This 102 page document is the most recently revised set of recommendations by the Town of Arlington’s Redevelopment Board. The report takes into consideration the comments and information provided over the last few months’ public hearing process. It also incorporates a citizen petition which strengthens the case for increasing permanent affordable housing with the passage of these zoning related Articles. Town Meeting convenes on April 22, 2019.

Related articles

It’s the time of year when folks in Arlington are taking out nomination papers, gathering signatures, and strategizing on how to campaign for the town election on Saturday April 1st. The town election is where we choose members of Arlington’s governing institutions, including the Select Board (Arlington’s executive branch), the School Committee, and — most relevantly for this post — Town Meeting.

If you’re new to New England, Town Meeting is an institution you may not have heard of, but it’s basically the town’s Legislative Branch. Town Meeting consists of 12 members from each of 21 Precincts, for 252 members total. Members serve three-year terms, with one-third of the seats up for election in any year, so that each precinct elects four representatives per year (perhaps with an extra seat or two, as needed to fill vacancies). For a deeper dive, Envision Arlington’s ABC’s of Arlington Government gives a great overview of Arlington’s government structure.

As our legislative branch, town meeting’s powers and responsibilities include:

- Passing the Town’s Operating Budget, which details planned expenses for the next year.

- Approving the town’s Capital Budget, which includes vehicle and equipment purchases, playgrounds, and town facilities.

- Bylaw changes. Town meeting is the only body that can amend the towns bylaws, including ones that affect housing — what kinds can be built, how much, and where.

Town Meeting is an excellent opportunity to serve your community, and to learn about how Arlington and its municipal government works. Any registered voter is eligible to run. If this sounds like an interesting prospect, we encourage you to run! Here’s what you’ll need to do:

- Have a look at the town’s Information for new and Prospective Town Meeting Members.

- Contact the Town Clerk’s office to get a set of nomination papers. You’ll need to do this by 5:00 PM February 12th, 2025 at the latest.

- Gather signatures. You’ll need signatures from at least ten registered voters in your precinct to get on the ballot (it’s always good to get a few extra signatures, to be safe).

- Return your signed nomination papers to the Clerk’s office by February 14, 2025 at 5:00 PM.

- Campaign! Get a map and voter list for your precinct, knock on doors, and introduce yourself. (Having a flier to distribute is also helpful.)

- Vote on Saturday April 5th, and wait for the results.

Town Meeting traditionally meets every Monday and Wednesday at 8:00 PM, starting on the 4th Monday in April (which is April 28th this year), and lasting until the year’s business is concluded (typically a few weeks).

If you’d like to connect with an experienced Town Meeting Member about the logistics of campaigning, or the reality of serving at Town Meeting, please email info(AT)equitable-arlington.org and we’d be happy to make an introduction.

During the past few years, Town Meeting was our pathway to legalizing accessory dwelling units, reducing minimum parking requirements, loosening restrictions on mixed-use development in Arlington’s business districts, and adopting multi-family zoning for MBTA Communities. Aside from being a rewarding experience, it’s a way to make a difference!

(Contributed by HCA Board Member Laura Wiener, and Executive Director Erica Schwarz)

The Housing Corporation of Arlington (HCA), the Town’s non-profit housing developer, is excited to create a new development on Sunnyside Ave with 43 new affordable homes. The homes will be a diverse mix of sizes and serve people of different incomes, all under 60% of the area median income. Arlington and the entire Greater Boston region have a severe shortage of affordable housing, which this project will help to address. Arlington’s Master Plan, Housing Plan, and Housing Trust Action Plan all acknowledge the need to create significantly more affordable housing.

The HCA’s new Sunnyside Ave proposal is located just off Broadway, near the Alewife Brook DCR Greenway and the Somerville line; it’s a great location near a supermarket, bus lines, and a modest walk to Davis Square. Currently, the site is a dilapidated former auto body shop. The proposal is designed to meet the specific needs of HCA’s residents and the Arlington community. The development will be Passive House certified. It includes 21 vehicle parking spaces, approximately 70 bike parking spaces, and a 2nd floor roof garden for tenants to enjoy. The development also includes a community room that the HCA will share with other local groups. The project will also add a sidewalk on Sunnyside Ave where there currently isn’t one. HCA owns the site and expects to start seeking zoning approval in the spring.

Building affordable housing is a long and complicated process, due to the permitting process plus the number and complexity of funding sources needed. The state’s Department of Housing and Community Development receives many more requests than they can fund in every funding round. We expect to complete the permitting process in 2023, secure our financing by the end of 2024, and start construction in early 2025. With an expected construction timeline of around one year, HCA expects to see tenants moving into the building in spring, 2026. A public forum on the project is anticipated in the coming months. Given the complicated funding and permitting challenges, your monetary and public support of our new development on Sunnyside Ave would be appreciated.

The Housing Corporation of Arlington is a non-profit, community-based developer and owner of affordable housing in Arlington. It owns 150 units of affordable rental housing in all parts of town. The units are occupied by a diverse mix of families and individuals. HCA has been purchasing, rehabilitating, and building new housing since 2000, and also provides social service programs to support family stability and build community connection and engagement. Every week, HCA staff help local families who are struggling with the extreme cost of housing, making the creation of more affordable homes both urgent and important.

The staff, board of directors, and the more than 1,000 tenants, donors, and members who make up the HCA organization are very excited about this opportunity to expand Arlington’s portfolio of affordable housing. Our most recent projects included three newly constructed buildings—two in Downing Square (Lowell Street) and a mixed-use property shared with “Arlington Eats” on Broadway. To learn more about HCA or apply for housing, go to: https://www.housingcorparlington.org.

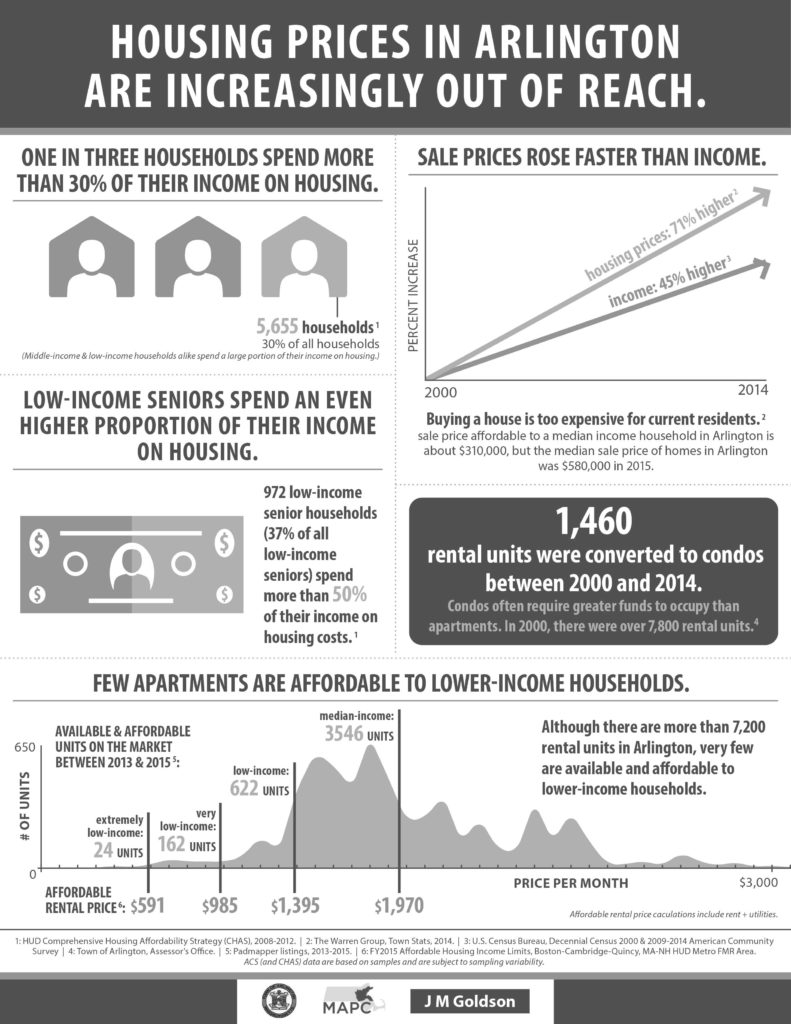

The new proposal is just the most recent step in a process that reaches back almost a decade, culminating in the Master Plan (2015), the Housing Production Plan (2016) and the mixed-using zoning amendments of 2016. The Town has consistently proposed smart growth: more development along Arlington’s transit corridors to increase the tax base, stimulate local commerce, and provide more varied housing opportunities for everyone, including low and moderate income Arlingtonians. This year’s proposals are no head-long rush into change. Today’s debate is similar to the debate before Town Meeting three years ago. If anything, progress has been frustratingly slow. To realize the Master Plan’s vision of a vibrant Arlington with diverse housing types for a diverse population, we must stay the course on which we have been embarked for so long.

(This post originally appeared as a one-page handout, distributed at The State of Zoning for Multi-Family Housing in Greater Boston.)

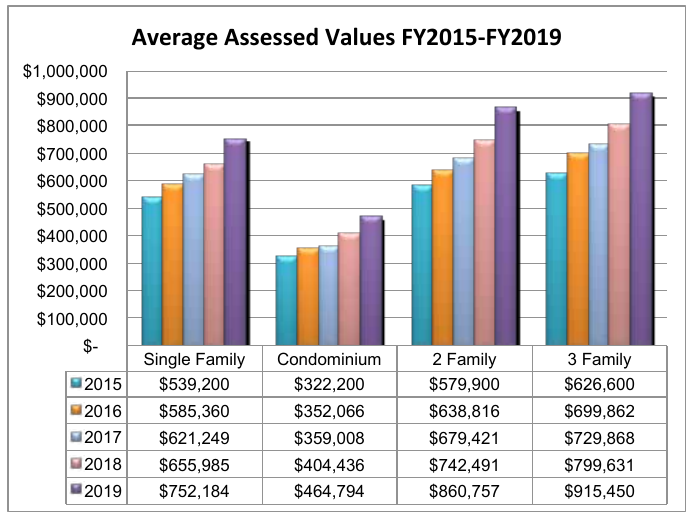

This chart shows the assessed value of Arlington’s low density housing from 2015–2019 (assessed values generally reflect market values from two years prior). During this time, home values increased between 39% (single-family homes) and 48% (two-family homes). Most of the change comes from the increasing cost of land. As a point of comparison, the US experienced 7.7% inflation during the same period. (1)

Arlington has constructed six apartment buildings in the 44 years since the town’s zoning bylaw was rewritten in 1975; we constructed 75 of them in the preceding 44 years.(2) Like numerous communities in the Metro-Boston area, we’re experiencing a high demand for housing, but our zoning regulations have created a paper wall that prevents more housing — including affordable housing — from being built.

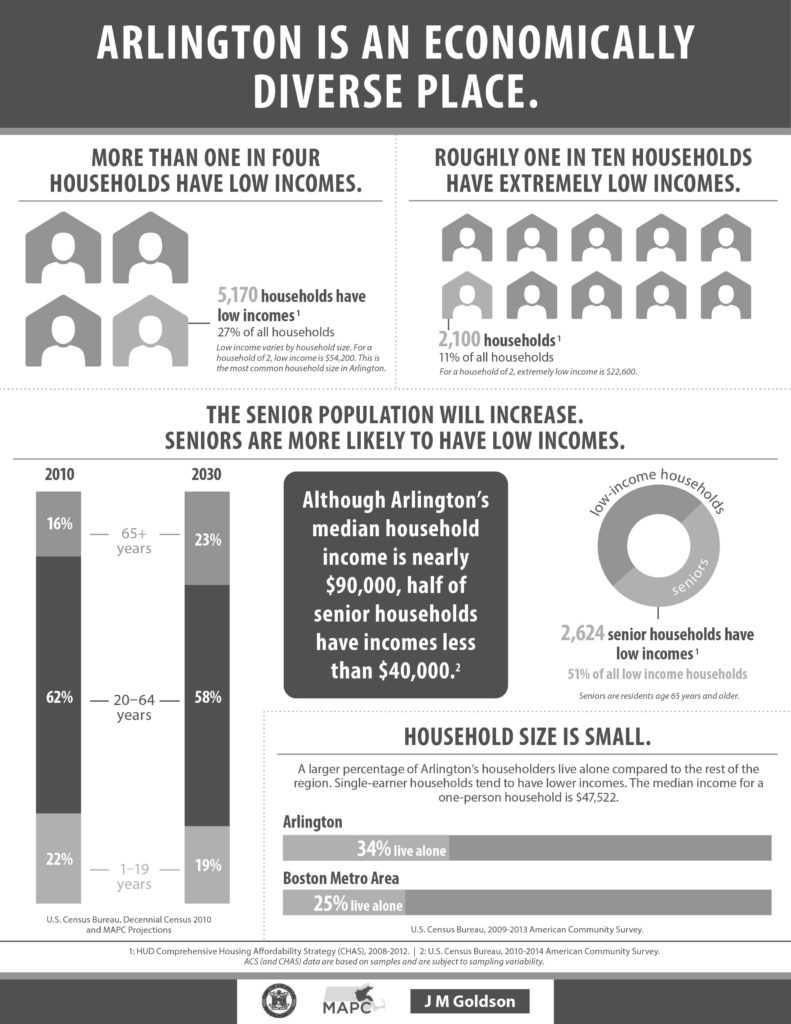

Communities need adequate housing, but they also need housing diversity: different types of housing at different price points. The housing needs of young adults are different than the housing needs of parents with children, which are in turn different than the housing needs of senior citizens. As demographics change, housing needs change too. Keeping people in town means providing them with the opportunity to upsize or downsize when the need arises.

If Arlington’s housing costs had only increased with the rate of inflation, the cost of single family housing would average $581K, over $170K less than today. The median household income in Arlington is about $103K/year.(3) Buying an average single family-home with that income on a typical 30-year mortgage would require approximately 46% of a household’s monthly income.(4)

Either homes in Arlington will only be available to people who have much more substantial incomes than current residents, or the town will find a way to balance the rapidly growing cost of land against the housing needs of its current citizens, those still in school, those preparing to downsize as well as those looking for a bigger space.

In addition, Arlington’s commercial economy will thrive with a greater number of housing units so we can keep the empty nesters, and the new college graduates who have lived in the town for years, as well as welcome new Arlingtonians to support our local businesses, restaurants and other services.

Our Town, like others in the state, is looking for ways to balance the needs of our citizens with the market forces of rising land costs while maintaining a healthy, diverse community.

Footnotes

- The inflation amount comes from Inflation amount from https://data.bls.gov/cgi-bin/cpicalc.pl.

- Figures on multi-family unit construction are taken from Arlington Assessor’s data. They reflect multi-family buildings that are still used as rental apartments.

- Income levels come from 2013-2017 ACS 5-year data for Arlington, MA.

- Assuming 10% downpayment, 4% interest, $800/year for insurance, and Arlington’s $11.26 tax rate, the monthly mortgage payment would be nearly $4000/month.

(By Vince Baudoin and James Fleming)

Could Arlington be better using its curb space? Here are some ways the curb can be used to create green infrastructure, promote public safety and accessibility, support sustainable transportation, strengthen business districts, and enable new ‘car-light’ development.

Roughly six inches high and made of concrete or granite, the curb marks the edge of the roadway, channels runoff, protects the sidewalk, and gathers stray leaves. When not assigned any other use, the space in front of the curb it usually serves as free storage for personal automobiles.

Yet the humble curb is a limited resource that can serve the community in many more ways. Have you thought about how your town budgets its curb space? For that matter, has your town thought about how it budgets its curb space?

While Arlington mostly uses its curb space for parking, some areas have other curb uses designed to achieve a specific goal. Consider the streets you use often. Have you seen an unsolved problem, or a missed opportunity, that a different use of the curb could help solve?

Create green infrastructure

The Town has miles of paved roadway. When it rains or snows, water runs into storm drains, carrying salt, oil, and other pollutants with it. The storm drains dump these pollutants directly into long-degraded waterways such as the Mill Brook, Alewife Brook, and the Mystic River. The Public Works department struggles to keep grates clear and drains from overflowing.

One solution: Use the curb for more greenery! The curb can be extended to create a rain garden or tree planting strip. The rain garden helps slow runoff and filter the water before it enters the drain, while trees benefit from additional room for the roots to grow without damaging the sidewalk. A side benefit: narrowing the street encourages drivers to slow down, making neighborhoods safer.

Promote public safety and accessibility

Often, portions of the curb are set aside for public safety purposes. For example, a fire lane provides fire department access to key buildings, such as the high school, shown below. Fire hydrants also enjoy special curb status.

Other times, no-parking zones are established to enhance the free flow of traffic, such as here at Broadway Plaza:

Where pedestrian crosswalks are present, a curb extension is a key safety enhancement. By narrowing the roadway, the curb extension encourages drivers to slow down and look for pedestrians. For pedestrians, it reduces the distance they must cross and prevents cars from parking directly next to the crosswalk and blocking visibility.

Finally, accessible parking spaces can be created along the curb. Arlington has at least 50 designated permit-only on-street parking spaces that provide convenient parking for residents with mobility issues or other disabilities.

Support sustainable transportation

When the curb is mostly used for cars, it is easy to overlook how curbside facilities can enhance other forms of transportation.

In the space of one or two parked cars, this bikeshare station offers space for 11 bikes. However, because it is installed on the roadway, it must be removed every winter so that snow can be cleared. If the curb were extended, the bikeshare station could be used year-round. Another nice feature is bicycle parking: the space to park one car can be used to park six or more bicycles.

A bus stop allows buses to pull to the curb. In some cases, it is appropriate to extend the curb so the bus would stop in the traffic lane; otherwise, it may experience delays when it merges back into traffic.

A bus priority lane provides a dedicated right of way for buses, helping to improve on-time performance. To date, these lanes extend only a few hundred feet into Arlington along Mass Ave. They have proven beneficial in many other communities.

Bike lanes, particularly if they are separated from cars by a physical buffer, greatly enhance the safety and comfort of people traveling on two wheels.

But with a limited roadway width, adding bike lanes is difficult unless the community is flexible enough to consider consolidating curb parking on one side of the street, or moving it to side streets entirely.

Finally, the Town could expand the use of on-street spaces for electric vehicle charging stations, such as this one on Park Ave:

Strengthen business districts

Nowhere is the curb more valuable than in business districts. Businesses thrive when their customers have a convenient way to reach them. Metered parking encourages people to park, do their business, and move along so another patron can take that space. Revenue from parking meters can be spent to improve the business district–for example, by planting flowers and trees.

Metered parking is not the only valuable use of curb space in a business district. Outdoor dining is a way the Town can directly support its restaurants by enabling them to serve additional customers. Here is one example in Arlington Center:

And in Arlington Heights:

Other valuable curb uses in business districts include taxi stands and loading zones. Loading zones in particular are crucial to businesses’ success and help prevent the street from being clogged by early-morning delivery trucks, late-night food-delivery vehicles, and everything in between.

Enable new ‘car-light’ development

With high housing costs and a relatively small commercial tax base, Arlington could benefit from some kinds of development. However, land is valuable and lots are small, so if new buildings are required to have large parking lots, it is very difficult to build new homes and businesses. Plus, large parking lots bring more cars and more traffic. But better curb management can help resolve this dilemma, supporting car-light development that is more sustainable and affordable.

For example, on-street permit parking can enable nearby development with few or no off-street parking spaces. New housing or businesses are a better use of land than parking and will generate more property tax revenue. When parking permits are priced appropriately, they are available to residents who need them but discourage households from adding extra cars they do not need.

Take these hillside houses: access to on-street parking made it possible to build on a steep hillside, where it would have been too expensive and difficult to blast to create off-street parking.

Conclusion

Ask your town leaders if they have a curb management strategy. Is the Town using its limited curb space in support of goals such as green infrastructure, public safety and accessibility, public transportation, local business, and car-light development?

It’s January 2023, and as we do every year, folks in Arlington are taking out nomination papers, gathering signatures, and strategizing on how to campaign for the town election on Saturday April 1st. The town election is where we choose members of Arlington’s governing institutions, including the Select Board (Arlington’s executive branch), the School Committee, and — most relevantly for this post — Town Meeting.

If you’re new to New England, Town Meeting is an institution you may not have heard of, but it’s basically the town’s Legislative Branch. Town Meeting consists of 12 members from each of 21 Precincts, for 252 members total. Members serve three-year terms, with one-third of the seats up for election in any year, so that each precinct elects four representatives per year (perhaps with an extra seat or two, as needed to fill vacancies). For a deeper dive, Envision Arlington’s ABC’s of Arlington Government gives a great overview of Arlington’s government structure.

As our legislative branch, town meeting’s powers and responsibilities include:

- Passing the Town’s Operating Budget, which details planned expenses for the next year.

- Approving the town’s Capital Budget, which includes vehicle and equipment purchases, playgrounds, and town facilities.

- Bylaw changes. Town meeting is the only body that can amend the towns bylaws, including ones that affect housing and commercial development.

Town Meeting is an excellent opportunity to serve your community, and to learn about how Arlington and its municipal government works. Any registered voter is eligible to run. If this sounds like an interesting prospect, I’d encourage you to run as a candidate. Here’s what you’ll need to do:

- Have a look at the town’s Information for new and Prospective Town Meeting Members.

- Contact the Town Clerk’s office to get a set of nomination papers. You’ll need to do this by 5:00 PM February 8th, 2023 at the latest.

- Gather signatures. You’ll need signatures from at least ten registered voters in your precinct to get on the ballot (it’s always good to get a few extra signatures, to be safe).

- Return your signed nomination papers to the Clerk’s office by February 10, 2023 at noon.

- Campaign! Get a map and voter list for your precinct, knock on doors, and introduce yourself. (Having a flier to distribute is also helpful.)

- Vote on Saturday April 1st, and wait for the results.

Town Meeting traditionally meets every Monday and Wednesday, from 8:00 — 11:00 pm, starting on the 4th Monday in April (which is April 24th this year), and lasting until the year’s business is concluded (typically a few weeks).

If you’d like to connect with an experienced Town Meeting Member about the logistics of campaigning, or the reality of serving at Town Meeting, please email info(AT)equitable-arlington.org and I’d be happy to make an introduction.

During the past few years, Town Meeting was our pathway to legalizing accessory dwelling units, reducing minimum parking requirements, and loosening restrictions on mixed-use development in Arlington’s business districts. Aside from being a rewarding experience, it’s a way to make a difference!

A few days ago, the Boston Globe ran an article titled “2021 set records in Boston Housing Market. What now?“. It’s not unusual to see stories about housing in the news — the market is highly competitive and the sale prices can be jaw dropping. Jaw dropping can take several forms: from the new (and used) homes that sell for over two million dollars, to the amount of money that someone will pay to purchase a small post-war cape (around $900,000, give or take).

According to the globe article, the Greater Boston Association of Realtors estimates that the median price of a single family homes in the Boston area rose 10.5% in 2021, to $750,000. Arlington is comfortably in the upper half of this median: according to our draft housing production plan the median sale price of our single family homes was $862,500 in 2020, and rose to $960,000 in the first half of 2021 (see page 39).

In June 2021, I got myself into a habit of sampling real estate sales listed in the Arlington Advocate, and compiling them into a spreadsheet. My observations are generally consistent with the sources cited above; Arlington’s housing is expensive and it’s appreciated rapidly, particularly in the last 6–10 years. It’s a great time for existing owners, but less so if you’re in the market for your first home.

We’re actually facing two problems, which are related but not identical. The first is high cost, which creates financial stress and a barrier to entry (though it is a boon for those who sell). The second problem is quantity; there are regional and national housing shortages, and that contributes to high prices and bidding wars.

Addressing these challenges will require collective effort on behalf of all communities in the metro area; this is a regional problem and we’ll all have to pitch in. There isn’t a single recipe for what “pitching in” means, but here are some for what communities can do.

First, produce more affordable housing. Affordable housing is a complex regulatory subject, but it basically boils down to two things: (1) the housing is reserved for households with lower incomes than the area as a whole, and (2) there’s a deed restriction (or similar) that prevents it from being sold or rented at market rates. Affordable housing usually costs more to produce than it generates in income, and the difference has to be made up with subsidies. It takes money.

Second, simply produce more housing. This is the obvious way to address an absolute shortage in the number of dwellings available. Some communities have set goals for housing production. Under the Walsh administration, Boston set a goal of producing 69,000 new housing units by 2030. Somerville’s goal is 6000 new housing units, and Cambridge’s is 12,500 (page 152 of pdf). To the best of my knowledge, Arlington has not set a numeric housing production goal, but it’s something I’d like to see us do.

Finally, communities could be more flexible with the types of housing they allow. Arlington is predominantly zoned for single- and two-family homes. The median sale price of our single family homes was $960,000 during the first half of 2021, and a large portion of that comes from the cost of land. That’s the reality we have, and the existing housing costs what it costs. So, we might consider allowing more types of “missing middle” housing, where the per dwelling costs tend to be lower: apartments, town houses, triple-deckers, and the like.

Of course, this assumes that our high cost of housing is a problem that needs to be solved; we could always decide that it isn’t. In the United States, home ownership is seen as a way to build equity and wealth. It’s certainly been fulfilling that objective, especially in recent years.