Related articles

Issues of supply, affordability, and equity all contribute to an ongoing housing crisis in Massachusetts. Among U.S. metro areas with knowledge-based industries, metro Boston ranks near the bottom in housing production and near the top on development costs. Due to the latter, production of new affordable housing units has scarcely increased over the past decade. And largely decentralized authority over land use regulations, by 351 cities and towns, does little to foster uniform housing equity standards.

Clark Ziegler in MassBENCHMARK Journal vol.21 issue 1

For more information on the challenges of supply, affordability and equity, see the article. Clark Ziegler is the Executive Director of the Massachusetts Housing Partnership.

Why Is This Our Issue & What Should We Do About It?

(presented by Adam Chapdelaine, Town Manager, to Select Board on July 22, 2019)

Overview

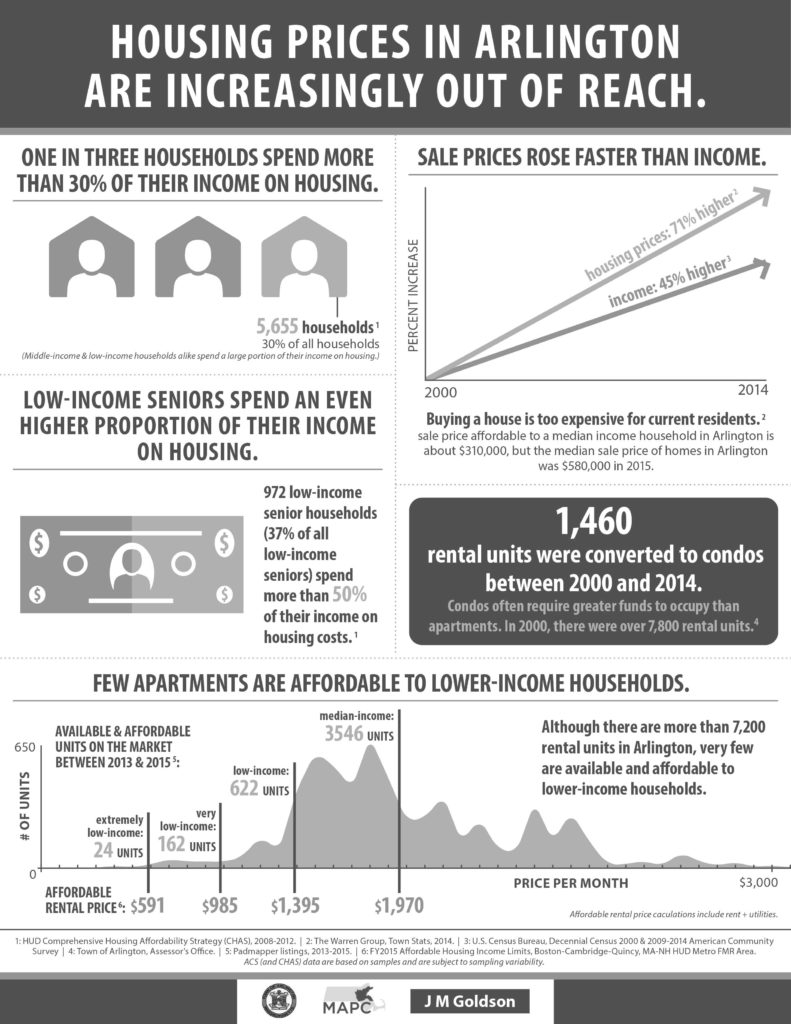

Since 1980 the price of housing in Massachusetts has surged well ahead of other fast growing states including California and New York. While the national “House Price Index” is just below 400, four times what an average house might have cost in 1980, a typical house in Massachusetts is now about 720% what it was in 1980. Median household income in the state has only increased about 15% during the same period. No wonder people in Arlington are feeling the stresses of housing costs if they want to live here and are feeling protective of the equity value time has provided them if they bought years ago.

In response to concerns about zoning, affordable housing and housing density, the Town joined the “Mayors’ (and Managers’) Coalition on Housing” to address these growing pressures. This 12 page slide deck presentation outlines the key data points, the number of low and very low income households in Arlington, the rate of condo conversion that is absorbing rental units, etc.

Solutions are offered including:

• Amendments to Inclusionary Zoning Bylaw

• Housing Creation Along Commercial Corridor – Mixed Use & Zoning Along Corridor

• Accessory Dwelling Units – Potential Age & Family Restrictions

• Other Tools Can Be Considered That Are Outside of Zoning But Have An Impact on Housing

Chapdelaine’s suggested next steps are:

• Continued Public Engagement

• Town Manager & Director of DPCD Meet with ARB

• Select Board & ARB Hold Joint Meeting in Early Fall

• ARB Recommends Strategies to Pursue in Late Fall/Early Winter

The Select Board approved the suggested next steps and a joint ARB/ Select Board meeting should be scheduled in the near future.

Note from Reporter: As a community, Arlington has long prided itself on its economic diversity. With condo conversions, tear downs leading to “McMansions”, higher paid workers arriving in response to new jobs, etc., Arlington is at great risk of losing this diversity that has long enriched the community. Retirees looking to downsize and young people who have grown up in Arlington looking for their first apartment are finding it impossible to stay in town. Shop keepers and town employees are challenged to afford the rising housing costs. With a reconsideration of zoning along Arlington’s transit corridors, Arlington NOW has an opportunity to create new village centers, like those recommended in the recent STATE OF HOUSING report. These village centers along our transit corridors could be higher, denser but also offer the compelling visual design and amenities desired by people who want to walk to cafes, shops and public transit.

(This post originally appeared as a one-page handout, distributed at The State of Zoning for Multi-Family Housing in Greater Boston.)

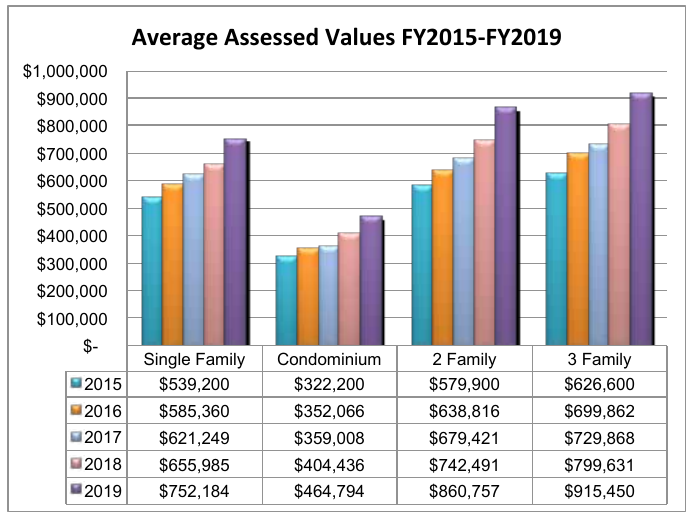

This chart shows the assessed value of Arlington’s low density housing from 2015–2019 (assessed values generally reflect market values from two years prior). During this time, home values increased between 39% (single-family homes) and 48% (two-family homes). Most of the change comes from the increasing cost of land. As a point of comparison, the US experienced 7.7% inflation during the same period. (1)

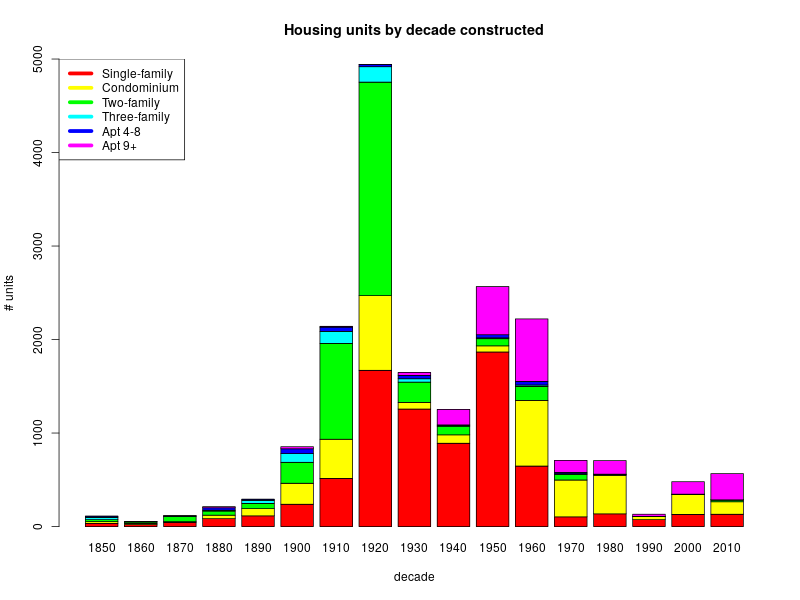

Arlington has constructed six apartment buildings in the 44 years since the town’s zoning bylaw was rewritten in 1975; we constructed 75 of them in the preceding 44 years.(2) Like numerous communities in the Metro-Boston area, we’re experiencing a high demand for housing, but our zoning regulations have created a paper wall that prevents more housing — including affordable housing — from being built.

Communities need adequate housing, but they also need housing diversity: different types of housing at different price points. The housing needs of young adults are different than the housing needs of parents with children, which are in turn different than the housing needs of senior citizens. As demographics change, housing needs change too. Keeping people in town means providing them with the opportunity to upsize or downsize when the need arises.

If Arlington’s housing costs had only increased with the rate of inflation, the cost of single family housing would average $581K, over $170K less than today. The median household income in Arlington is about $103K/year.(3) Buying an average single family-home with that income on a typical 30-year mortgage would require approximately 46% of a household’s monthly income.(4)

Either homes in Arlington will only be available to people who have much more substantial incomes than current residents, or the town will find a way to balance the rapidly growing cost of land against the housing needs of its current citizens, those still in school, those preparing to downsize as well as those looking for a bigger space.

In addition, Arlington’s commercial economy will thrive with a greater number of housing units so we can keep the empty nesters, and the new college graduates who have lived in the town for years, as well as welcome new Arlingtonians to support our local businesses, restaurants and other services.

Our Town, like others in the state, is looking for ways to balance the needs of our citizens with the market forces of rising land costs while maintaining a healthy, diverse community.

Footnotes

- The inflation amount comes from Inflation amount from https://data.bls.gov/cgi-bin/cpicalc.pl.

- Figures on multi-family unit construction are taken from Arlington Assessor’s data. They reflect multi-family buildings that are still used as rental apartments.

- Income levels come from 2013-2017 ACS 5-year data for Arlington, MA.

- Assuming 10% downpayment, 4% interest, $800/year for insurance, and Arlington’s $11.26 tax rate, the monthly mortgage payment would be nearly $4000/month.

The material in this post came from my efforts to learn about when Arlington’s housing was built. The data comes from the town’s 2019 property tax assessments, where I took our nineteen-thousand-and-some-odd homes and apartments and broke them down by housing type and decade built. It’s not exactly a history housing of production, though it is a close approximation. In this analysis, a single-family home built in the 1912 and rebuilt as a two-family in 1976 would show up as two units built in the 1970s. Similarly, a three-family home that was built in the 1924 and later converted to condominiums would show up as three condominiums built in the 1920s.

Here’s the visual summary:

And here’s a small spreadsheet with the underlying numbers.

My first surprise was at how much we built in the 1920s: just under five thousand units. This was our biggest decade for housing production, and nearly double our second biggest (the 1950s). Another surprise was the 1990s; 132 of our homes were constructed during that decade, which is the smallest number since the 1870s.

What about homes constructed before 1850? There are only 117 of them, and they’re omitted from the data set. I’ve also omitted residential units in mixed-use buildings, since my copy of the assessors data doesn’t break mixed-use buildings into residential and non-residential units.

by Steve Revilak

The term “AMI” or “Area Median Income” comes up in almost any discussion about affordable housing, because it’s used to set rents and the household incomes for people who are eligible to live in affordable dwellings. AMI is a fairly technocratic concept and my goal is to make the concept (and the numbers) easier to understand.

AMIs are set each year by the U.S. Department of Housing and Urban Development; broadly speaking, an AMI is the median income of a region. Arlington is part of the “Boston-Cambridge-Quincy, MA-NH HUD Metro FMR Area” which consists of more than 100 cities and towns in Massachusetts and New Hampshire. Median incomes represent the “middle” family income of an area—half of households make more, and half make less.

In the process of turning median incomes into income limits, HUD also considers household size: larger households are assigned larger AMI limits than smaller ones, in order to reflect the higher cost of living for more family members.

How do these limits translate into affordable housing regulations? Arlington’s affordable housing requirements (aka “inclusionary zoning”) require that rents for affordable units be priced for the 60% area median income, but the dwellings are available to households making up to 70%. Let’s show an example with some numbers.

| Household size | 60% Income Limit | 70% Income Limit | 60% Rent |

|---|---|---|---|

| 1 | $68,520 | $79,940 | $1,717/month |

| 2 | $78,360 | $91,420 | $1,959/month |

| 3 | $88,140 | $102,830 | $2,203/month |

HUD considers an apartment suitable for a household if it has one bedroom less than the number of household members, so a two-bedroom apartment would be suitable for a household of three, a one-bedroom would be suitable for a household of two, and a studio would be suitable for a household of one. The monthly rent for a two-bedroom apartment would be calculated as follows: $88,140 ÷ 12 × 30% = $2,203. The 30% comes from HUD’s rule that affordable housing tenants should not be cost-burdened, meaning that they pay no more than 30% of their income in rent.$88k or $102k/year can seem like a lot of money (and once upon a time it was). To get a better sense of what these income levels mean, I looked into what kinds of jobs pay these wages. To that end, I found wage information from the Arlington Public Schools report to Town Meeting, the Arlington town budget, and wage data from the Bureau of Labor Statistics. Here are a few scenarios:

Scenario 1: single adult

Scenario 1 represents a single adult living alone, and earning between $68,520 and $79,940. Jobs in this pay range include:

- Elementary classroom teacher ($62,000 – $75,000)

- Town planner ($75,000 – 79,000)

- Animal Control Officer ($72,000)

- Firefighter ($73,640)

- Librarian ($70,395)

- Lab Technician ($70,710)

- Social Worker ($71,470)

- Subway operator ($72,270)

- Licensed Practical Nurse ($75,690)

- Paralegal ($77,500)

- Chef ($78,040)

- Carpenter ($78,000)

Scenario 2: single parent with household of two

Scenario 2 represents a single parent earning between $78,360 and $91,420/year. Jobs in this pay range include:

- Office Manager – Assessor’s office ($80,399)

- Assistant Town Clerk ($77,375)

- Town Engineer ($74,000 – $80,000)

- Police Department Patrol Officer ($87,000)

- Town Budget Director ($88,488)

- Telecommunications equipment installer ($80,350)

- Plasterer and Stucco Mason ($82,250)

- Electrician ($82,380)

- Cement Mason ($86,250)

- Plumber and pipe fitter ($90,580)

Scenario 3: household of two, both adults

Scenario 3 has two adults, each earning $39,180 – $45,710 per year. Jobs in this salary range include several that we’ve come to know as “essential workers” during the pandemic.

- Special education teaching assistant ($34,290)

- Arlington Public Schools Paraprofessional ($36,290 – 42,440)

- Substitute Teacher ($34,921)

- Inspectional Services Record Keeper ($44,481)

- Food preparation worker ($39,590)

- Bartender ($39,730)

- Childcare worker ($40,470)

- Ambulance Driver ($40,890)

- Waiter ($41,440)

- Pharmacy aide ($41,460)

- Bank teller ($42,270)

- Tailor and dressmaker ($43,790)

- Restaurant cook ($44,140)

You may have noticed gaps in these lists — for example, there are no jobs listed in the $50,000 – $60,000 range because it’s in between the income limits for one- and two-income households. It’s also worth noting that a fair number of town employees’ salaries would qualify them for affordable housing (the town is Arlington’s largest employer).

So who qualifies to live in affordable housing? People with a lot of ordinary, working-class jobs, including many town employees.

Does Arlington need more housing? If yes, will more housing result in higher school costs? There is a perception that more housing means more school age children and more school age children will strain the capacity and expand the budget of the Arlington Public Schools.

Prelimary reviews suggest that more housing would not strain the APS capacity for a variety of complex reasons. These reasons include: school age children do not always go to APS; by the time new housing came on line, the school enrollment, now growing, will have begun to decline; Arlington needs more diverse kinds of housing, not just family housing; the 283 units of housing that came on line through Brigham Square and 360 contributed more in property tax revenue than they cost in school enrollment costs…. by over $980K in 2019. Read this for more information.

More analysis is needed. More discussion is needed. These are complicated and nuanced issues. Readers with additional comments should send them to info@equitable-arlington.org.

Restrictive covenants are a “list of obligations that purchasers of property must assume … For the first half of the 20th century, one commonplace commitment was a promise never to sell or rent to an African American”. [1] These covenants gained popularity after the Supreme Court’s 1917 decision in Buchanan v. Warley.

Rothstein’s book The Color of Law mentions examples from Brookline, MA; Arlington, MA has examples of it’s own. We’ll look at one from an East Arlington deed dating to 1923. Credit to Christopher Sacca for finding these documents.

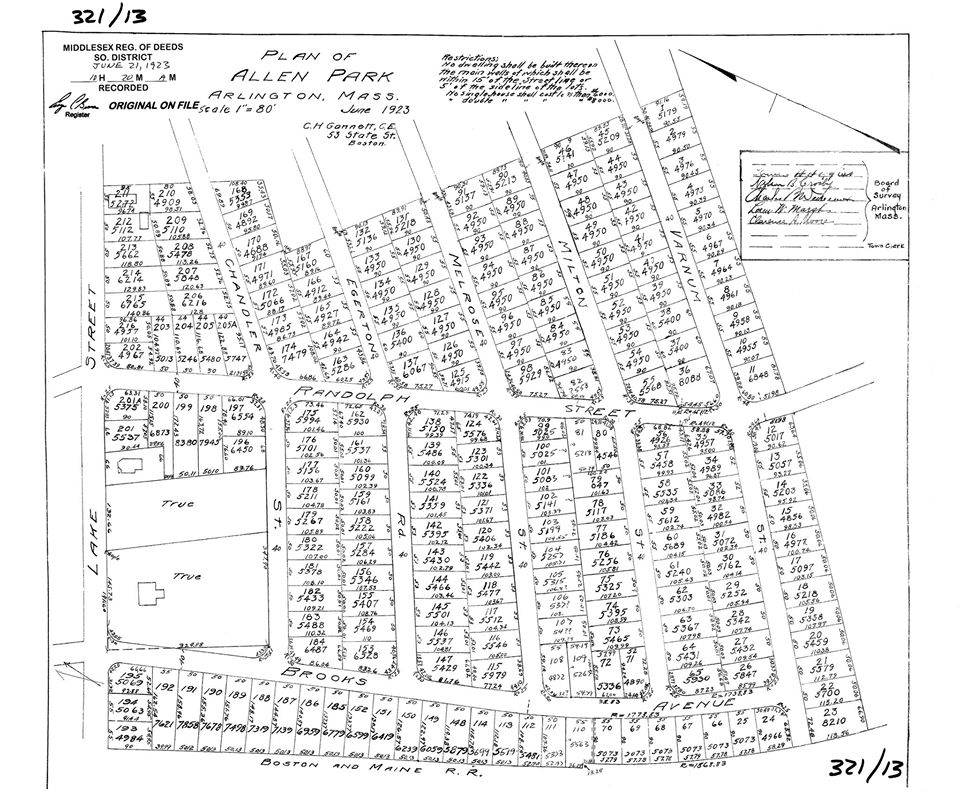

First, a land plan to establish content. Below is the subdivision plan for a farm owned by Herbert and Margaret Allen. I count a little over 200 lots in this subdivision. The plan itself states that “no single house shall cost less than $6,000 and no double house shall

cost less than $8,000″. This language also appears in the property deed.

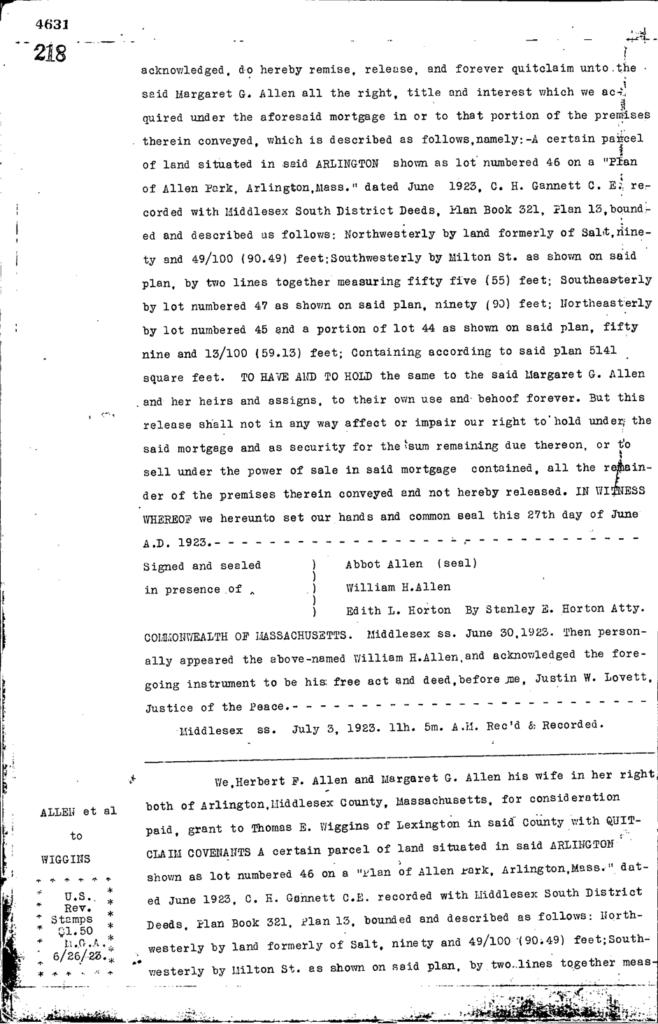

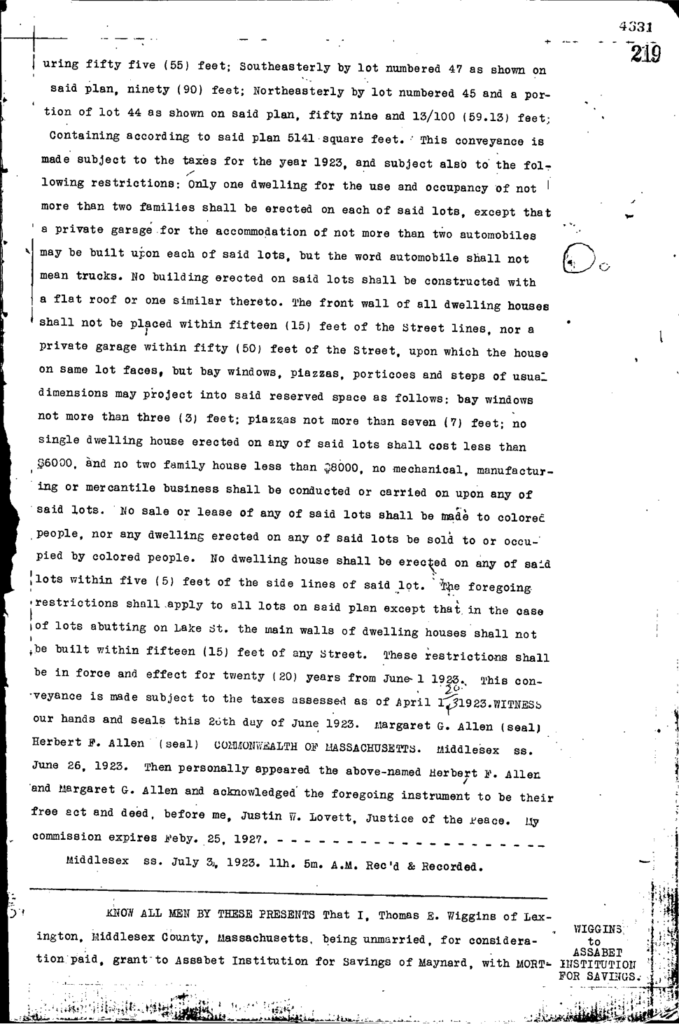

One of the deeds from these parcels appears in book 4631 page 218 and book 4631 page 219, in the Southern Middlesex registry of deeds.

Here’s page 218; the deed begins at the bottom.

Here’s page 219. The racial covenant appears halfway down the page. It reads “No sale or lease of any said lots shall be made to colored people, no any dwelling on any said lots be sold or occupied by colored people”.

The 1920’s were a time of significant residential growth in Arlington, as farmers (called “Market Gardeners” at the time) subdivided and sold off their land. This example shows that Arlington, MA landowners employed some of the same discriminatory tactics for segregation as other communities in the United States. It would take further research to determine how common the use of such covenants was early twentieth-century Arlington.

Footnotes

[1] The Color of Law. Richard Rothstein. pg. 78

A new report for Boston Indicators, “Exclusionary by Design”, shows the clear intent of many Greater Boston suburbs to resist racial and class integration in the 1970s. Housing scholar Amy Dain demonstrates how racial prejudice and class exclusion figured into suburbs’ downzoning in the 1970s; and how putatively legitimate concerns like tax revenue, aesthetic continuity, and the environment served the cause of exclusion.

Read the “Exclusionary by Design” report, and see the accompanying 1-hour webinar with Amy Dain, Luc Shuster of Boston Indicators and Ted Landsmark of Northeastern University.

“This research finds widespread evidence that over the past 100 years, zoning has been used by cities and towns across Greater Boston as a tool for excluding certain groups of people, including:

- Racial minorities, especially Black residents

- Lower-income and working-class residents

- Families with school-aged children• Religious minorities

- Immigrants

- And, in some cases, any newcomers/outsiders at all”

Low Diversity is No Accident

In the 1970s, municipalities were ordered by state law to create Growth Policy Statements – but with no mandate that communities actually endorse growth nor inclusion. Exclusionary language in these statements was seemingly anodyne, seeking to preserve the “present characteristics of their communities” or “socio-economic status“. In several cases the fear of integration was quite apparent: Milton’s statement referred to problems in “surrounding communities” (ie Mattapan and Dorchester) and “breakdown of society”; both Milton and Melrose make mention of the pressures caused by people “moving out of Boston”. Belmont’s plan explicitly calls for the town to stay “relatively expensive … [so as to] attract only those families so economically situated.”

The intent of such language was not somehow lost on people in that era. Needham’s Local Growth Policy Statement included, but pointedly disavowed its own “Appendix A” — a dissenting statement by the Congregational Church of Needham, calling out the town’s exclusionary aims and endorsing a vision of inclusive growth.

In addition, in many places where multi-family housing was theoretically allowed, “poison pill” requirements and impediments were added to make such building a practical impossibility. More recently we have seen the ironic use of infeasible “inclusionary zoning” requirements – which ensure that no affordable housing can actually be built.

The same language, un-evolved and unrefined, is still invoked by “neighborhood defenders” today. Our current housing affordability crisis and segregation is the plain result. The report is a sobering, enlightening read – essential for any active citizen or town official in eastern Massachusetts.