by Annie LaCourt

One of the concerns people have about the current MBTA Communities zoning proposal is the effect that the increase in housing will have on the town’s budget. Will the need for new services make demands on our budget we cannot meet without more frequent overrides? Or will the new tax revenues from the new buildings cover the cost of that increase in services?

The simple answers to these questions are

- No: It will not make unmanageable demands on the budget; and

- Yes: the new tax revenue from the multi-family housing anticipated will cover the costs of any new services required.

Adopting the current MBTA Communities zoning proposal may even slow the growth of our structural deficit, as I will show in more detail using as examples some of the more recent multi-family projects that have been built in Arlington.

How Does Our Budget Work and What is the Structural Deficit?

First, some basic facts about finance in Arlington: Like every other community in Massachusetts, Arlington’s property tax increases are limited by Proposition 2.5 to 2.5% of the levy limit each year. What is the levy limit? It’s all of the taxes we are allowed to collect across the whole town, without getting specific approval from the Town’s voters. For FY 23 the levy limit is $135,136,908. $3,271,996 of that is the 2.5% increase we are allowed under the law. But also added to that is $1,202,059 of new growth, which comes from properties whose assessment changed because they were substantially improved–either renovated or by increasing capacity. When we reassess a property that has a new house or building on it, we are allowed to add the new taxes generated by the change in value of the property to the levy limit.

Property taxes make up approximately 75% of the town’s revenue. So – except for new growth – that means that the bulk of our budget can only grow 2.5% a year. Other categories of income like State Aid have a much less reliable growth pattern. If the state has a bad fiscal year, our state aid is likely to remain flat or decrease.

Expenses

On the expense side, our default is a budget to maintain the same level of services year to year. We cap increases in the budgets of town departments by 3.25% and the school budget by 3.5%, save for special education costs which are capped slightly higher.

We also have several major categories of expense that are beyond our control that increase at a greater rate than 2.5%. These include, among other things, funding our pension obligations, health insurance costs and our trash collection contract.

Structural Deficit

This difference between the increase in revenues and the increase in costs is the structural deficit. It’s structural because we can’t cut our way out of it without curtailing services severely and we can’t stop paying for things like pensions and insurance that are contractual obligations.

The question of how MBTA communities zoning will affect this is crucial. So let’s take a deeper dive, first on revenue and then on expenses.

How Will MBTA Communities Affect New Growth?

How MBTA-C zoning will affect new growth depends on what gets built and at what rate. Let’s consider some real world examples:

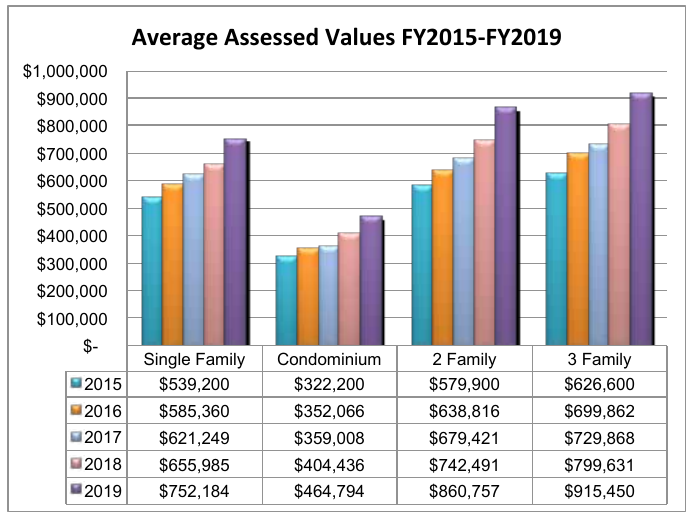

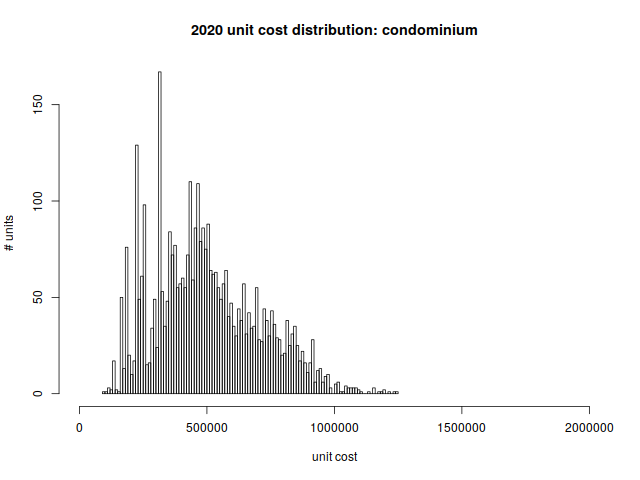

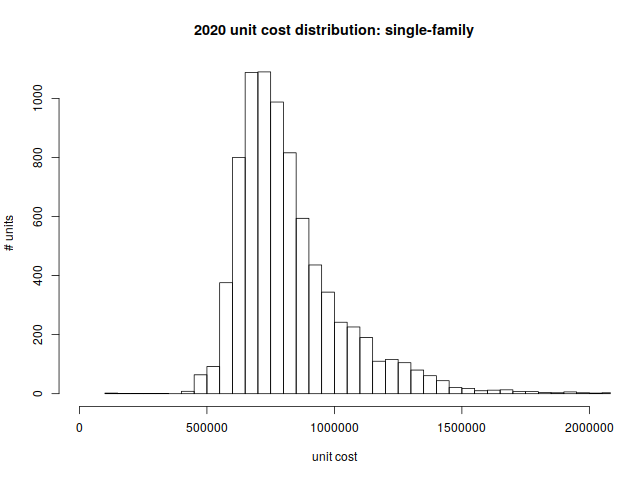

882 Mass Ave. used to be a single story commercial building. It was assessed at $938,000 and the owner paid approximately $9,887 in taxes annually. It has been rebuilt as a mixed use building with commercial space on the ground level and 22 apartments on 4 floors above. The new assessment is approximately $4,800,000 and the new tax bill is about $54,000.00. That means $45,000 in new growth – new property taxes that will grow at the rate of 2.5% in subsequent years.

Another example is 117 Broadway. The building that used to be at that address was entirely commercial, assessed at $1,050,000 and paid around $11,770 in taxes annually. After being rebuilt as mixed use by the Housing Corporation of Arlington, it is assessed at $3,900,000 and taxed at $43,719. 117 Broadway has commercial on the ground floor and 4 stories of affordable housing above. The new growth for this example is approximately $30,000.

What these examples show, and our assessor believes is a pattern, is that a new mixed use or multi-family building increases the taxes we can collect by as much as 400%, depending on the kinds of housing units.

So we can expect new development under MBTA Communities to increase the levy limit substantially over time, reducing the size and frequency of future tax increases.

How Will This New Housing Affect the Cost of Services?

Of course, with new residents comes a need for additional services. However, town-provided services will be impacted differently. Snow and Ice removal, for example, will not be affected at all – we aren’t adding new roads. Many other services provided by public works are like snow and ice: They would only increase at a faster rate if we added more land area or more town facilities to the base.

Services like public safety and health and human services may see gradual increases in service requests, as more people place more demand on these departments. Right now we have a patrol officer for every 850 or so residents. This means we might need to add a new patrol officer if the population increases by 850 residents. But it’s not clear that a new officer would be needed; it depends on the trends the police department sees in their data. I think of these services as increasing by stair steps: Adding a few, or even a few hundred, residents doesn’t require us to add staff to provide more services. Adding a few thousand might mean we need to add a position but we will have added a great deal to the levy limit before we need to add those positions.

Trash Collection Impact

There is one town service that sees an impact every time we add a new unit of housing – trash collection. The town spends approximately $200 per household on solid waste collection and disposal. As mentioned above, 882 Broadway has 22 new 1 bedroom and studio apartments. When that building was all commercial the businesses paid privately for trash removal. The new trash collection costs will be at least $4,400 annually. It’s possible, however, that the building will need a dumpster and that could cost up to $20,000 annually. Either way the new revenue ($45,000) outstrips the increased costs. The town is working on creative solutions for new buildings to keep this cost as affordable as possible.

What About Schools?

Regardless of new housing construction, our student population ebbs and flows. Families move in with small children who go through the school system. The kids graduate high school but their parents, now in their 50’s or 60’s, don’t move until they are much older and need a different living situation. When they sell their homes, the new owners are likely to be families with children again. We can see a pattern of boom and bust in our school population if we look back. Right now, we are seeing a drop in elementary population as this cycle plays out again. We now have 221 fewer students enrolled in the elementary schools than we did in 2019.

We account for this ebb and flow in the budget. A number of years ago, we set a policy to add a growth factor to the school budget. We increase the budget by 50% of per pupil costs for each new student. Currently that is $8800.00 per student. But the policy works in reverse as well. We reduce the budget by the same amount per child as the student population wanes. We also see increased state aid under chapter 70 when our student population grows and may see reductions if it shrinks.

Will Multifamily Homes Add Students?

The new multi-family housing generated by MBTA communities zoning may add students to our schools – but not as many as you might think. Other large multi-family developments like the Legacy apartments and the new development at the old Brigham site have not added a lot of children to the schools directly. Going back to our two example buildings, 882 Mass Ave is all studio and 1 bedroom units, so we are unlikely to see children living there. Our MBTA communities zoning, however, must by law allow new housing that is appropriate for families. So for planning purposes, it’s best to assume we will see growth in the school population.

So what will the effect of this new housing be on the school population and our budget? Given that the new housing will be built gradually, it’s more likely to stabilize our student population than precipitously increase it. The same will be true for our budget: We will see some increases in the school budget growth factor but also increases in state aid and increases in tax revenue from the new construction.

Conclusions

If we create an MBTA communities zone per the working groups recommendation or something close to that, we will see the effect on our budget over time, not immediately. Even if the zone has a theoretical capacity of 1300 additional units (total capacity minus what is already there) the development of new housing won’t be abrupt. For budget purposes, we project our long range plan five years into the future.

When we get to a year, say FY 2023, the actual state of our budget never looks exactly like the projection created five years earlier. We cannot predict the future very far out. What we can do is look back and see what the effects of previous development have been on our budget, and we can assess the risks of our decisions. Experience tells us that multi-family development doesn’t break the budget or swamp the schools, even when the developments are large. It also tells us that turnover in the population causes ebbs and flows in the school population, regardless of new development. We can say with certainty that multi-family development increases our revenues through new growth, and that past experience has been that that new growth mitigates the need for overrides.

My conclusion is that the new development that will occur if we create a robust zone that allows multi-family development by right, will at worst give us growth in our revenues that keeps pace with any increase in services we need. At best, those new revenues will outstrip the growth in expenses and help mitigate our structural deficit. The risk of allowing this new growth is low, and the rewards are worth it, in the form of new missing middle housing, climate change mitigation, and vibrant business districts fueled by new customers nearby.