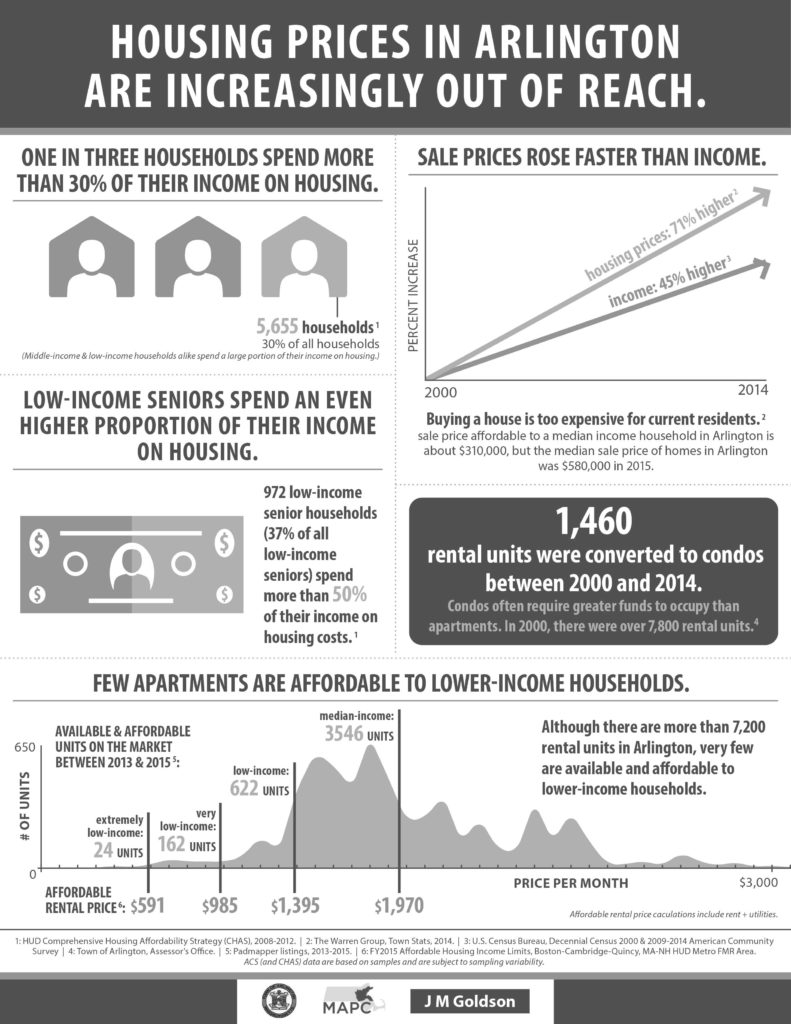

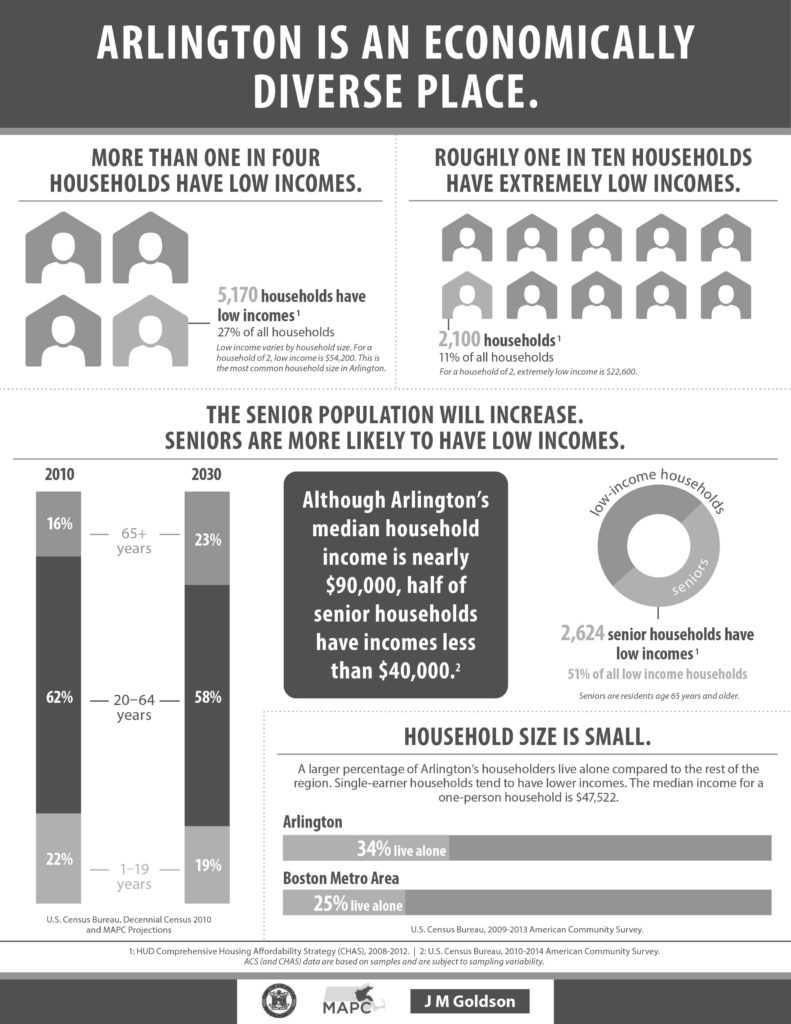

Many issues are under discussion as a result of these proposed zoning Articles. Issues include: housing affordability, the diversity of housing and incomes in Arlington, environmental concerns and sustainability, tax burdens or tax savings potentially resulting from growth, the risk of postponing the decisions, and the image of Arlington as a community that values diversity and equitability. This one page “fact sheet” attempts to address many of these issues and concerns.

Related articles

Restrictive covenants are a “list of obligations that purchasers of property must assume … For the first half of the 20th century, one commonplace commitment was a promise never to sell or rent to an African American”. [1] These covenants gained popularity after the Supreme Court’s 1917 decision in Buchanan v. Warley.

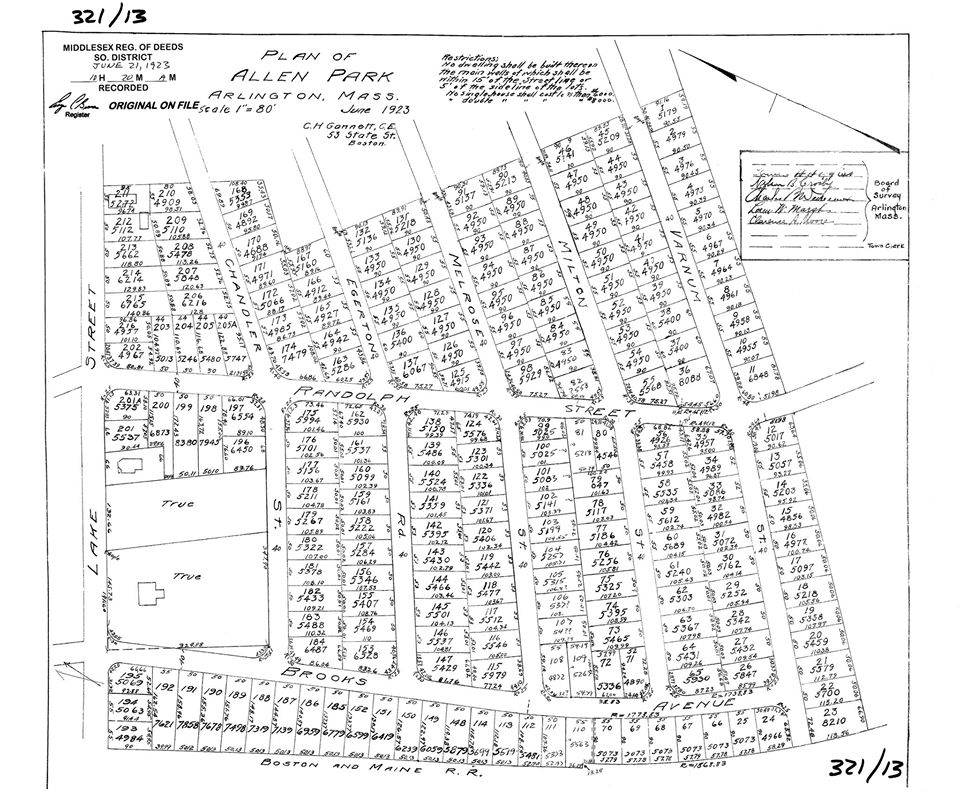

Rothstein’s book The Color of Law mentions examples from Brookline, MA; Arlington, MA has examples of it’s own. We’ll look at one from an East Arlington deed dating to 1923. Credit to Christopher Sacca for finding these documents.

First, a land plan to establish content. Below is the subdivision plan for a farm owned by Herbert and Margaret Allen. I count a little over 200 lots in this subdivision. The plan itself states that “no single house shall cost less than $6,000 and no double house shall

cost less than $8,000″. This language also appears in the property deed.

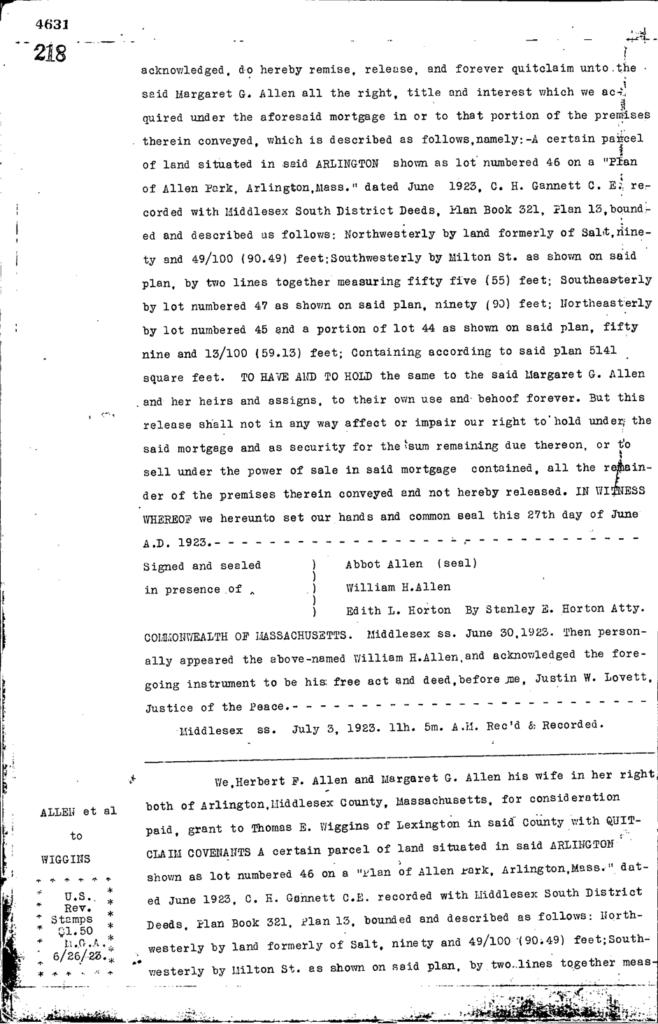

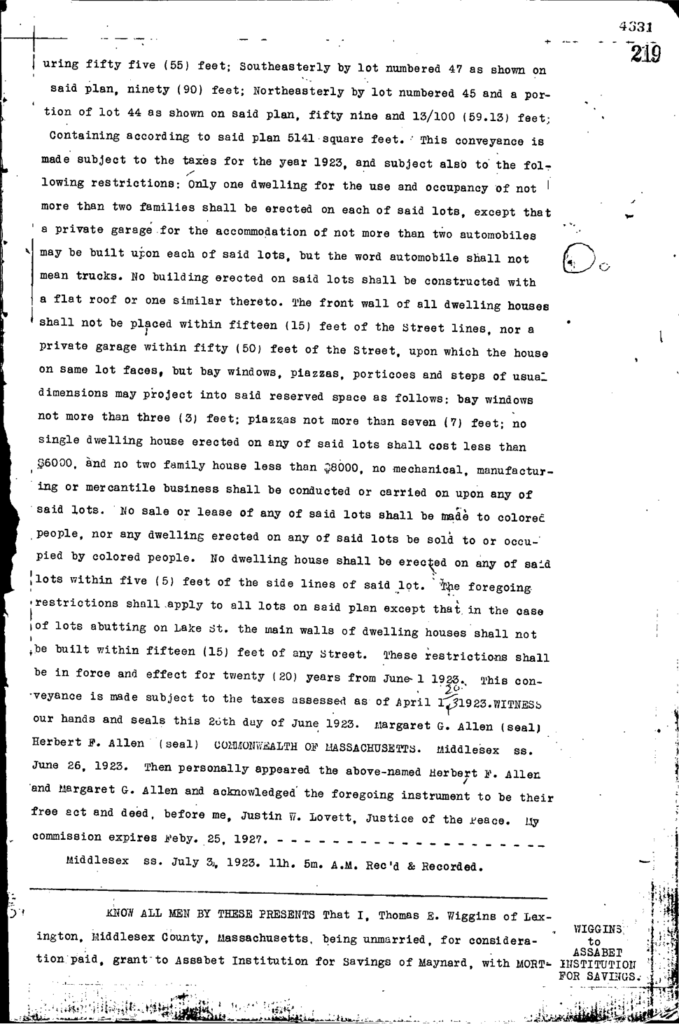

One of the deeds from these parcels appears in book 4631 page 218 and book 4631 page 219, in the Southern Middlesex registry of deeds.

Here’s page 218; the deed begins at the bottom.

Here’s page 219. The racial covenant appears halfway down the page. It reads “No sale or lease of any said lots shall be made to colored people, no any dwelling on any said lots be sold or occupied by colored people”.

The 1920’s were a time of significant residential growth in Arlington, as farmers (called “Market Gardeners” at the time) subdivided and sold off their land. This example shows that Arlington, MA landowners employed some of the same discriminatory tactics for segregation as other communities in the United States. It would take further research to determine how common the use of such covenants was early twentieth-century Arlington.

Footnotes

[1] The Color of Law. Richard Rothstein. pg. 78

As the public hearings on the zoning articles proceeded in late winter and early spring, 2019, it became clear that there was a very strong sentiment that the proposed increase in density in these designated zoning districts should result in an increase in affordable housing in Arlington. This coincided with the approved 2015 Master Plan’s stated goals:

- Encourage mixed-use development that includes affordable housing, primarily in well-established commercial areas.

- Provide a variety of housing options for a range of incomes, ages, family sizes, and needs.

- Preserve the “streetcar suburb” character of Arlington’s residential neighborhoods.

- Encourage sustainable construction and renovation of new and existing structures (see ch. 5, pg 77++ for housing section)

- The Yes on 16 report supports the citizen initiated petition resulting in Article 16 and demonstrates the tremendous impact of rapidly increasing land values on the overall affordability of property in Arlington. Building a stack of homes on one footprint is far more financially affordable than creating a single home on the same footprint of land.

Accessory Dwelling Units (aka “granny flats”)

The following information was presented to the Arlington Redevelopment Board in October, 2020 by Barbara Thornton, TMM, Precinct 16

This Article proposes to allow Accessory Dwelling Units, “as of right”, in each of the 8 residential zoning districts in Arlington.

Why is this zoning legislation important?

Arlington is increasingly losing the diversity it once had. It has become increasingly difficult for residents who have grown up and grown old in the town to remain here. This will only become more difficult as the effects of tax increases to support the new schools, including the high school, roll into the tax bills for lower income residents and senior citizens on a fixed income. For young adults raised in Arlington, the price of a home to buy or to rent is increasingly out of reach.

Who benefits from ADUs?

- Families benefit from greater flexibility as their needs change over time and, in particular providing options for older adults to be able to stay in their homes and for households with disabled persons or young adults who want additional privacy but still be within a family setting.

- Residents seeking an increase in the diversity of housing choices in the Town while respecting the residential character and scale of existing neighborhoods; ADUs provide a non-subsidized form of housing that is generally less costly and more affordable than similar units in multifamily buildings;

- Residents wanting more housing units in Arlington’s total housing stock with minimal adverse effects on Arlington’s neighborhoods.

What authority and established policy is this built on?

Arlington’s Master Plan is the foundational document establishing the validity and mission for pursuing the zoning change that will allow Accessory Dwelling Units.

Under Introduction in Part 5, Housing and Residential Development, the Master Plan states: Arlington’s Master Plan provides a framework for addressing key issues such as affordability, transit-oriented residential development, and aging in place.

The Master Plan states that the American Community Survey (ACS) reports that Arlington’s housing units are slightly larger than those in other inner-suburbs and small cities. In Arlington, the median number of rooms per unit is 5.7. There is a great deal of difference in density and housing size among the different Arlington neighborhoods. The generally larger size of homes makes it easier to contemplate a successful move to encourage ADUs.

What do other municipalities do?

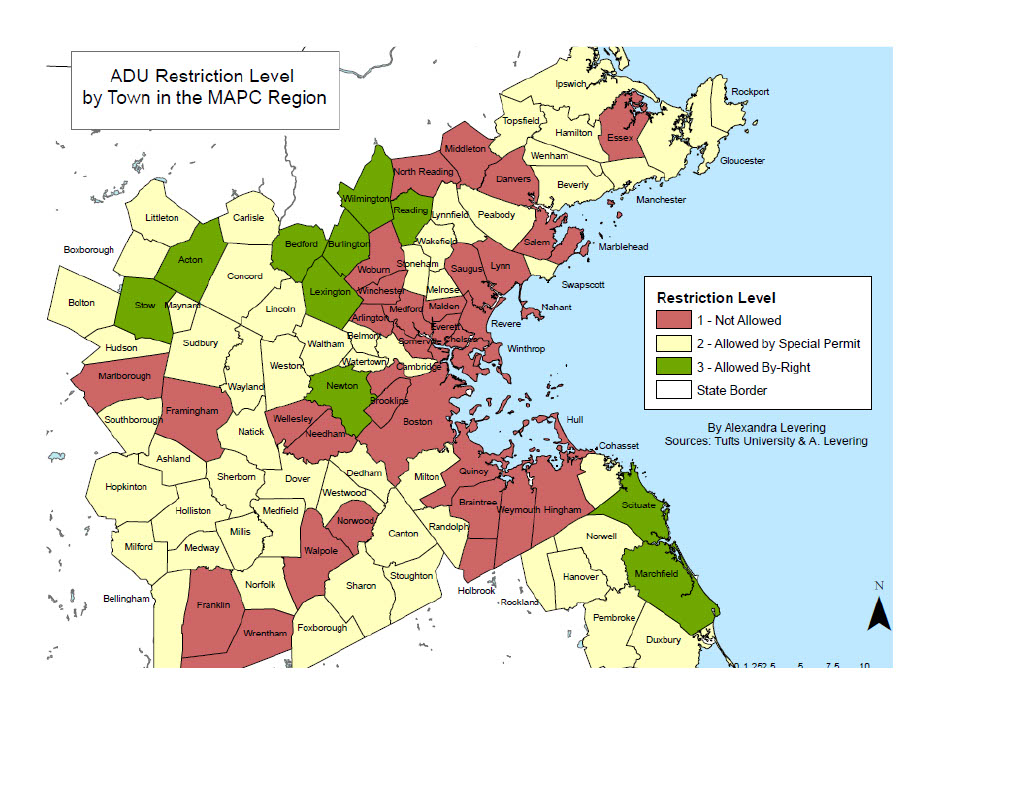

According to a study (https://equitable-arlington.org/2020/02/16/accessory-dwelling-units-policies/), by 2017 65 out of 101 municipalities in the greater Boston (MAPC) region allowed Accessory Dwelling Units by right or by special permit. The average number of ADU’s added per year was only about 3. But by 2017, Lexington had 75 ADUs and Newton had 73. Both of these communities were among about 10 “as of right” municipalities in the MAPC region. This finding suggests that communities with more restrictions are less likely to see any significant affordable housing benefits.

Even in the midst of a housing crisis in this region, according to Amy Dain, housing expert, (https://equitable-arlington.org/2020/02/18/zoning-for-accessory-dwelling-units/) most municipalities still have zoning laws that restrict single family home owners from creating more affordable housing.

And this is despite the fact that, as according to Banker & Tradesman, March 10, 2020: https://www.bankerandtradesman.com/63-percent-in-greater-boston-back-adus/, 63% of people in the region approve of ADUs. California has recently passed strong pro-ADU legislation. A study by Zillow further corroborated this strong interest in communities across the US, including our region. https://equitable-arlington.org/2020/03/10/adu-popularity/.

Learn more about Accessory Dwelling Units/ “Granny Flats” here: https://planning.org/knowledgebase/accessorydwellings/

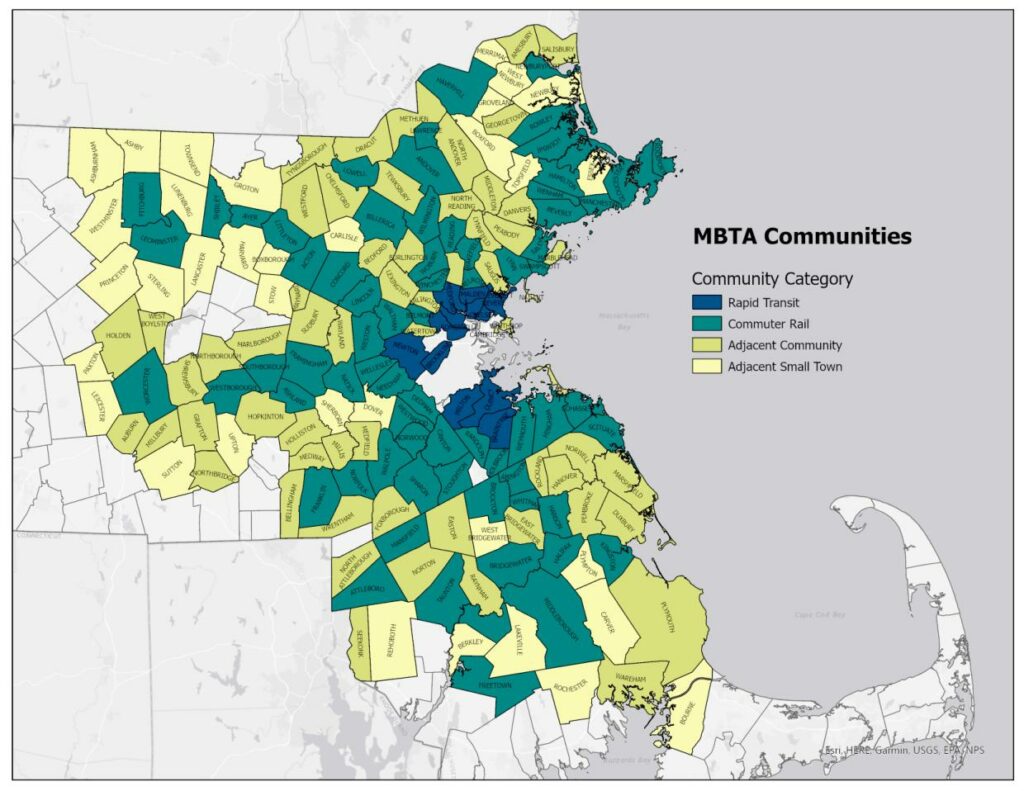

Massachusetts’ 2020 Economic Development Bill included a set of housing choice provisions: these require communities served by the MBTA to provide a district of reasonable size where multi-family housing is allowed by right. The law gives us significant flexibility to design a district that best suits our needs, but the district must allow housing suitable for families with children, without age restrictions, and at a rate of at least 15 dwelling units per acre. Arlington is one of 175 MBTA communities in Massachusetts that share in the responsibility for meeting these requirements.

The law requires a “district of reasonable size”, but what does that mean? Throughout much of 2021 the Massachusetts Department of Housing and Community Development (DHCD) worked on a set of supporting regulations that set the district requirements according to the type of transit service a community has, the number of existing homes in the community (as of the 2020 Census), and the amount of developable land near transit stations. The specifics vary by community, but here is what the requirements mean for Arlington:

- Our district needs a capacity of (at least) 2,046 homes. This isn’t a requirement to build 2,046 additional homes; instead, it reflects the total number of homes that district might contain in the future. For example, if a parcel with a two-family home were rezoned to allow a three-family home, that single parcel would have a capacity of three.

- Our district needs to allow multi-family housing by right. “By right” means that the development only requires a building permit, where the Building Inspector determines whether the project complies with zoning and building codes. While Arlington allows multi-family housing (three or more dwellings on a single parcel) in some areas, such projects are not allowed by right.

- Our district needs to allow (at least) 15 dwellings/acre. This is more or less in line with the density of the streetcar suburbs that were built in East Arlington during the 1920s. Although portions of Arlington likely meet the density requirement, none of these areas currently comply, as they don’t allow multi-family housing to be built by right.

- Our district needs to be at least 32 acres, but it could be larger. We have flexibility here, as we’ll discuss in a moment.

- Finally, due to the lack of developable land around the Alewife T station, Arlington is free to locate its multi-family district (or districts) anywhere in town. We’re not tied to any particular geographic location.

The new law’s requirements provide Arlington with a great deal of flexibility. We’re free to place our district (or districts) anywhere in town, and we’ll be able to choose from a variety of options as long as they meet the requirements set forth above. For example, providing the capacity of 2,046 homes in the minimum district size of 32 acres would give us a density of 64 dwellings/acre; roughly the scale of mid-rise apartment buildings. On the other hand, if we went with the minimum density of 15 dwellings/acre, we’d have a 135 acre district that allowed smaller multi-family homes. Our district can be anywhere within this range; we also have the option of having multiple districts, with smaller multi-family buildings in some areas of town and larger multi-family buildings in others.

Arlington has a track record of producing thorough and comprehensive planning documents, such as our Master Plan, Net Zero Action Plan, Sustainable Transportation Plan, and Housing Production Plan. These plans contain plenty of building blocks that could be used to formulate a compliant multi-family district. Viewed in that light, the MBTA community requirements are an opportunity to meet some of the goals we’ve already set for ourselves; we just have to go about it in a way that satisfies the law’s new requirements.

Arlington has one unique consideration, which doesn’t apply to most MBTA communities. In 2020, Arlington’s Town Meeting sent a home rule petition to the state legislature, asking for permission to regulate the use of fossil fuels in new building construction; it’s an important component of our plan to become carbon-neutral by 2050. A number of other communities in the Commonwealth filed similar petitions, and the legislature responded by establishing a pilot program: ten cities and towns will be allowed to enact “fossil fuel bans”, but only if they (a) have 10% subsidized housing, (b) achieve safe harbor via compliances with an approved housing production plan, or (c) establish a multi-family district of reasonable size by February 2024. Arlington doesn’t meet the subsidized housing requirement (only 6.54% of our homes are on the subsidized housing inventory), and we’re unlikely to gain safe harbor status during the next year; our most viable path to participation hinges on meeting the multi-family requirements.

In summary, the multi-family requirement for MBTA communities creates new requirements for Arlington, while also presenting us with new opportunities: the opportunity to meet planning goals, the opportunity to meet sustainability goals (e.g., by regulating fossil fuel use in new construction), and the opportunity to reimagine how we do multi-family housing in Arlington as our town moves forward into the twenty-first century.

The new proposal is just the most recent step in a process that reaches back almost a decade, culminating in the Master Plan (2015), the Housing Production Plan (2016) and the mixed-using zoning amendments of 2016. The Town has consistently proposed smart growth: more development along Arlington’s transit corridors to increase the tax base, stimulate local commerce, and provide more varied housing opportunities for everyone, including low and moderate income Arlingtonians. This year’s proposals are no head-long rush into change. Today’s debate is similar to the debate before Town Meeting three years ago. If anything, progress has been frustratingly slow. To realize the Master Plan’s vision of a vibrant Arlington with diverse housing types for a diverse population, we must stay the course on which we have been embarked for so long.

by Annie LaCourt

One of the concerns people have about the current MBTA Communities zoning proposal is the effect that the increase in housing will have on the town’s budget. Will the need for new services make demands on our budget we cannot meet without more frequent overrides? Or will the new tax revenues from the new buildings cover the cost of that increase in services?

The simple answers to these questions are

- No: It will not make unmanageable demands on the budget; and

- Yes: the new tax revenue from the multi-family housing anticipated will cover the costs of any new services required.

Adopting the current MBTA Communities zoning proposal may even slow the growth of our structural deficit, as I will show in more detail using as examples some of the more recent multi-family projects that have been built in Arlington.

How Does Our Budget Work and What is the Structural Deficit?

First, some basic facts about finance in Arlington: Like every other community in Massachusetts, Arlington’s property tax increases are limited by Proposition 2.5 to 2.5% of the levy limit each year. What is the levy limit? It’s all of the taxes we are allowed to collect across the whole town, without getting specific approval from the Town’s voters. For FY 23 the levy limit is $135,136,908. $3,271,996 of that is the 2.5% increase we are allowed under the law. But also added to that is $1,202,059 of new growth, which comes from properties whose assessment changed because they were substantially improved–either renovated or by increasing capacity. When we reassess a property that has a new house or building on it, we are allowed to add the new taxes generated by the change in value of the property to the levy limit.

Property taxes make up approximately 75% of the town’s revenue. So – except for new growth – that means that the bulk of our budget can only grow 2.5% a year. Other categories of income like State Aid have a much less reliable growth pattern. If the state has a bad fiscal year, our state aid is likely to remain flat or decrease.

Expenses

On the expense side, our default is a budget to maintain the same level of services year to year. We cap increases in the budgets of town departments by 3.25% and the school budget by 3.5%, save for special education costs which are capped slightly higher.

We also have several major categories of expense that are beyond our control that increase at a greater rate than 2.5%. These include, among other things, funding our pension obligations, health insurance costs and our trash collection contract.

Structural Deficit

This difference between the increase in revenues and the increase in costs is the structural deficit. It’s structural because we can’t cut our way out of it without curtailing services severely and we can’t stop paying for things like pensions and insurance that are contractual obligations.

The question of how MBTA communities zoning will affect this is crucial. So let’s take a deeper dive, first on revenue and then on expenses.

How Will MBTA Communities Affect New Growth?

How MBTA-C zoning will affect new growth depends on what gets built and at what rate. Let’s consider some real world examples:

882 Mass Ave. used to be a single story commercial building. It was assessed at $938,000 and the owner paid approximately $9,887 in taxes annually. It has been rebuilt as a mixed use building with commercial space on the ground level and 22 apartments on 4 floors above. The new assessment is approximately $4,800,000 and the new tax bill is about $54,000.00. That means $45,000 in new growth – new property taxes that will grow at the rate of 2.5% in subsequent years.

Another example is 117 Broadway. The building that used to be at that address was entirely commercial, assessed at $1,050,000 and paid around $11,770 in taxes annually. After being rebuilt as mixed use by the Housing Corporation of Arlington, it is assessed at $3,900,000 and taxed at $43,719. 117 Broadway has commercial on the ground floor and 4 stories of affordable housing above. The new growth for this example is approximately $30,000.

What these examples show, and our assessor believes is a pattern, is that a new mixed use or multi-family building increases the taxes we can collect by as much as 400%, depending on the kinds of housing units.

So we can expect new development under MBTA Communities to increase the levy limit substantially over time, reducing the size and frequency of future tax increases.

How Will This New Housing Affect the Cost of Services?

Of course, with new residents comes a need for additional services. However, town-provided services will be impacted differently. Snow and Ice removal, for example, will not be affected at all – we aren’t adding new roads. Many other services provided by public works are like snow and ice: They would only increase at a faster rate if we added more land area or more town facilities to the base.

Services like public safety and health and human services may see gradual increases in service requests, as more people place more demand on these departments. Right now we have a patrol officer for every 850 or so residents. This means we might need to add a new patrol officer if the population increases by 850 residents. But it’s not clear that a new officer would be needed; it depends on the trends the police department sees in their data. I think of these services as increasing by stair steps: Adding a few, or even a few hundred, residents doesn’t require us to add staff to provide more services. Adding a few thousand might mean we need to add a position but we will have added a great deal to the levy limit before we need to add those positions.

Trash Collection Impact

There is one town service that sees an impact every time we add a new unit of housing – trash collection. The town spends approximately $200 per household on solid waste collection and disposal. As mentioned above, 882 Broadway has 22 new 1 bedroom and studio apartments. When that building was all commercial the businesses paid privately for trash removal. The new trash collection costs will be at least $4,400 annually. It’s possible, however, that the building will need a dumpster and that could cost up to $20,000 annually. Either way the new revenue ($45,000) outstrips the increased costs. The town is working on creative solutions for new buildings to keep this cost as affordable as possible.

What About Schools?

Regardless of new housing construction, our student population ebbs and flows. Families move in with small children who go through the school system. The kids graduate high school but their parents, now in their 50’s or 60’s, don’t move until they are much older and need a different living situation. When they sell their homes, the new owners are likely to be families with children again. We can see a pattern of boom and bust in our school population if we look back. Right now, we are seeing a drop in elementary population as this cycle plays out again. We now have 221 fewer students enrolled in the elementary schools than we did in 2019.

We account for this ebb and flow in the budget. A number of years ago, we set a policy to add a growth factor to the school budget. We increase the budget by 50% of per pupil costs for each new student. Currently that is $8800.00 per student. But the policy works in reverse as well. We reduce the budget by the same amount per child as the student population wanes. We also see increased state aid under chapter 70 when our student population grows and may see reductions if it shrinks.

Will Multifamily Homes Add Students?

The new multi-family housing generated by MBTA communities zoning may add students to our schools – but not as many as you might think. Other large multi-family developments like the Legacy apartments and the new development at the old Brigham site have not added a lot of children to the schools directly. Going back to our two example buildings, 882 Mass Ave is all studio and 1 bedroom units, so we are unlikely to see children living there. Our MBTA communities zoning, however, must by law allow new housing that is appropriate for families. So for planning purposes, it’s best to assume we will see growth in the school population.

So what will the effect of this new housing be on the school population and our budget? Given that the new housing will be built gradually, it’s more likely to stabilize our student population than precipitously increase it. The same will be true for our budget: We will see some increases in the school budget growth factor but also increases in state aid and increases in tax revenue from the new construction.

Conclusions

If we create an MBTA communities zone per the working groups recommendation or something close to that, we will see the effect on our budget over time, not immediately. Even if the zone has a theoretical capacity of 1300 additional units (total capacity minus what is already there) the development of new housing won’t be abrupt. For budget purposes, we project our long range plan five years into the future.

When we get to a year, say FY 2023, the actual state of our budget never looks exactly like the projection created five years earlier. We cannot predict the future very far out. What we can do is look back and see what the effects of previous development have been on our budget, and we can assess the risks of our decisions. Experience tells us that multi-family development doesn’t break the budget or swamp the schools, even when the developments are large. It also tells us that turnover in the population causes ebbs and flows in the school population, regardless of new development. We can say with certainty that multi-family development increases our revenues through new growth, and that past experience has been that that new growth mitigates the need for overrides.

My conclusion is that the new development that will occur if we create a robust zone that allows multi-family development by right, will at worst give us growth in our revenues that keeps pace with any increase in services we need. At best, those new revenues will outstrip the growth in expenses and help mitigate our structural deficit. The risk of allowing this new growth is low, and the rewards are worth it, in the form of new missing middle housing, climate change mitigation, and vibrant business districts fueled by new customers nearby.

by Steve Revilak

The term “AMI” or “Area Median Income” comes up in almost any discussion about affordable housing, because it’s used to set rents and the household incomes for people who are eligible to live in affordable dwellings. AMI is a fairly technocratic concept and my goal is to make the concept (and the numbers) easier to understand.

AMIs are set each year by the U.S. Department of Housing and Urban Development; broadly speaking, an AMI is the median income of a region. Arlington is part of the “Boston-Cambridge-Quincy, MA-NH HUD Metro FMR Area” which consists of more than 100 cities and towns in Massachusetts and New Hampshire. Median incomes represent the “middle” family income of an area—half of households make more, and half make less.

In the process of turning median incomes into income limits, HUD also considers household size: larger households are assigned larger AMI limits than smaller ones, in order to reflect the higher cost of living for more family members.

How do these limits translate into affordable housing regulations? Arlington’s affordable housing requirements (aka “inclusionary zoning”) require that rents for affordable units be priced for the 60% area median income, but the dwellings are available to households making up to 70%. Let’s show an example with some numbers.

| Household size | 60% Income Limit | 70% Income Limit | 60% Rent |

|---|---|---|---|

| 1 | $68,520 | $79,940 | $1,717/month |

| 2 | $78,360 | $91,420 | $1,959/month |

| 3 | $88,140 | $102,830 | $2,203/month |

HUD considers an apartment suitable for a household if it has one bedroom less than the number of household members, so a two-bedroom apartment would be suitable for a household of three, a one-bedroom would be suitable for a household of two, and a studio would be suitable for a household of one. The monthly rent for a two-bedroom apartment would be calculated as follows: $88,140 ÷ 12 × 30% = $2,203. The 30% comes from HUD’s rule that affordable housing tenants should not be cost-burdened, meaning that they pay no more than 30% of their income in rent.$88k or $102k/year can seem like a lot of money (and once upon a time it was). To get a better sense of what these income levels mean, I looked into what kinds of jobs pay these wages. To that end, I found wage information from the Arlington Public Schools report to Town Meeting, the Arlington town budget, and wage data from the Bureau of Labor Statistics. Here are a few scenarios:

Scenario 1: single adult

Scenario 1 represents a single adult living alone, and earning between $68,520 and $79,940. Jobs in this pay range include:

- Elementary classroom teacher ($62,000 – $75,000)

- Town planner ($75,000 – 79,000)

- Animal Control Officer ($72,000)

- Firefighter ($73,640)

- Librarian ($70,395)

- Lab Technician ($70,710)

- Social Worker ($71,470)

- Subway operator ($72,270)

- Licensed Practical Nurse ($75,690)

- Paralegal ($77,500)

- Chef ($78,040)

- Carpenter ($78,000)

Scenario 2: single parent with household of two

Scenario 2 represents a single parent earning between $78,360 and $91,420/year. Jobs in this pay range include:

- Office Manager – Assessor’s office ($80,399)

- Assistant Town Clerk ($77,375)

- Town Engineer ($74,000 – $80,000)

- Police Department Patrol Officer ($87,000)

- Town Budget Director ($88,488)

- Telecommunications equipment installer ($80,350)

- Plasterer and Stucco Mason ($82,250)

- Electrician ($82,380)

- Cement Mason ($86,250)

- Plumber and pipe fitter ($90,580)

Scenario 3: household of two, both adults

Scenario 3 has two adults, each earning $39,180 – $45,710 per year. Jobs in this salary range include several that we’ve come to know as “essential workers” during the pandemic.

- Special education teaching assistant ($34,290)

- Arlington Public Schools Paraprofessional ($36,290 – 42,440)

- Substitute Teacher ($34,921)

- Inspectional Services Record Keeper ($44,481)

- Food preparation worker ($39,590)

- Bartender ($39,730)

- Childcare worker ($40,470)

- Ambulance Driver ($40,890)

- Waiter ($41,440)

- Pharmacy aide ($41,460)

- Bank teller ($42,270)

- Tailor and dressmaker ($43,790)

- Restaurant cook ($44,140)

You may have noticed gaps in these lists — for example, there are no jobs listed in the $50,000 – $60,000 range because it’s in between the income limits for one- and two-income households. It’s also worth noting that a fair number of town employees’ salaries would qualify them for affordable housing (the town is Arlington’s largest employer).

So who qualifies to live in affordable housing? People with a lot of ordinary, working-class jobs, including many town employees.