median sale price of our single family homes was $960,000 during the first half of 2021, and a large portion of that comes from the cost of land. That’s the reality we have, and the existing housing costs what it costs. So, we might consider allowing more types of “missing middle” housing, where the per dwelling costs tend to be lower: apartments, town houses, triple-deckers, and the like.

Of course, this assumes that our high cost of housing is a problem that needs to be solved; we could always decide that it isn’t. In the United States, home ownership is seen as a way to build equity and wealth. It’s certainly been fulfilling that objective, especially in recent years.

by JP Lewicke

When you love the place you live and you want to help it become even better, how can you make a difference? Arlington is an extremely civically active community, with hundreds of residents involved in Town Meeting, several dozen boards and committees, and numerous other groups that play an important role in improving our town. The vast array of options can be a bit dizzying for a newcomer to sort through.

Fortunately, Arlington has recently launched Arlington Civic Academy to provide interested residents with a pathway to becoming more civically literate and involved. Ably organized by Joan Roman, Arlington’s Public Information Officer, Civic Academy takes place over the course of six weeks and aims to provide participants with the information they need for constructive civic engagement. Applications are open from now until August 4th for the fall session, which will take place between September 12th and October 17th.

Find Out How the Town Works

It’s clear that town government takes the Academy seriously. The Town Manager, Select Board Chair, Town Moderator, and the heads of several town departments have stayed late into the evening to attend Civic Academy sessions. Their formal presentations do a great job of explaining how different areas of town government work and how best to get involved, but the chance to meet them and ask them questions is equally valuable. The participants usually have a lot of very insightful questions, and it’s a great opportunity to learn more and become a more effective advocate in the future.

Participants Make Arlington Civic Academy Great

The other participants are another great part of the program. It’s also a great chance to make connections with other people who are equally enthusiastic about learning and getting involved in making their town a better place. There have been two sessions of the program so far, and several participants have gone on to run for Town Meeting, join the Master Plan Update Advisory Committee, volunteer for last fall’s tax override campaign, and propose warrant articles. We just had a get-together for members of both Civic Academy sessions to meet each other and network, and are hopeful that Civic Academy alumni can help connect future participants in the program to opportunities to get involved in helping Arlington become even better.

Helping Others Learn to Navigate Town Processes

I ran for Town Meeting this spring after attending Civic Academy last fall, and I found that it served me well after I was elected. It taught me how the budgeting process worked, including all the steps from the Town Manager’s office working with individual departments, the Finance Committee compiling a cohesive budget, and Town Meeting approving that budget. When constituents from my precinct have questions about how to get help with something from the town, I know which boards or committees or town departments they should reach out to. I also have a better understanding of the current constraints and opportunities faced by our town across multiple areas.

When I started working with Paul Schlictman on advocating for extending the Red Line further into Arlington, I reached out to the members of my Civic Academy class to see if they were also interested, and several of them were incredibly generous with their time and helped us set up our website and mailing list. I would highly recommend applying to Civic Academy, and I’m very thankful that the town puts so much effort into making it a great experience.

I’ve had an annual ritual for the past several years: obtain a spreadsheet of property assessments from the Town Assessor, load them in to a database, and run a series of R computations against the data. I started doing this for a number of reasons: to understand what was built where (our zoning laws have changed over time, and there are numerous non-conforming uses), the relationship between land and building values, the capital costs of different types of housing, and how these factors have changed over time.

I’d typically compile these analyses into a fact-book of sorts, and email it around to people that I thought might be interested. This year, I’m going to post the analyses here as a series of articles. This first installment contains basic information about Arlington’s low-density housing: single-, two-, and three-family homes, as well as condominiums. Condominiums are something of an oddball in this category — a condominium can be half of a two-family structure, part of a larger residential building, or somewhere in between. There’s a lot of variety.

Here’s a table showing how the number of units has changed over time, since 2013.

| land use | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|---|---|---|

| Single Family | 7984 | 7983 | 7991 | 8000 | 7994 | 7994 | 7998 | 7999 |

| Condominium | 3242 | 3304 | 3367 | 3492 | 3552 | 3662 | 3726 | 3827 |

| Two-family | 2352 | 2332 | 2308 | 2282 | 2263 | 2218 | 2183 | 2139 |

| Three-family | 207 | 201 | 196 | 194 | 193 | 190 | 185 | 182 |

Arlington’s predominant form of housing — the single family home — has stayed relatively static; we’ve added 15 over the last seven years. The number of condominiums has increased significantly: +585 over seven years. That, coupled with the reduction of two-family homes (-213) and three-family homes (-25) leads me to believe that a fair number of rental units have been removed from the market.

Next, I’d like to look at how these homes are spread across our various zoning districts. (The “Notes” section at the bottom of the post explains what the zoning district codes mean).

| Zone | Single-Family | Condo | Two-family | Three-family |

|---|---|---|---|---|

| B1 | 8 | 22 | 13 | 11 |

| B2 | 1 | 4 | 1 | |

| B2A | 1 | 18 | ||

| B3 | 59 | 4 | ||

| B4 | 1 | 59 | 5 | 5 |

| B5 | 1 | 1 | ||

| I | 8 | 18 | 7 | 1 |

| R0 | 502 | |||

| R1 | 6798 | 168 | 200 | 7 |

| R2 | 647 | 1816 | 1881 | 124 |

| R3 | 4 | 39 | 11 | 17 |

| R4 | 23 | 79 | 2 | 3 |

| R5 | 3 | 616 | 5 | 4 |

| R6 | 2 | 686 | 8 | 7 |

| R7 | 1 | 243 | 2 | 1 |

A few points to note:

- R0 is our newest district, which was established in 1991. It consists only of conforming single-family homes.

- R1 is Arlington’s original (per 1975 zoning) single-family district. It’s predominantly single-family homes, but there are a fair number of two-family homes, and even a few three-families. The presence of condominiums suggests additional multi-family homes (that consist of two or more condominiums)

- R2 is predominantly two-, and three-family homes. Although three-family homes are no longer allowed in this district, R2 has the largest number of three-families in town.

- Residential uses are no longer allowed in the industrial (I) districts, but the I districts contain 34 homes. These buildings pre-date the current zoning laws (aka “pre-existing non-conforming”). A good portion of the Dudley street industrial district is a residential neighborhood.

I’m pointing out these conformities (and non-conformities) for a reason. The zoning map (and use tables) dictate what is allowed today, along with specifying a vision for the future. Our zoning bylaw happens to contain a strong statement to this effect: “It is the purpose of this Bylaw to discourage the perpetuity of nonconforming uses and structures whenever possible” (section 8.1.1(A)). Despite the strong statement of intent, it can take decades (if not generations) for a built environment to catch up with the bylaw’s prescriptions.

I’ll finish this post with a breakdown of how condominiums are distributed across the various zoning districts:

| Zone | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | delta |

|---|---|---|---|---|---|---|---|---|---|

| (N/A) | 14 | 15 | 0 | 0 | 0 | 0 | 0 | 0 | -14 |

| B1 | 16 | 16 | 18 | 18 | 18 | 22 | 22 | 22 | 6 |

| B2 | 2 | 2 | 2 | 2 | 4 | 4 | 4 | 4 | 2 |

| B2A | 19 | 18 | 18 | 18 | 18 | 18 | 18 | 18 | -1 |

| B3 | 55 | 55 | 61 | 59 | 59 | 59 | 59 | 59 | 4 |

| B4 | 47 | 47 | 59 | 59 | 59 | 59 | 59 | 59 | 12 |

| I | 18 | 18 | 18 | 18 | 18 | 18 | 18 | 18 | 0 |

| R1 | 140 | 144 | 146 | 148 | 150 | 154 | 162 | 168 | 28 |

| R2 | 1355 | 1406 | 1456 | 1518 | 1574 | 1670 | 1723 | 1816 | 461 |

| R3 | 22 | 25 | 28 | 31 | 31 | 37 | 37 | 39 | 17 |

| R4 | 65 | 67 | 67 | 79 | 79 | 79 | 79 | 79 | 14 |

| R5 | 616 | 616 | 616 | 616 | 616 | 616 | 616 | 616 | 0 |

| R6 | 630 | 632 | 635 | 683 | 683 | 683 | 686 | 686 | 56 |

| R7 | 243 | 243 | 243 | 243 | 243 | 243 | 243 | 243 | 0 |

The last column (“delta”) shows the difference between 2013 and 2020. The largest increase occurred in the R2 (two-family) district, followed by R6 (medium-density apartments, where most of the increase took place in 2014) and R1 (single-family).

That it will do it for the first installation. In the next post, we’ll look at how the cost (assessed values, actually) of Arlington’s low density housing has changed over the last seven years.

Here is a spreadsheet, containing the various tables shown in this article.

Notes

Arlington’s zoning map divides the town into a set of districts, and each district has regulations about what kinds of buildings and uses are allowed (or not allowed). The districts mentioned in this article are:

- B1 (Neighborhood Office district)

- B2 (Neighborhood Business distrct)

- B2A (Major Business District)

- B3 (Village Business District)

- B4 (Vehicular-Oriented Business District)

- I (Industrial District)

- R0 (Single-Family, large-lot district)

- R1 (Single-Family Distict)

- R2 (Two-Family District)

- R3 (Three-Family District)

- R4 (Townhouse District)

- R5 (Low-Density Apartment District)

- R6 (Medium-Density Apartment District)

- R7 (High-Density Apartment District)

Arlington’s Zoning Bylaw describes each district in detail (see sections 5.4.2, 5.5.2, and 5.6.2)

Thanks to so many of you who came out Monday evening for the demonstration in support of the MBTA Communities proposal before the Arlington Redevelopment Board meeting! Over 20 people were there – a substantial and notable showing, especially on such short notice. Paulette Schwarz took some photos of the demonstration early in the evening which she kindly shared with us.

A study by Elise Rapoza and Michael Goodman shows that new housing construction in MA does not have an adverse affect on municipal or school budgets. And when it might, state funding covers the difference. This study contradicts the often heard argument against new housing development, especially multi-family housing, because it, the argument claims, it will have a negative fiscal impact on communities.

In the aggregate, development of new housing offers net fiscal benefit to both municipalities and the state. Additional analysis validates a second study which found that increased housing production does not predict enrollment changes in Massachusetts school districts. In the new study, a distinct minority of municipalities did incur net fiscal burdens—burdens that the net new state tax proceeds associated with the development of new housing are more than sufficient to offset.

This 102 page document is the most recently revised set of recommendations by the Town of Arlington’s Redevelopment Board. The report takes into consideration the comments and information provided over the last few months’ public hearing process. It also incorporates a citizen petition which strengthens the case for increasing permanent affordable housing with the passage of these zoning related Articles. Town Meeting convenes on April 22, 2019.

Restrictive covenants are a “list of obligations that purchasers of property must assume … For the first half of the 20th century, one commonplace commitment was a promise never to sell or rent to an African American”. [1] These covenants gained popularity after the Supreme Court’s 1917 decision in Buchanan v. Warley.

Rothstein’s book The Color of Law mentions examples from Brookline, MA; Arlington, MA has examples of it’s own. We’ll look at one from an East Arlington deed dating to 1923. Credit to Christopher Sacca for finding these documents.

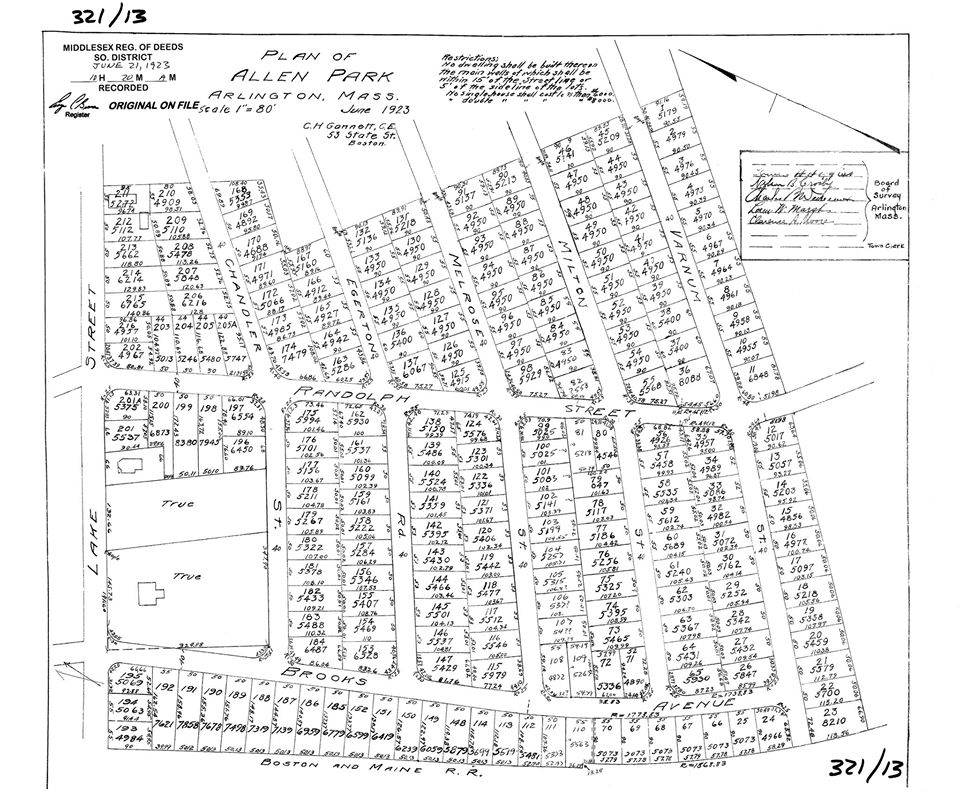

First, a land plan to establish content. Below is the subdivision plan for a farm owned by Herbert and Margaret Allen. I count a little over 200 lots in this subdivision. The plan itself states that “no single house shall cost less than $6,000 and no double house shall

cost less than $8,000″. This language also appears in the property deed.

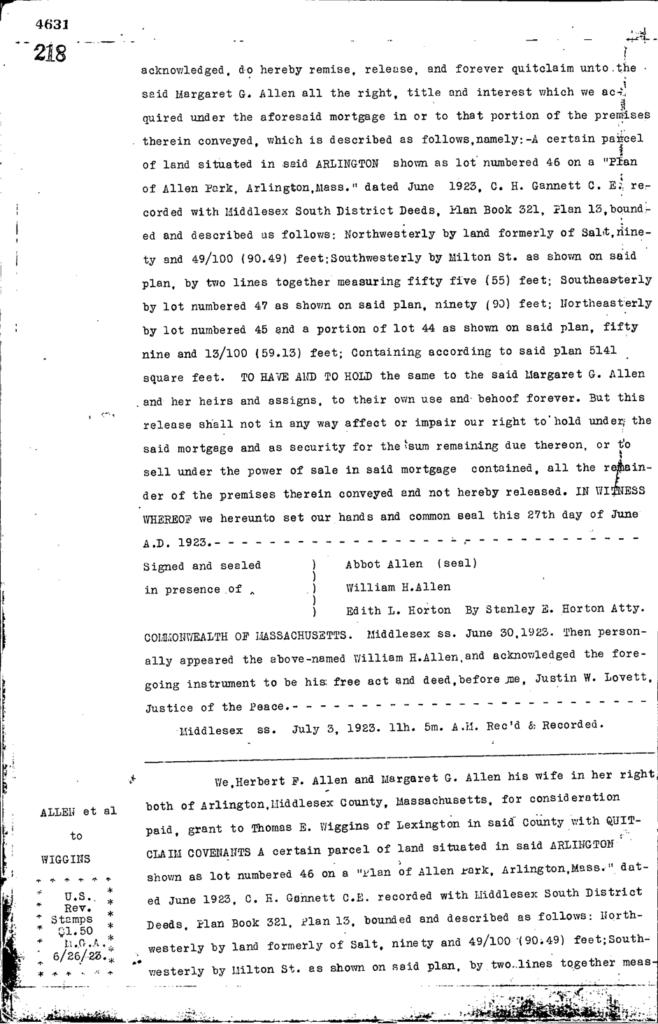

One of the deeds from these parcels appears in book 4631 page 218 and book 4631 page 219, in the Southern Middlesex registry of deeds.

Here’s page 218; the deed begins at the bottom.

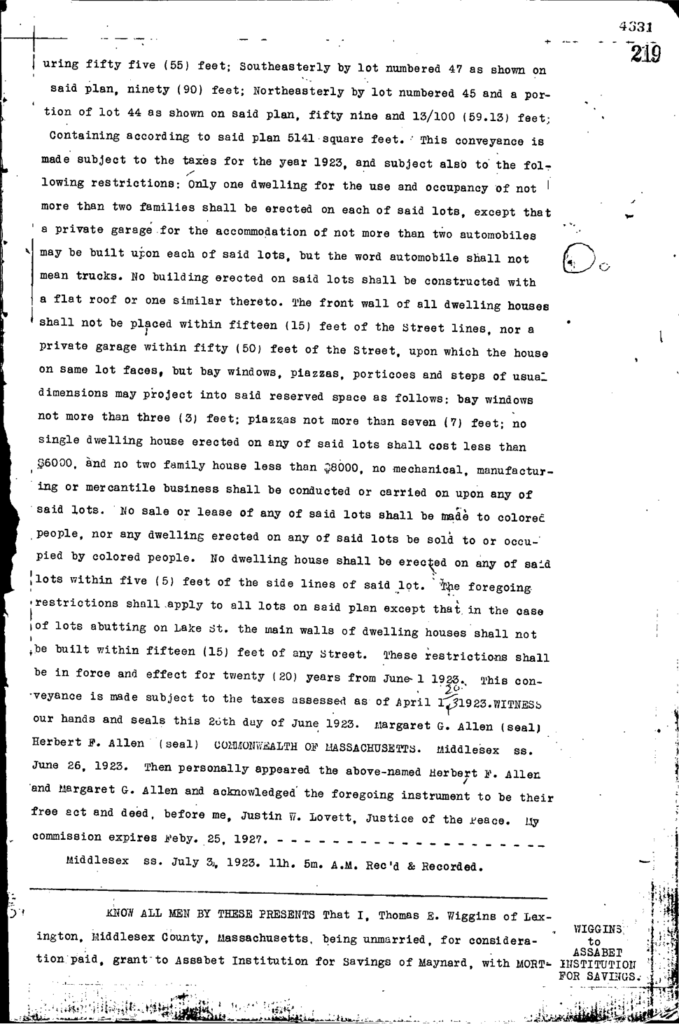

Here’s page 219. The racial covenant appears halfway down the page. It reads “No sale or lease of any said lots shall be made to colored people, no any dwelling on any said lots be sold or occupied by colored people”.

The 1920’s were a time of significant residential growth in Arlington, as farmers (called “Market Gardeners” at the time) subdivided and sold off their land. This example shows that Arlington, MA landowners employed some of the same discriminatory tactics for segregation as other communities in the United States. It would take further research to determine how common the use of such covenants was early twentieth-century Arlington.

Footnotes

[1] The Color of Law. Richard Rothstein. pg. 78

(This post originally appeared as a one-page handout, distributed at The State of Zoning for Multi-Family Housing in Greater Boston.)

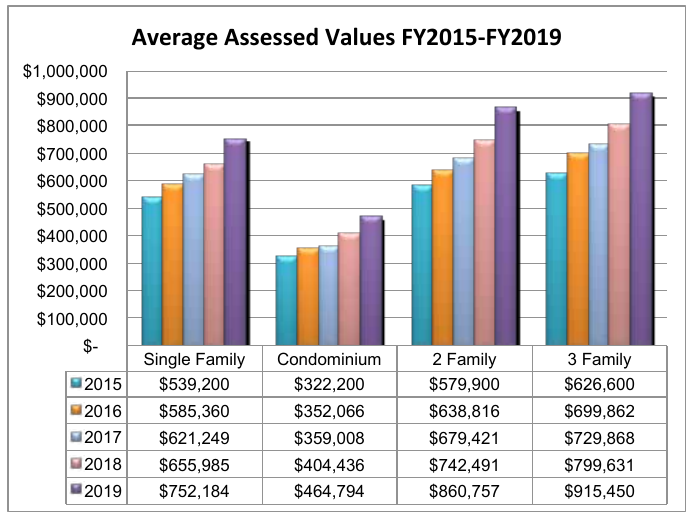

This chart shows the assessed value of Arlington’s low density housing from 2015–2019 (assessed values generally reflect market values from two years prior). During this time, home values increased between 39% (single-family homes) and 48% (two-family homes). Most of the change comes from the increasing cost of land. As a point of comparison, the US experienced 7.7% inflation during the same period. (1)

Arlington has constructed six apartment buildings in the 44 years since the town’s zoning bylaw was rewritten in 1975; we constructed 75 of them in the preceding 44 years.(2) Like numerous communities in the Metro-Boston area, we’re experiencing a high demand for housing, but our zoning regulations have created a paper wall that prevents more housing — including affordable housing — from being built.

Communities need adequate housing, but they also need housing diversity: different types of housing at different price points. The housing needs of young adults are different than the housing needs of parents with children, which are in turn different than the housing needs of senior citizens. As demographics change, housing needs change too. Keeping people in town means providing them with the opportunity to upsize or downsize when the need arises.

If Arlington’s housing costs had only increased with the rate of inflation, the cost of single family housing would average $581K, over $170K less than today. The median household income in Arlington is about $103K/year.(3) Buying an average single family-home with that income on a typical 30-year mortgage would require approximately 46% of a household’s monthly income.(4)

Either homes in Arlington will only be available to people who have much more substantial incomes than current residents, or the town will find a way to balance the rapidly growing cost of land against the housing needs of its current citizens, those still in school, those preparing to downsize as well as those looking for a bigger space.

In addition, Arlington’s commercial economy will thrive with a greater number of housing units so we can keep the empty nesters, and the new college graduates who have lived in the town for years, as well as welcome new Arlingtonians to support our local businesses, restaurants and other services.

Our Town, like others in the state, is looking for ways to balance the needs of our citizens with the market forces of rising land costs while maintaining a healthy, diverse community.

Footnotes

- The inflation amount comes from Inflation amount from https://data.bls.gov/cgi-bin/cpicalc.pl.

- Figures on multi-family unit construction are taken from Arlington Assessor’s data. They reflect multi-family buildings that are still used as rental apartments.

- Income levels come from 2013-2017 ACS 5-year data for Arlington, MA.

- Assuming 10% downpayment, 4% interest, $800/year for insurance, and Arlington’s $11.26 tax rate, the monthly mortgage payment would be nearly $4000/month.