Two weeks ago, I helped to organize a precinct meeting for residents and town meeting members. During the meeting, we got into a discussion about public open spaces, how the town funds their upkeep, and whether having more commercial tax revenue might provide additional funding for parks and recreation.

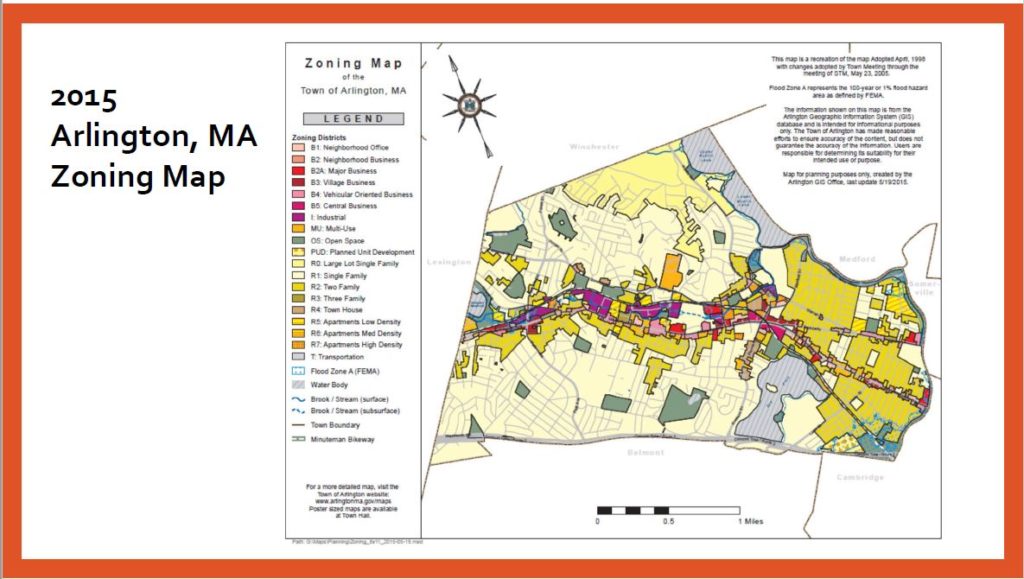

As I discussed in an earlier post, only about 5.6% of Arlington’s is zoned for commercial uses, and that limits the amount of commercial property tax revenue we can generate. Commercial property tax revenue is sometimes referred to as “CIP”, which stands for “Commercial, Industrial, and Personal”. Commercial and Industrial refer to property taxes on land and buildings that are respectively used for commercial and industrial uses. Personal tax is tax on the value of equipment that’s owned and used by a business for the purpose of carrying out whatever their business is. This could include things like desks, display fixtures, cooking equipment, fork lifts, and the like.

In 2020, Arlington’s CIP levy was 5.45%, meaning that 5.45% of our property tax revenue came from Commercial, Industrial, and Property tax revenue. Breaking this down further, 4.2% was commercial ($5,562,528 tax levy), 0.2% was industrial ($278,351 tax levy), and 1.1% was personal ($1,423,117 tax levy). The town’s total 2020 tax levy was $133,350,155. This data comes from MassDOR’s Division of Local Services, and I’ll provide more specific sources in the “References” section of this post.

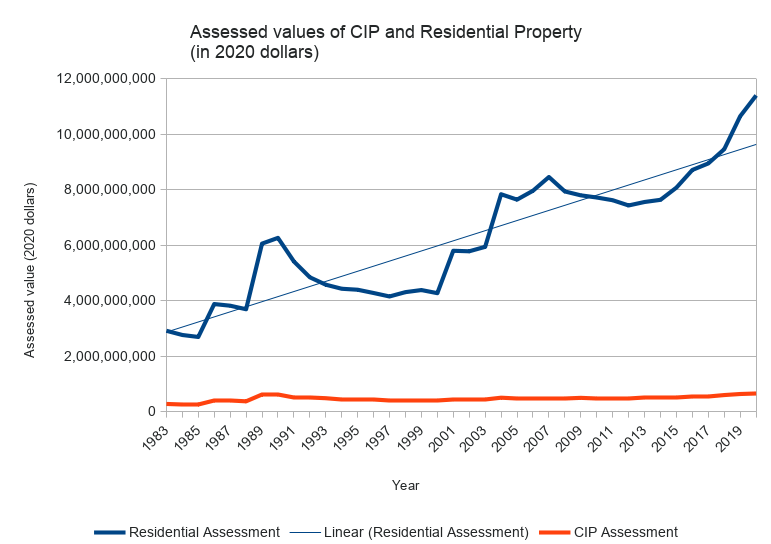

A CIP levy of 5.45% is low (compared with other communities in the commonwealth), and occassionaly folks like to talk talk about how to raise it. Which is to say, we about how to raise the ratio of commercial to residential taxes. I moved to Arlington in 2007, when our CIP levy was 5.37%. This increased in subsequent years, peaking at 6.26% in 2013, and has been gradually decreasing since. Recall that 2008 was the year the housing market crashed, and the “great recession” began. The value of Arlington’s residential property fell, but the value of business properties was relatively stable in comparison. Thus, our CIP percentage got a boost for a couple of years.

Tax levies (the amount of tax collected) are a direct reflection of the tax basis (the assessed value of property). I’m going to shift from talking about the former to talking about the latter, because that will lead nicely to a discussion about property wealth. Which is to say, the aggregate value of property assessments in town.

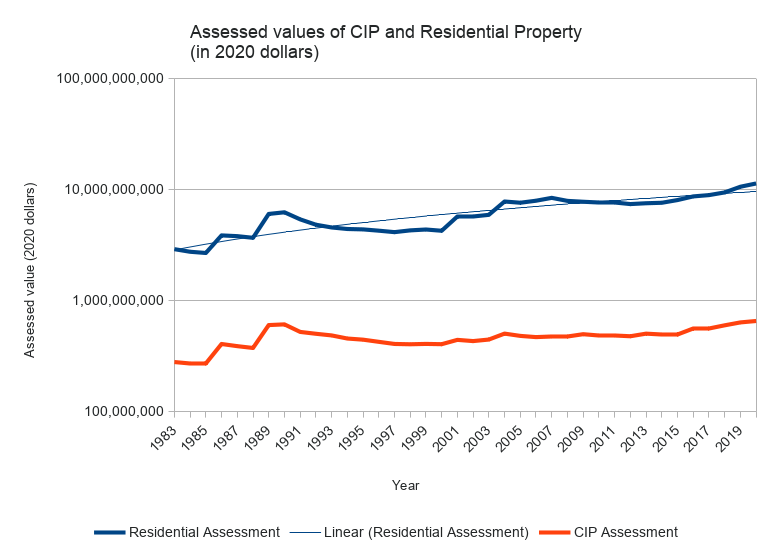

Here’s a chart showing Arlington’s net CIP and residential property values, from 1983–2020, adjusted to 2020 dollars. (This is similar to the chart that appears on page 102 of Arlington’s Master plan, but for a longer period of time).

Generally speaking, the value of Arlington’s residential property has appreciated considerably, and there’s a widening gap between our residential and CIP assessments (in terms of raw dollars). Because the gap is so large, it’s helpful to see it on a log scale.

Viewed this way, the curvatures are generally similar, but residential property wealth is rising faster than business property wealth.

In summary, there are three reasons why our CIP is as low as it is: (1) a limited amount of land where one can run a business, (2) the value of residential property is appreciating faster than the value of business property, and (3) occasionally business properties are converted to residential (perhaps with the residential property being worth more than the former business property). That’s not to say we can’t improve the commercial tax base. We can, but we will have to think about what and where, and how to compete with a generally competitive residential market.

References

- MassDOR Division of Local Services reports

- DOR Query Tool for Municipal Property Assessments

- DOR Query Tool for Municipal Tax Levies

- Spreadsheet of Arlington Property Assessments, 1983–2020. Data obtained from MassDOR, with calculations added to adjust for inflation.

- Spreadsheet of Massachusetts Property assessments for 2020. Data obtained from MassDOR.

(Updated 7/2/2020, to add log scale graph and revise conclusion.)